How general counsels (GCs) can partner with Forge

A practical guide to unlocking liquidity, supporting governance and managing risk

Introduction: Why GCs are critical private market partners

General Counsels (GCs) sit at the crossroads of corporate governance, legal risk and shareholder relations. In today’s private market, companies face increasing pressure from employees, early investors and institutional stakeholders to provide liquidity solutions—without compromising compliance or corporate control.

Forge (NYSE: FRGE), as the world’s leading private securities marketplace, has developed a suite of solutions tailored to address the unique challenges GCs manage every day in providing liquidity: regulatory oversight, fiduciary responsibility, cap table control and shareholder transparency.

This guide explores how GCs can work directly with Forge to implement structured, compliant and efficient liquidity strategies that meet both corporate and shareholder needs.

The role of the GCs in liquidity planning

GCs often face a difficult balance:

- Shareholder pressure for liquidity

- Regulatory obligations around transfers and disclosures

- Governance concerns tied to maintaining control of the company’s trajectory

Forge helps GCs resolve these tensions by acting as a trusted advisor and operational partner, providing tailored liquidity programs, compliance-minded execution and capital formation pathways that align with company goals.

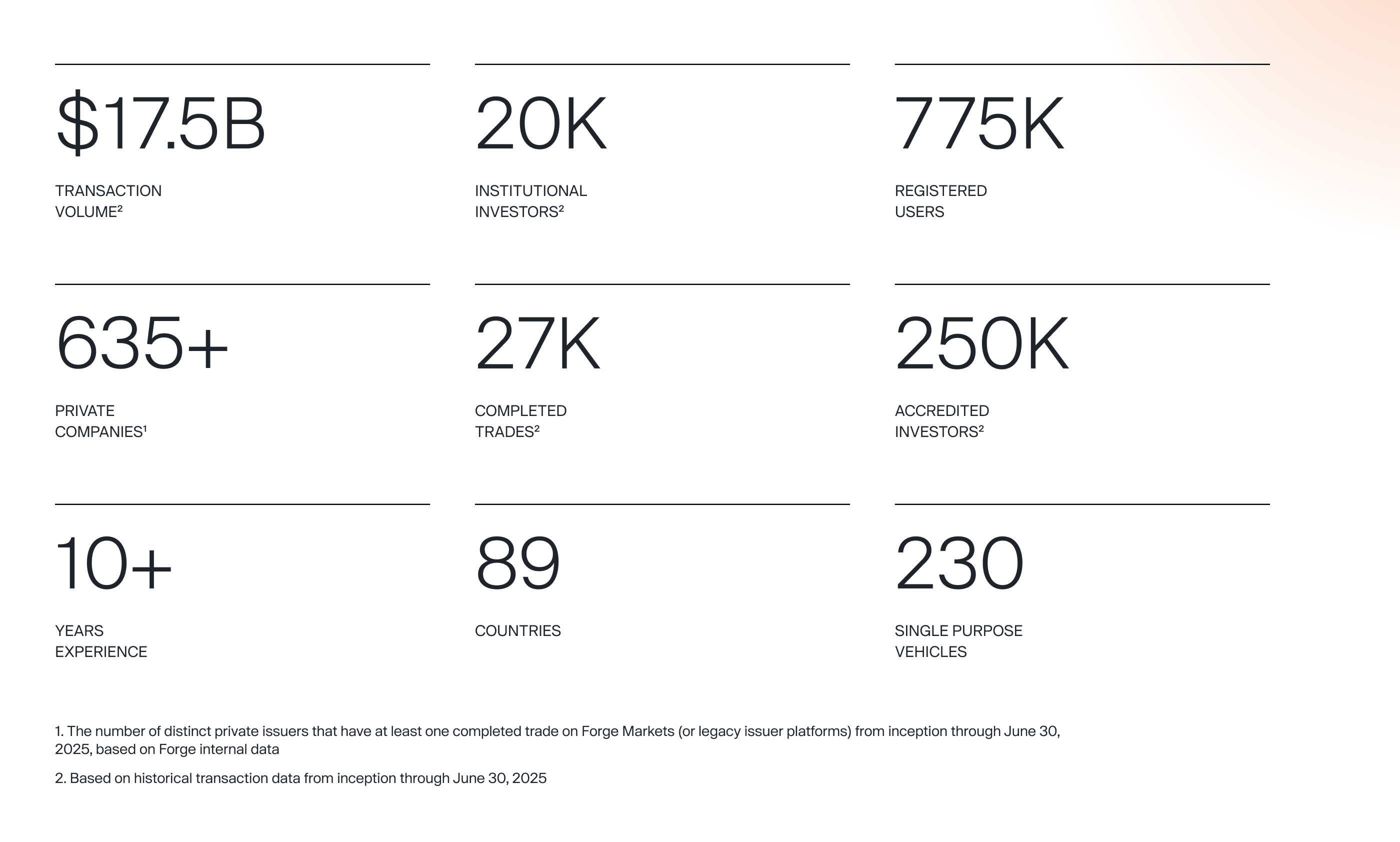

Forge: By the numbers

Key Forge solutions for GCs

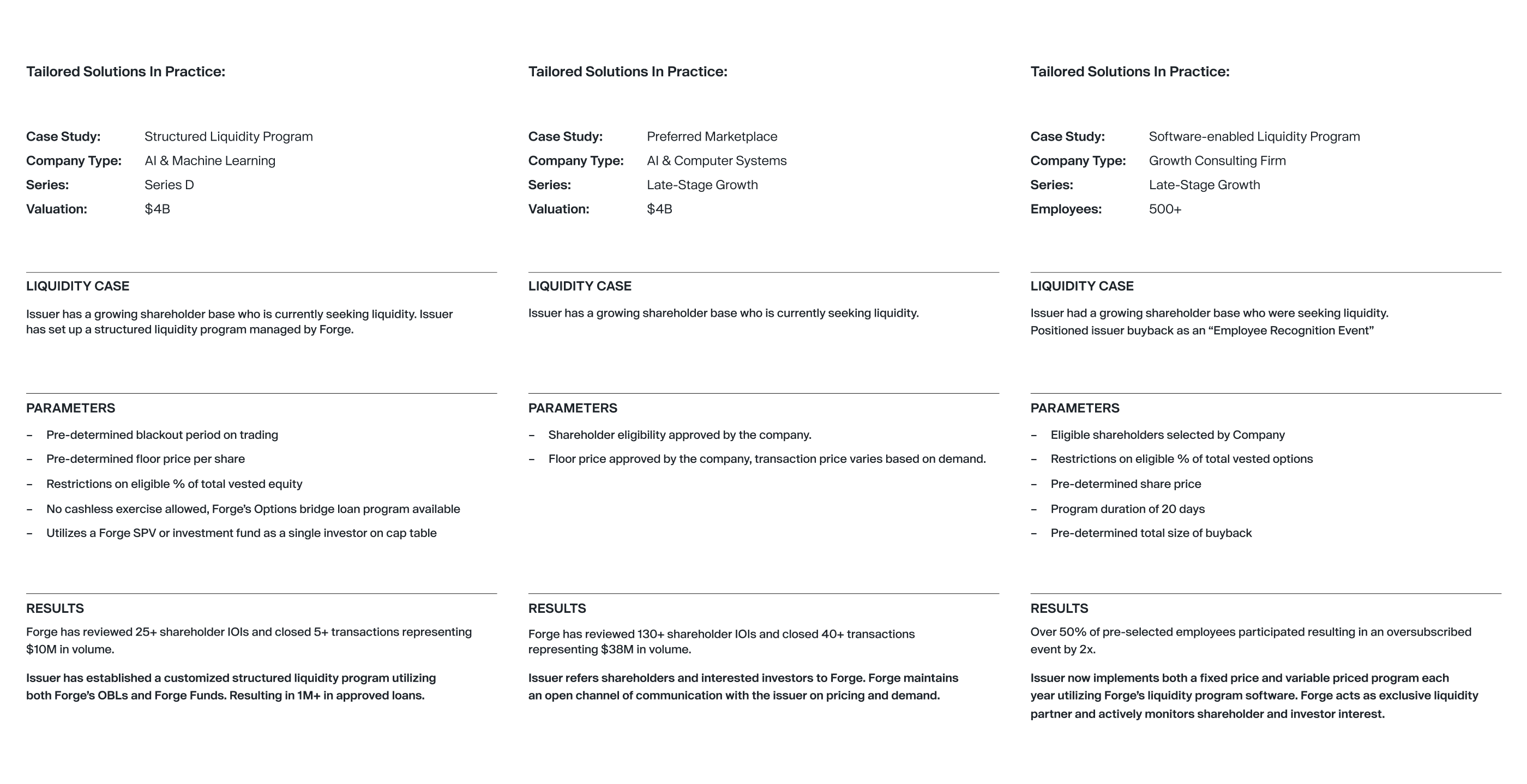

1. Structured liquidity programs

- What they are: Ongoing, compliant opportunities for shareholders and employees to access liquidity under company-defined terms.

- Why they matter to GCs: They reduce the administrative burden, replace the need to manage one-off requests for secondary transfers, and ensure every transaction remains within the company’s governance framework.

- The GC’s role: Define program parameters, oversee compliance with securities law and approve eligible participants.

2. Tender offer programs

- What they are: Formal, time-bound liquidity events where shareholders can sell stock back to the company or a third-party at a fixed price.

- Why they matter to GCs: Provide clarity and control over who participates and at what valuation, while maintaining regulatory oversight.

- The GC’s role: Structure terms of participation, manage disclosure obligations, and supervise execution through Forge’s tender software and operational team.

3. One-off transactions & exclusive blocks

- What they are: Liquidity options for individual transactions (ongoing or for one-off specific shareholder cases) or large, issuer-preapproved blocks of shares.

- Why they matter to GCs: Allow ad hoc flexibility while ensuring compliance with the corporate governance documents of the company and use of the company’s Right of First Refusal (ROFR) or other applicable co-sale rights granted by the company.

- The GC’s role: Approve the specific transaction parameters and structure as proposed, ensure compliance with company corporate governance framework.

4. Preferred marketplace

- What it is: An issuer-directed liquidity channel where all shareholder inquiries are consolidated through Forge.

- Why it matters to GCs: Ensures transparency, centralizes liquidity and minimizes risk of “shadow” trading.

- The GC’s role: Establish Forge as the trusted partner for all shareholder liquidity requests.

5. Capital formation

- What is it: Access to institutional capital through Forge’s investor network for primary capital raises by the company.

- Why does it matter to GCs: Source investors and allow for more streamlined capital raise through a sophisticated investor base.

- The GC’s role: Oversee primary raise process, approve participation terms and investors introduced by Forge, and ensure regulatory compliance under applicable exemptions from registration.

6. Forge Funds

- What they are: Special Purpose Vehicles (SPVs) or multi-asset Investment vehicles that sit on the cap table. Forge funds can be used for both primary capital raises and secondary transfers.

- Why they matter to GCs: Streamline governance and manage the company cap table.

- The GC’s role: Approve participation terms, and ensure regulatory compliance for both primary and secondary transactions.

7. Options exercise bridge loans (OBLs)

- What they are: Non-recourse loans that allow employees to exercise options and sell resulting shares without incurring significant upfront costs.

- Why they matter to GCs: Provide a compliant mechanism for employees to unlock value, reducing pressure on the company to offer internal liquidity programs.

- The GC’s role: Review issuer loan agreement, confirm governance alignment and approve subsequent sale of shares.

Governance, risk & compliance: How Forge can help GCs

Forge’s approach is designed with GCs in mind:

- Clean cap tables: Forge Funds allow for consolidation of multiple investors into one entity, reducing governance complexity.

- Compliance infrastructure: All programs comply with ROFR rights, transfer restrictions and disclosure obligations.

- Operational support: Forge manages documentation, wire instructions, reducing administrative strain on legal teams.

- Transparency: GCs retain oversight via issuer dashboards and can receive real-time reporting on liquidity events.

Partnering with Forge: Next steps for GCs

The following are some recommendations that can help set you up for success when you partner with Forge:

- Engage early: Partner with Forge during liquidity planning to design programs aligned to your company strategy.

- Define guardrails: Work with Forge to set participation rules, blackout periods and disclosure protocols.

- Leverage Forge experts: Forge’s seasoned professionals work directly with GCs to manage the complexities and nuances of private market transactions.

- Communicate proactively: Position Forge as your official liquidity partner for shareholder inquiries, which can help reduce the risk of potential “shadow” markets.

Forge: Helping GCs to lead with confidence

By partnering with Forge, GCs can transform liquidity from a governance headache into a strategic advantage. With structured, compliant and tailored solutions, Forge helps GCs safeguard corporate interests while delivering shareholder value.

Forge is not just a liquidity provider—we are an operational ally, compliance partner and a strategic advisor for today’s most forward-thinking legal teams.