Private company valuations can often seem arbitrary, lacking clear benchmarks or context. But when those valuations are standardized by another metric, such as revenue or employee count, patterns start to emerge. Those patterns can reveal how investors perceive efficiency, growth, and potential across different companies.

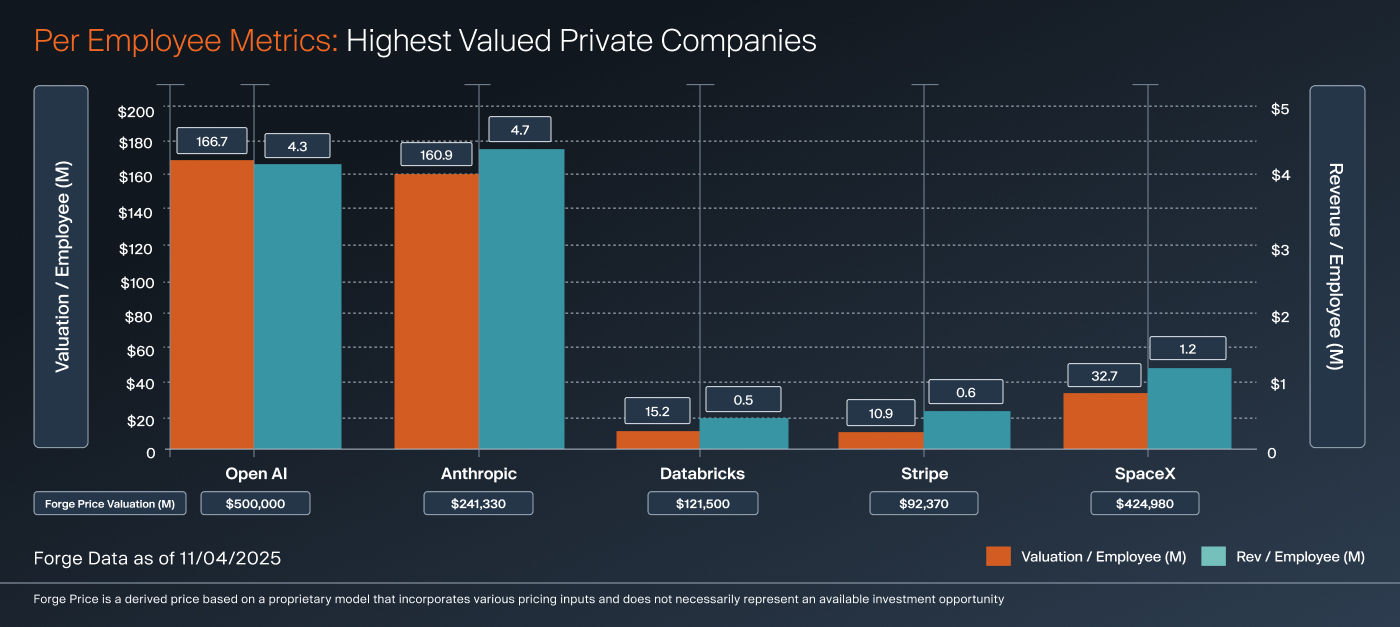

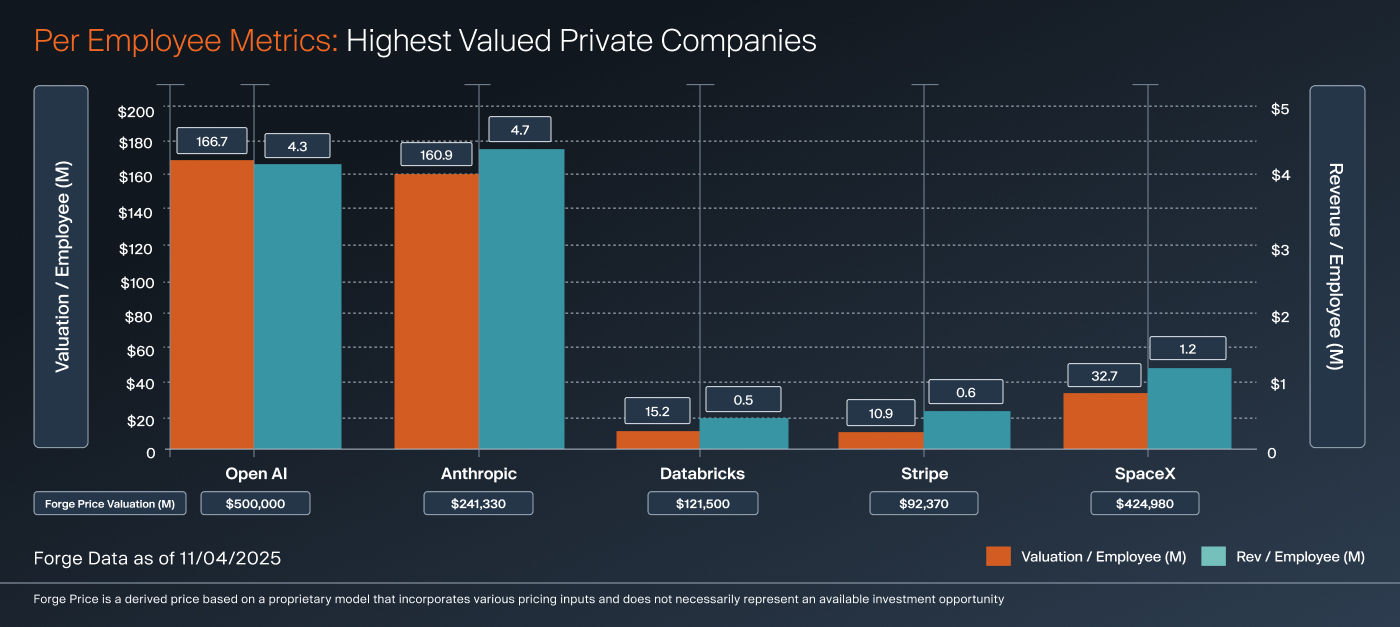

We looked at several of the highest-valued private companies — OpenAI, SpaceX, Anthropic, Databricks, and Stripe — and compared their valuation and revenue per employee. Each of these companies has a Forge PriceTM Valuation around or well above $100 billion,1 but they differ widely in sector, business model, and stage of maturity. Viewing them through a per-employee lens gives a unique look at financial and operational efficiency.

OpenAI vs. Anthropic: The AI powerhouses

The two foundational AI model builders are neck and neck in investor perception, despite differences in scale and approach.2

- Valuation per employee: OpenAI leads slightly with $166.7M vs. $160.9M for Anthropic.

- Revenue per employee: Anthropic edges ahead with $4.7M vs. $4.3M for OpenAI.

In short, investors see them as peers, both commanding extraordinary valuations per person, reflecting not just technological promise but the enormous expectations around generative AI.

Databricks vs. Stripe: Software meets fintech

At first glance, Databricks and Stripe might seem worlds apart, one is a high-growth AI data platform, the other a mature, transaction-driven payments company.

- Valuation per employee: Databricks holds a lead at $15.2M compared to Stripe’s $10.9M.

- Revenue per employee: Stripe counters with $0.6M, just above Databricks at $0.5M.

That mix of results highlights a key tension: Databricks is scaling rapidly, while Stripe’s business is steadier and profitable.3 Databricks’ growth rate—currently about double that of Stripe—could quickly narrow or reverse the gap in revenue per employee.

SpaceX: The outlier that defies gravity

Traditional public market logic says capital-intensive hardware companies should trade at a discount compared to software firms.4 Yet SpaceX breaks that rule.

- Valuation per employee: $32.7M, more than double Databricks.

- Revenue per employee: $1.2M, also higher than Databricks or Stripe.

SpaceX’s edge likely stems from its dual role as both a space exploration innovator and a global communications player via Starlink. Add the Musk factor, a founder synonymous with bold bets that historically have paid off,5 and it is clear why investors see SpaceX as something entirely different.

Takeaway: Context turns chaos into insight

Valuations often look mysterious in isolation. But when viewed through comparative lenses, especially metrics like valuation and revenue per employee, the logic starts to come into focus. These ratios reveal not just how companies are performing, but how efficiently they convert intellectual capital into value.

Sometimes, understanding the private market isn’t about finding the number — it’s about finding the pattern behind it.

For investors interested in buying stock of these private companies, while they remain private, should read Forge’s buyer’s guide to investing in private market shares. However, if you’re ready to start trading, you can create an account today to buy and sell shares.