As governments turn to emerging technology to modernize their defense systems, venture capital is pouring into the defense tech sector. This new wave of VC-backed defense companies is attracting attention for their innovation, government partnerships, and investor interest.

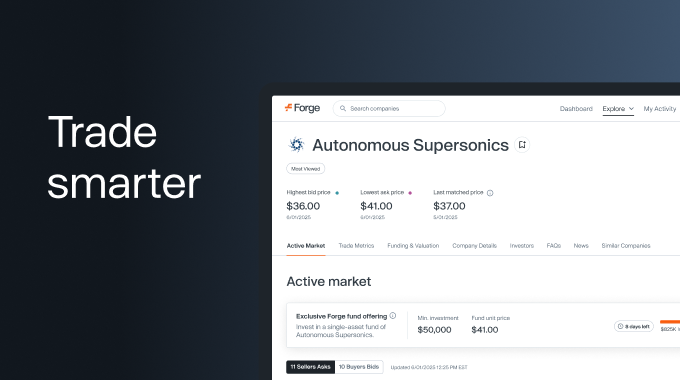

Four defense tech companies listed on Forge Global have emerged as leaders within this up-and-coming sector.

Anduril, autonomous drone technology

Irvine, California-based Anduril builds autonomous systems, artificial intelligence platforms, and counter-drone technology for U.S. and allied forces.

In June 2025, Anduril announced a $2.5 billion Series G funding round led by Founders Fund. The raise more than doubled the private company’s previous valuation, bringing its post-money valuation to over $30 billion.1

Founded in 2017, the company has steadily won defense contracts with the U.S. government and recently partnered with technology firm Palantir to form a consortium bidding on AI and software programs across the Pentagon.2

Anduril recently topped CNBC’s “2025 Disruptor 50 List,” replacing OpenAI from the previous year as awareness and investor interest in the defense tech sector grows.3

Anduril’s Forge Price™ is $42.52 as of June 12, 2025, implying a valuation of $31.72 billion. The company’s notable investors include Andreessen Horowitz, Spark Capital, 137 Ventures, and 9yards Capital.

Shield AI, defense software company

Shield AI is developing autonomous aircraft and drone software designed to give U.S. and allied forces an operational advantage in GPS-denied or communication-contested environments. Its signature product, Hivemind, provides unmanned vehicles to make split-second decisions independently.4

In March 2025, the San Diego-based company raised $240 million in Series F-1 funding, led by investors L3 Harris Technologies and Hanwha Aerospace.5

Shield AI has grown its aerospace partnerships since its founding in 2015, including work with Boeing6 on carrier-launched drones and a joint venture with Kratos Defense on AI-piloted planes.7

The company has continued to make progress on its latest autonomous drone model, the V-BAT UAV, designed for interrupted GPS environments and search and rescue missions.8

The defense tech company’s Forge Price™ is $77.85 as of June 12, 2025, implying a valuation of $5.30 billion. Other notable investors include 8VC, Washington Harbour Partners, and General Dynamics Land Systems.

Saronic, autonomous surface vessels

Austin, Texas-based Saronic, launched in 2022, is quickly gaining traction for its work on unmanned surface vessels (USVs) aimed at transforming maritime defense operations. The company aims to integrate advanced naval hardware, software and AI into a cohesive platform while employing a modular open systems architecture (MOSA) that enhances maritime security and domain awareness for defense systems.

Just this year, the firm unveiled two of its latest self-directed surface vessels, dubbed Mirage and Cipher, which measure 40 and 60 feet long, respectively.9

In February 2025, the firm raised $600 million in Series C funding, putting its price per share at $15.49 with a post-money valuation of $4 billion. This follows a July 2024 Series B funding haul of $175 million.

The private company’s notable investors include Andreessen Horowitz, 8VC, Point72 Ventures, and Trousdale Ventures.

Epirus, high-energy interceptor technology

Epirus is an emerging defense tech startup developing cutting-edge directed energy interceptors capable of disabling drones and other aerial threats using high-powered microwaves. Its technology uses a combination of waveform optimization, open API, and replaceable amplifier modules (LRAMs) to power its defense solutions.

In May 2025, the private company announced the U.S. Army was initiating tests of its sensor equipment in conjunction with the Philippine Air Force.10

In February 2025, the firm announced a strategic agreement with Peraton, a leading national security contractor. The collaboration looks to research and develop the next generation of defense technology by 2030.11

The startup recently closed a $250 million Series D funding haul co-led by investors 8VC and Washington Harbour Partners. This March 2025 funding round places the Epirus price per share at $2.77 with a post-money valuation at nearly $1 billion.