Shield AI, which is developing self-flying aircraft for the U.S. military, announced last week that it’s raising $200 million in an oversubscribed funding round.

The Series F funding round -- from a variety of backers including U.S. Innovative Technology Fund, Riot Ventures, and tech investor Cathie Wood’s Ark Invest -- would value Shield AI at $2.7 billion. In prepared remarks, Brandon Tseng, Shield AI's president and a co-founder, said that his company is building “the world's best AI pilot to ensure air superiority and deter conflict because we believe the greatest victory requires no war.”

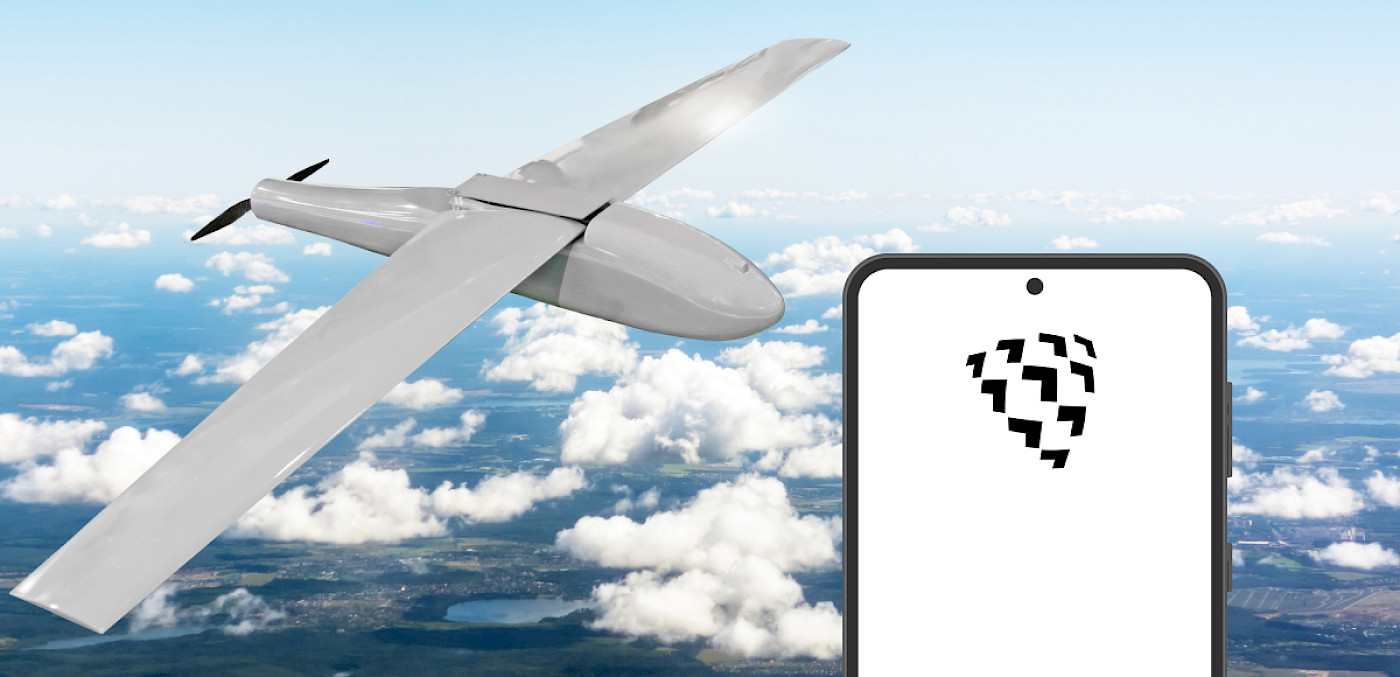

Founded in 2015, the San Diego-based company has created an artificial-intelligence pilot called Hivemind, which enables teams of intelligent aircraft to operate autonomously in high-threat environments and without the need for remote operators, command inputs, or even GPS. “The technology approach is similar to those in the self-driving car industry and its software stack is aircraft agnostic, allowing Shield AI to provide autonomy to a variety of form factors across the aerospace industry,” the release stated.

AI startup Anthropic receives an additional $2 billion from Google

The late Major League pitcher Satchel Paige famously warned fellow competitors: “Don’t look back. Something might be gaining on you.” Executives with OpenAI, the creator of ChatGPT and one of the most valuable U.S-based AI startups, can be forgiven if they are thinking similar thoughts these days about Anthropic, a fast-growing AI competitor.

Last week, The Wall Street Journal reported that Google, a division of Alphabet, agreed to invest up to $2 billion in Anthropic, a commitment that comes in addition to the $550 million investment Google made in the AI company earlier this year. In late September, Amazon also announced a roughly $4 million investment in Anthropic.

These corporate investments in San Francisco-based Anthropic, along with a series of Microsoft investments in OpenAI totaling $13 billion, reflect “the excitement among tech giants to align themselves with promising startups trying to seize upon the overnight success of ChatGPT and develop their own AI-powered audio, text and image technology,” the Journal wrote.

Founded in 2017, Anthropic is known for Claude, a chatbot that in the words of the company is “capable of a wide variety of conversational and text processing tasks.” Anthropic has also gained a reputation for seeking to develop AI technology that is guided by ethical considerations. The company’s last known valuation, as of May 2023, was $4.1 billion.

OpenAI rolls out new ChatGPT features for premium customers

Of course, OpenAI isn’t standing still and watching Anthropic’s development. In the past week, there’s been news about a couple of initiatives at OpenAI.

An article in trade publication The Verge reveals that OpenAI is rolling out new features for ChatGPT Plus members. “Subscribers have reported that the update includes the ability to upload files and work with them…basically users won’t have to select modes like Browse with Bing from the GPT-4 dropdown – it will instead guess what they want based on context.”

In addition, a TechCrunch article details a series of OpenAI-powered reading and writing tools being employed by LinkedIn, the social-media website for the business world. Currently, these features will only be available for LinkedIn users who pay for premium services. For example, artificial intelligence will provide personalized digests for LinkedIn users reading content on the site, and AI will also help them write their own content on the platform.

This partnership between OpenAI and LinkedIn is hardly a surprise: LinkedIn is owned by Microsoft, which now has a 49% stake in San Francisco-based OpenAI following a series of large investments.

Recent reports by several leading news outlets state that OpenAI has been in talks about a sale of existing shares at a price that would effectively value the San Francisco -based company at $80 billion or more.