Offbeat and edgy beverage maker Liquid Death has had a knack for generating buzz, along with a slew of investors from the world of sports and entertainment.

Last week, the L.A.-based company, whose slogan is “Murder Your Thirst,” announced a new $67 million fund round that includes a fresh batch of celebrities such as actor Josh Brolin, NFL wide receiver DeAndre Hopkins, Neal Brennan, the co-creator of The Chappelle Show, and Derrick Green, the American lead singer of Brazilian heavy metal band Sepultura.

The new funding round, which values the company at $1.4 billion according to Bloomberg, has also attracted some new institutional investors such as SunRo and a spate of Liquid Death’s distributors from a variety of states across the United States.

In remarks in a press release announcing the funding round, Liquid Death CEO Mike Cessario said “We continue to see extremely strong consumer and retailer demand and are proud to have raised a strategic, oversubscribed, ‘up’ round to fuel our growth.”

Founded in 2017, Liquid Death’s Forge Price™ was $11.44 as of March 19, 2024 which implied a valuation of $1.35 billion. The private company packages still and sparkling non-alcoholic beverages in tall-boy cans with designs that more closely resemble the kind found on cans of beer or malt liquor.

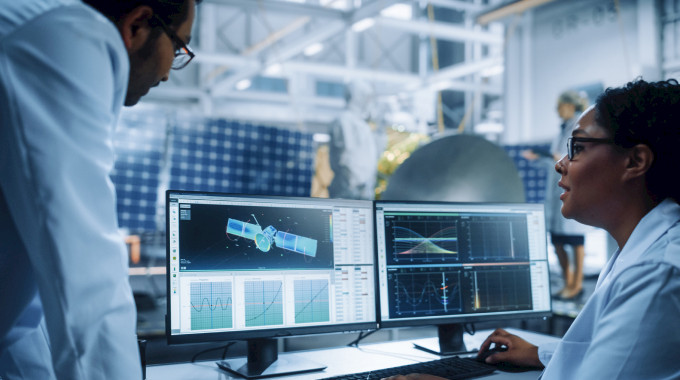

Covariant developing an AI brain for physical robots

A slew of private companies have gained plenty of fanfare and investor attention in the past year for developing large-language AI models. Other companies are producing human-like robots that can perform various industrial tasks.

Covariant is bridging both of these cutting-edge industries. Founded in 2017, the company is developing AI software that empowers robots with the ability to learn from experience and perform complex tasks efficiently.

Last week, the Berkeley, Calif.-based company announced the launch of Robotics Foundation Model 1 or RFM-1, its latest AI software. According to the company, RFM-1, which is trained on both general Internet data and data culled from real-world physical interactions, “represents a remarkable leap forward toward building generalized AI models that can accurately simulate and operate in the demanding conditions of the physical world.”

According to the company, RFM-1, which functions as a robot’s AI brain, is an 8 billion parameter transformer trained on text, images, videos, robot actions, and a range of numerical sensor readings. Among other functions, it can combine text instructions with image observations to generate desired grasp actions or motion sequences.

Founded in 2017, the private company has a Forge Price™ of $10.25 which implies a valuation of $394 million as of March 19, 2024.

Agility Robotics unveils platform for managing its robots

While Covariant is focused on developing AI-powered brains for the next generation of robots, Agility Robotics is focused on building the robots themselves.

Agility Robotics is known for its two-legged industrial robot, Digit, which can unload trailers and deliver goods, among other functions. Last week, the Corvallis, Ore.-based company announced the debut of Agility Arc, a cloud-based platform for deploying and managing fleets of its Digit robots.

In prepared remarks, Melonee Wise, the chief technology officer of Agility Robotics, said that Agility Arc will allow warehouse workers to put Digit robots to work in warehouses, distribution centers, and factory floors and to monitor that work.

The private company, which was founded in 2015, had a Forge Price™ of $34.14 which implied a valuation of $607 million as of March 19, 2024.