Electric-vehicle battery startups Redwood Materials, Ascend Elements, and NanoGraf are taking bold steps to advance their business prospects. In the case of Ascend and NanoGraf, their efforts are being backed by federal funding towards more battery technology that will satisfy the potential increase in demand for electric cars in the future.

Redwood Materials is partnering with automaker BMW

Redwood Materials, a developer of battery recycling technology, announced in September that it will recycle lithium-ion batteries from all electrified vehicles for BMW of North America.

The battery recycler plans to work with BMW’s network of more than 700 locations to refurbish end-of-life lithium-ion batteries. According to Redwood, the minerals inside of a lithium-ion battery, which include nickel, cobalt, lithium, and copper, are infinitely recyclable.

The partnership is just the latest in a string of collaborations with large vehicle manufacturers, including Volkswagen and Toyota in recent years.

Founded in 2017, Carson City, Nev.-based Redwood Materials has a Forge Price™ of $50 a share as of September 23, 2024. That gives the company an implied valuation of $5.5 billion, which is a 4.7% premium over the company’s post-money valuation of $5.25 billion, a figure based on the company’s last funding round in August 2023, according to Forge Global.

Among Redwood’s leading financial backers are Amazon, Emerson Collective, Fidelity, Franklin Templeton, Goldman Sachs, Microsoft Climate Innovation Fund, and T. Rowe Price.

Ascend Elements receives federal grant to boost battery production

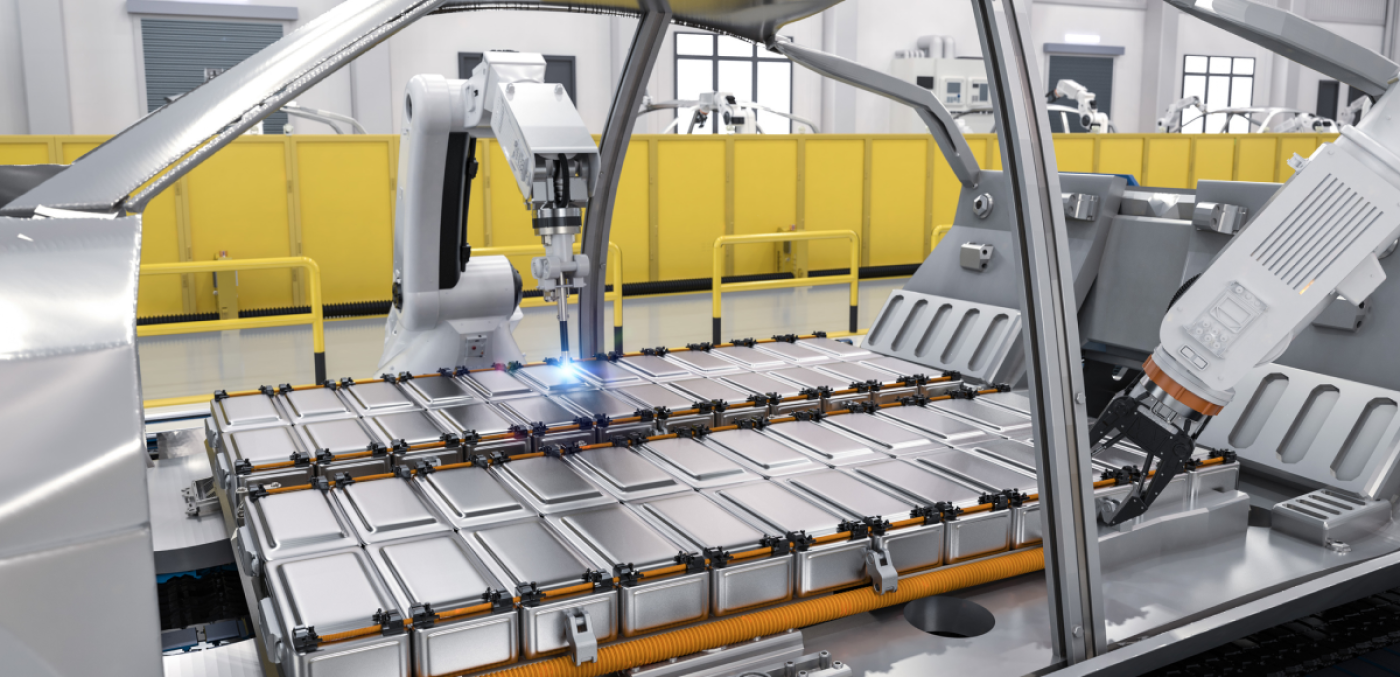

Westborough, Mass.-based Ascend Elements manufactures advanced battery materials that use elements reclaimed from discarded lithium-ion batteries.

The company announced recently that the U.S. Department of Energy has selected it, along with Koura Global, a producer of fluorochemicals used in the battery-making process, to receive a $125 million grant. This money is part of a $3 billion federal government investment in 25 projects across the U.S. to boost production of advanced batteries. The grant for Ascend Elements will go toward construction of a battery recycling facility to recover graphite from used lithium-ion batteries and manufacturing scrap.

Founded in 2015, Ascend has a Forge Price™ of $10.65 as of September 23, 2024, giving the company an implied valuation of $1.6 billion. That is consistent with the company’s post-money valuation of $1.6 billion based on the company’s last funding round of February 2024, according to Forge Global.

Ascend has received support from over two dozen investors including Agave Partners, Alliance Resource Partners, Alumni Ventures, Doral Energy, Mirae Asset Capital, and the Qatar Investment Authority.

NanoGraf gets grant of its own to produce silicon anode battery material

NanoGraf is a producer of anode battery material, which is believed to create longer-lasting lithium-ion batteries. On September 20, 2024, the company announced that it received a $60 million federal grant to expand its production.

The Chicago-based company said in a press release that it would use some of the funding, in addition to its own capital, to retrofit a plant in Flint, Michigan. At full capacity, the facility will produce enough of its proprietary silicon anode material to produce 1.5 million electric vehicles a year, according to a recent press release.

Among the company’s investors are Arosa Capital Management, CC Industries, Earth Foundry, Emerald Technology Ventures, and GIC Capital.