SpaceX’s private market valuation has continued to increase, and Forge’s pricing now implies a valuation in the trillion-dollar range.5

There has been much speculation around whether SpaceX will eventually go public via an IPO, such as with Vijay Marolia, Chief Investment Officer of Regal Point Capital, telling MarketWatch in early 2024 that a SpaceX IPO could come as soon as 2025 or 2026.6 Yet MarketWatch reported in December 2024 that the most recent tender offer talks suggest that an IPO is not on the table right now.7

SpaceX’s valuation has climbed quickly in recent years, and Forge data indicates a December 2025 tender offer implying an $800 billion valuation.8

SpaceX: Company background

SpaceX, formally named Space Exploration Technologies Corp., was founded in 2002,9 and the company is headquartered in the Los Angeles area in Hawthorne, CA — though the company is now planning on relocating its headquarters to Brownsville, TX.10

With Musk as founder and CEO, he recruited Tom Mueller as SpaceX's first employee, with Mueller instrumental in developing rocket engines that today power SpaceX's famous Falcon 9 rocket.11 In 2020, however, Mueller left to start his own space company, Impulse Space, though the two companies are more complementary than competitors.12

Rocketing toward new horizons

SpaceX stands out as arguably one of the most successful private aerospace companies, and its ability to reuse rockets — as opposed to them burning up upon re-entry into Earth's atmosphere — has enabled the company to bring down the costs of satellite launches and other aspects of space aeronautics.13

In addition to grand ambitions like restarting human missions to the Moon and eventually colonizing Mars,14 SpaceX earns significant revenue from government contracts, such as working with NASA to make deliveries to the International Space Station.15 Since 2008, SpaceX has brought in nearly $20 billion from government contracts, primarily via NASA as well as some from the Department of Defense, according to USA Today.16

Recently, however, a subset of SpaceX has been a big money driver. Starlink — an internet service provider under the SpaceX umbrella that uses satellites launched by SpaceX rockets to deliver connectivity — is expected to bring in an estimated $11.8 billion in revenue for 2025, according to Quality Space.17

Yet SpaceX is even more bullish on the possibilities that could come from its next-generation reusable rocket, Starship, which is still in testing, but SpaceX has indicated it wants to ramp up its Starship launch cadence as testing progresses.18 Part of that may depend on approvals from the Federal Aviation Administration (FAA), which Musk has criticized in the past, yet his relationship with President Trump and expected role in the new administration could potentially alleviate this issue.19

"Ultimately, I think Starship will be the thing that takes us over the top as one of the most valuable companies," said Gwynne Shotwell, President and Chief Operating Officer of SpaceX at the 31st Annual Baron Investment Conference, as reported by SpaceNews.20

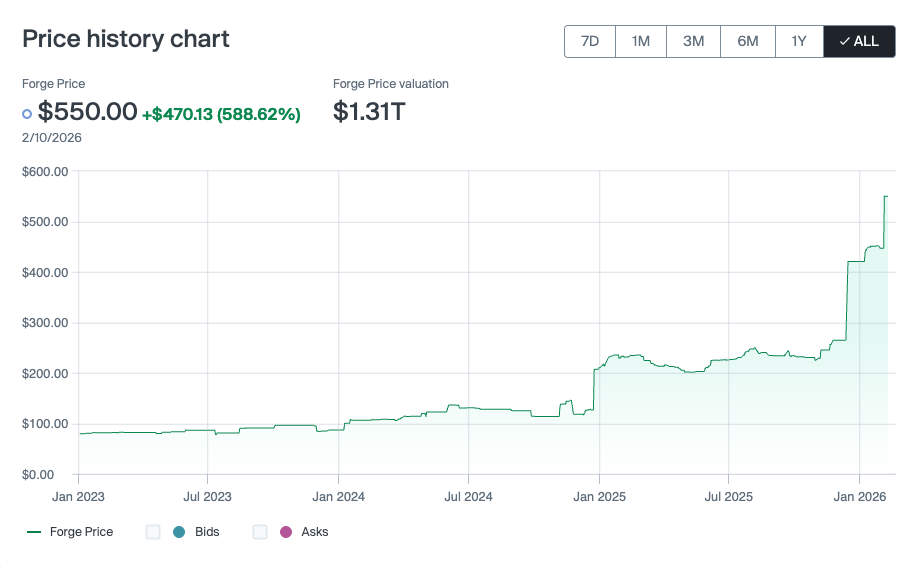

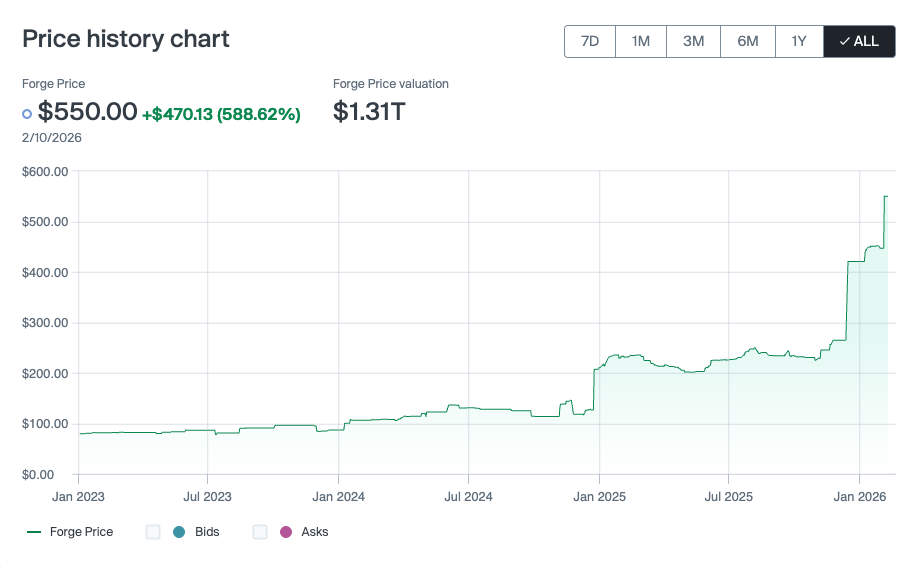

SpaceX stock price history

Forge Data as of 02/06/2026

SpaceX's Forge Price is $550.00 as of February 6, 2026, which implies a valuation of about $1.31 trillion. This compares to a $118.59 Forge Price (about $211.77 billion implied valuation) cited in January 2025.21

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information and secondary market transactions on Forge.

For broader context, the Forge Private Market Index posted a 94.7% return in 2025 and is up 7.9% year-to-date in 2026 (as of the index data updated on 2/6/26).22

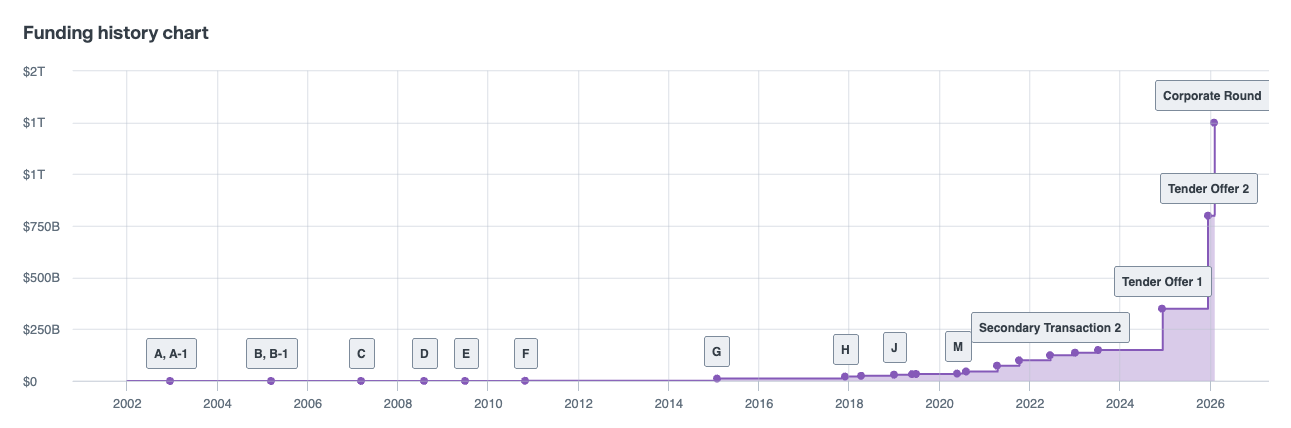

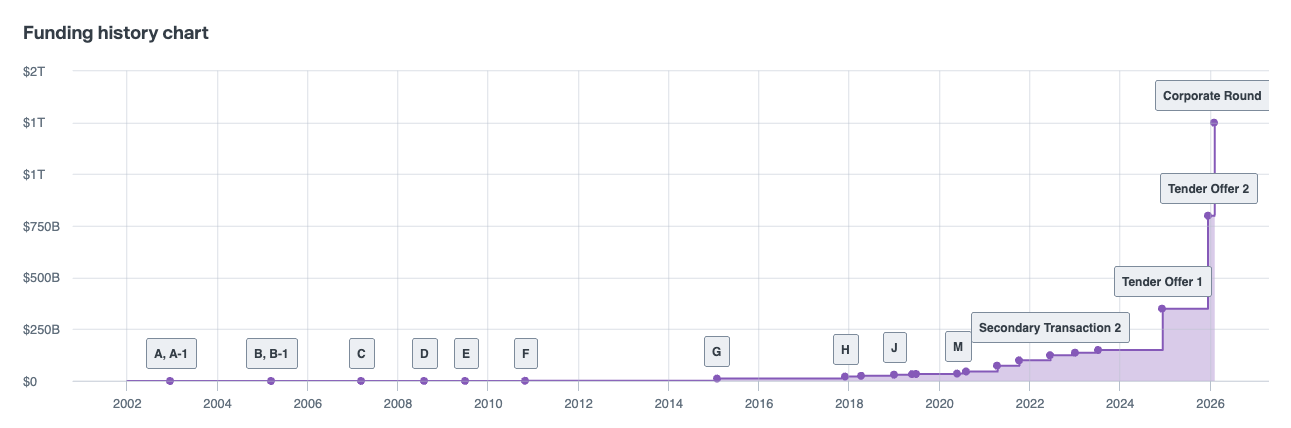

SpaceX funding history and private market valuation

Forge Data as of 2/6/2026

SpaceX's funding history dates back to its Series A in 2002, raising $30.5 million at a $122 million valuation. The company reached unicorn status in 2010 with its Series F, raising over $50 million from investors such as Draper Fisher Jurvetson and Founders Fund at a $1.02 billion valuation.23

In 2015, SpaceX raised over $1 billion for its Series G at a $12 billion valuation, and in 2017 it raised nearly half a billion more at a $21.5 billion valuation,24 with investors such as Zillow Group's CEO Spencer Rascoff joining in.25

SpaceX's largest primary funding round was in 2020, with a $1.9 billion equity raise in 2020 for its Series N, valuing the company at $46.08 billion.26

In 2021, the company raised another $850 million at a $74 billion valuation, with investors such as Sequoia Capital, Coatue Management, and Fidelity Investments participating.27

More recently, SpaceX has seen its valuation rise sharply through tender offers and private-market activity, including Forge data indicating a December 2025 tender offer implying an $800 billion valuation.28

Looking ahead

SpaceX has not announced a specific IPO timeline, but several recent signals suggest the company may be moving closer to public markets. The Wall Street Journal reported that SpaceX is preparing for a massive IPO in 2026 and is seeking earlier inclusion in major stock indexes after listing.29 Separately, Yahoo Finance reported that Musk confirmed SpaceX will merge with xAI ahead of a potential IPO.30 Even so, details like timing, exchange, and pricing remain unclear, and SpaceX could continue using tender offers alongside (or instead of) an IPO to provide shareholder liquidity.

For now, as it remains private, interested investors can learn more about how to invest in SpaceX pre-IPO. Those looking to buy shares of SpaceX, or other late-stage private companies, should also read Forge’s buyer’s guide to investing in private market shares.

Check back here or take a look at Forge’s upcoming IPO calendar to stay in the loop about a possible SpaceX IPO and other pending public offerings.

Finally, if you’re ready to start trading, you can create an account today to explore available opportunities and buy and sell shares (subject to eligibility and availability).