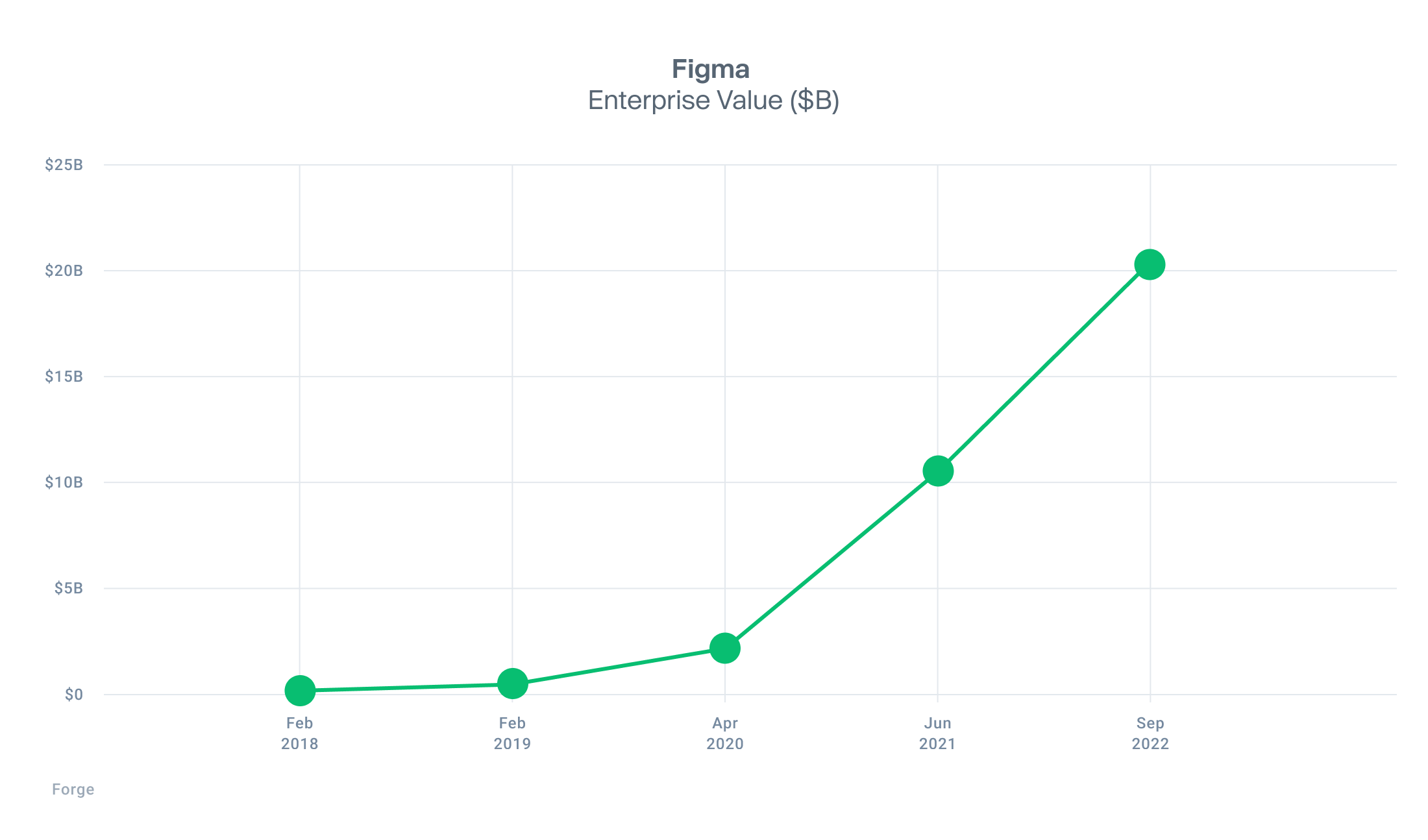

Receiving equity as part of your compensation package at a privately held company, especially a hot startup, can feel like winning the lottery. As the company grows, it usually raises money at an increasing valuation with an eye to going public via an IPO. Recently, Figma, the design collaboration startup, was recently acquired by Adobe for $20 billion representing a nearly 100% increase from Figma’s last primary financing round just last year. That was on top of a 5x increase in Figma’s value from 2019 to 2021. Although not an IPO, this acquisition proved to be a successful exit for the company.

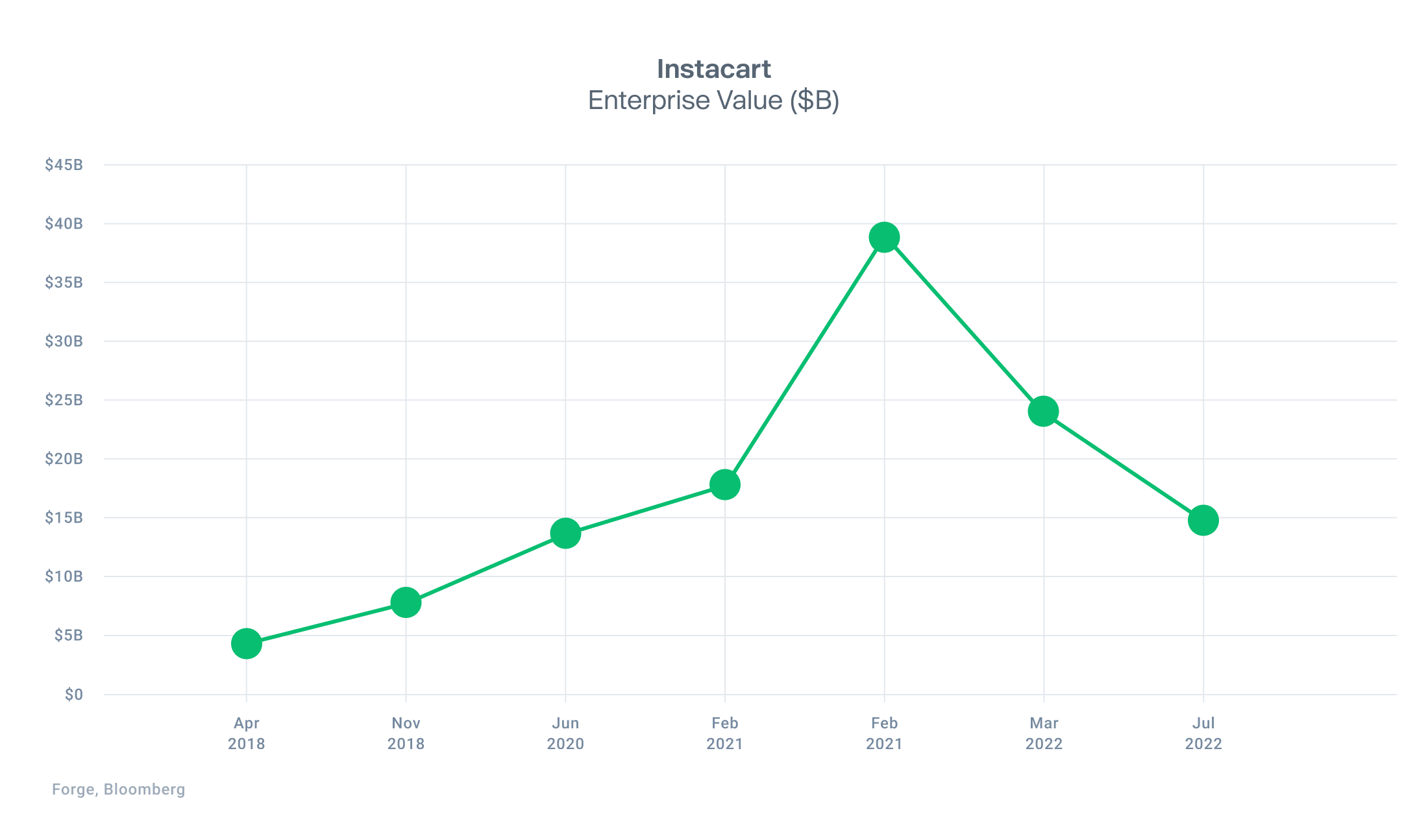

But sometimes startup companies lose value which can negatively affect your financial well-being. Unfavorable macro-economic conditions can create significant headwinds to a company’s growth. Last March, the grocery delivery giant Instacart took the step of slashing its own value by 40% to $24 billion. A few months later, several of their key investors announced they had further reduced the company’s value to $14.7 billion constituting a 62% drop from their $39 billion valuation in February 2021. In May, Instacart announced that it had confidentially filed for an IPO.

Understanding how your startup equity figures in your overall net worth is important and can help you make smarter financial decisions.

Startup Equity as a component of your overall net worth

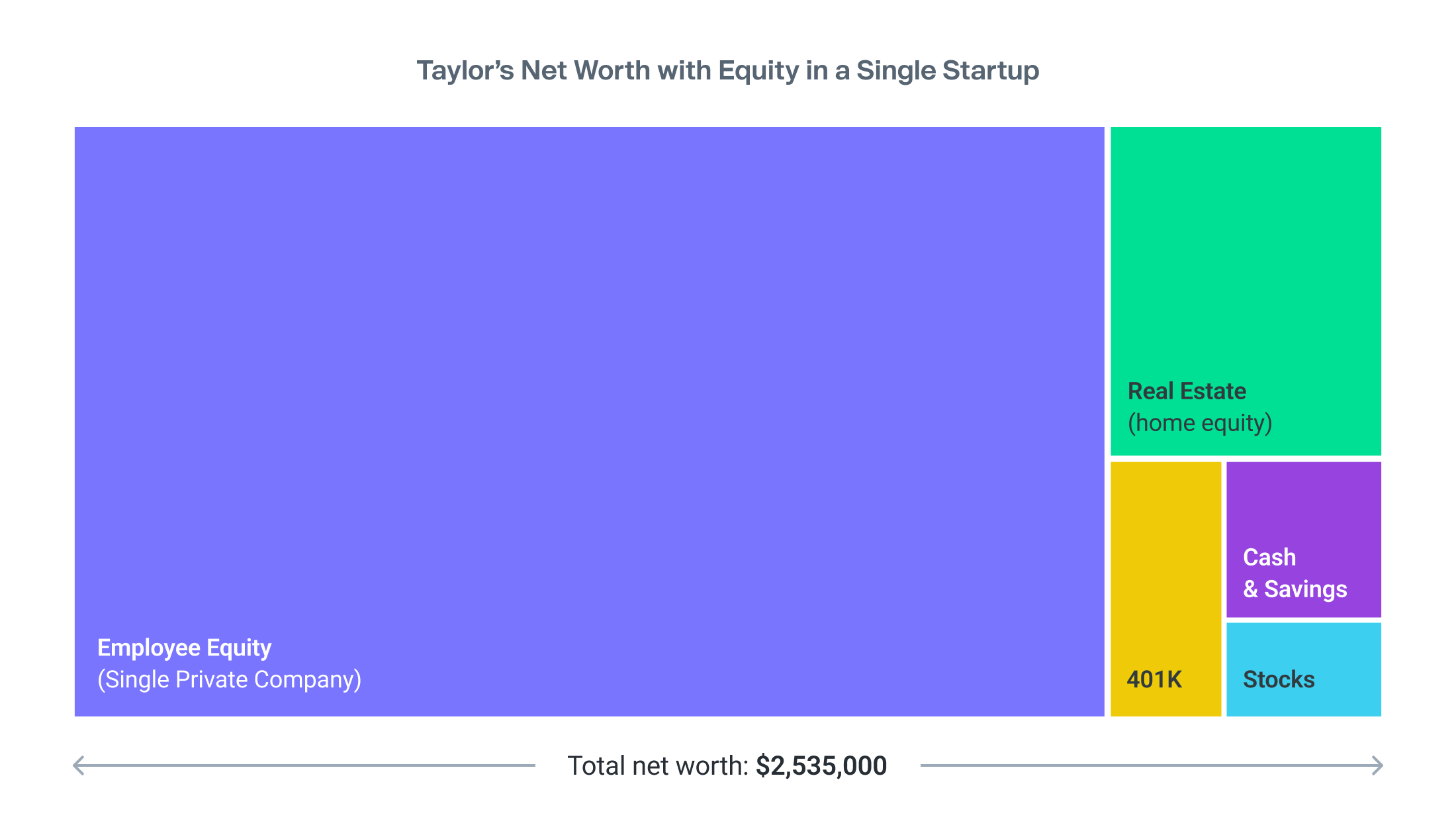

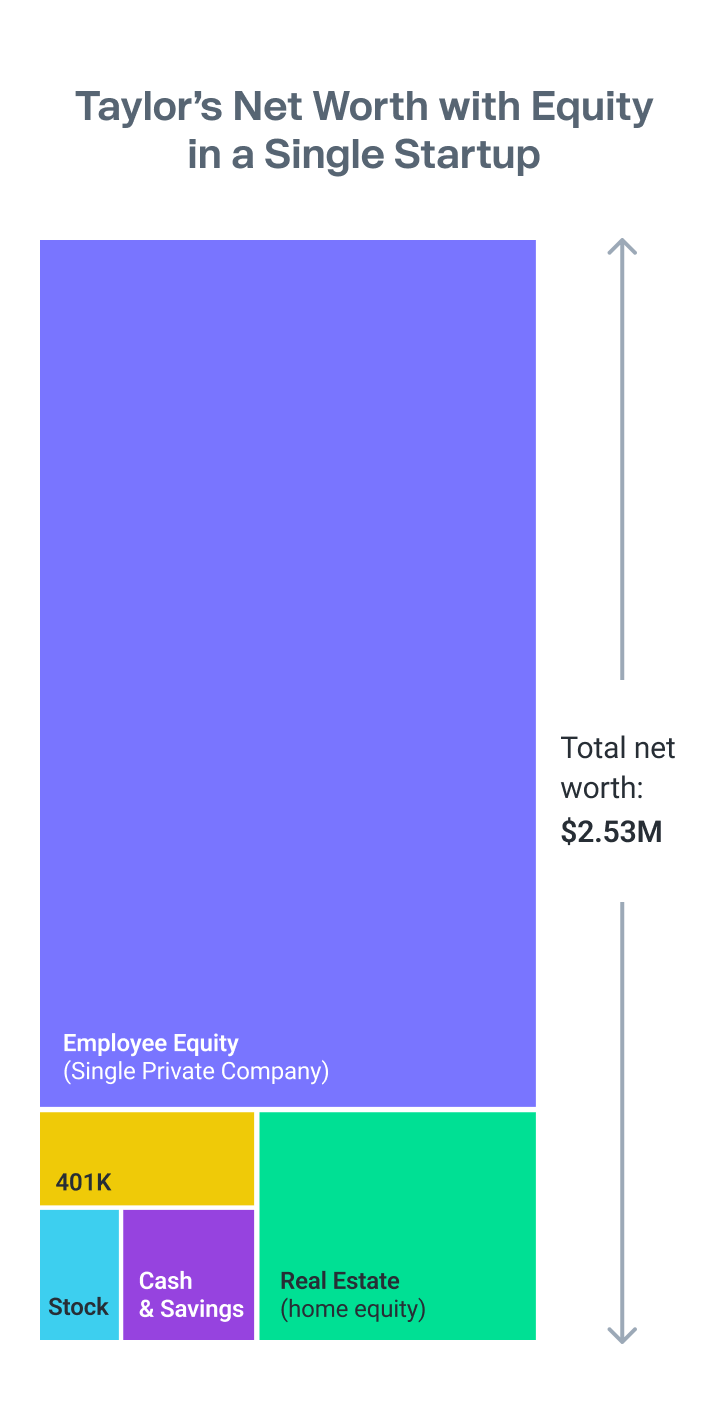

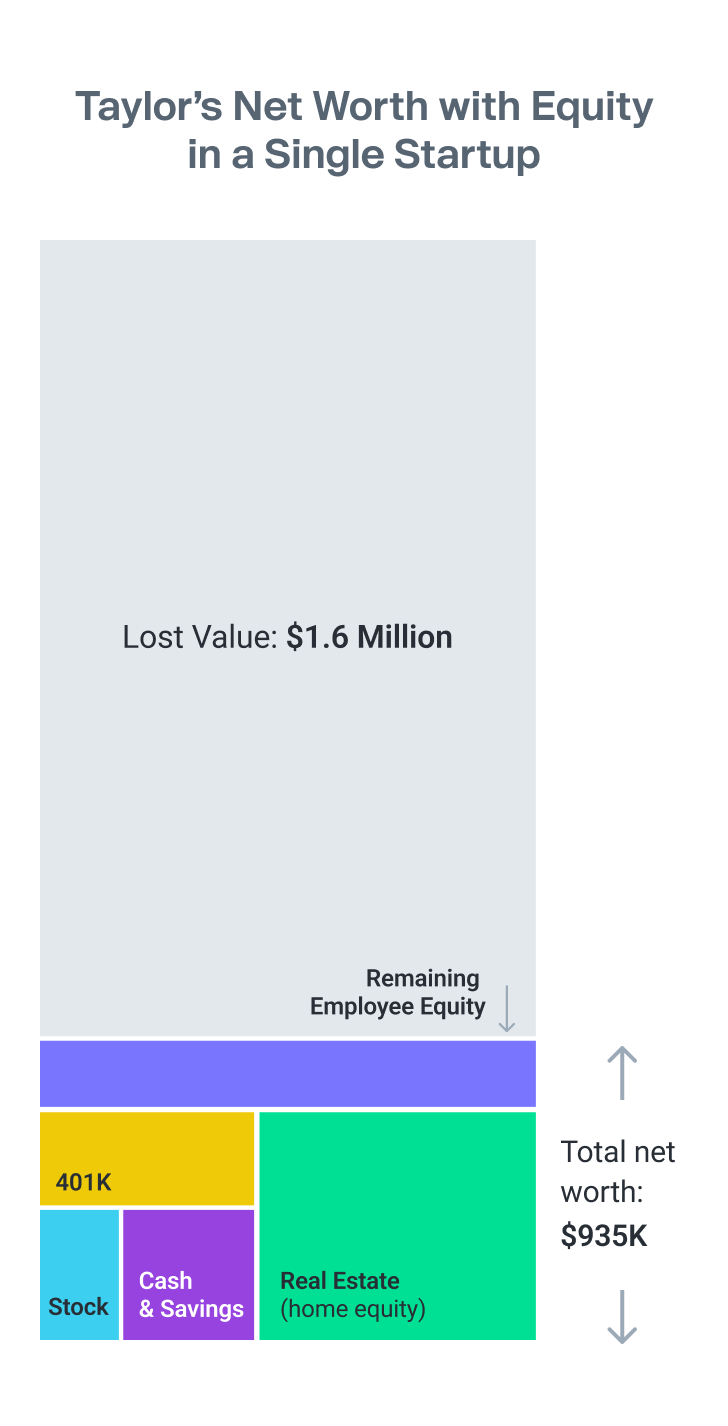

Let’s take a look at a hypothetical example of a startup employee’s net worth. Meet Taylor. Taylor has worked for five years as an engineer at a successful SaaS startup. She owns a home, contributes to her 401k and puts a little money every month into a portfolio of publicly traded stocks. But the overwhelming bulk of Taylor’s net worth is comprised of the equity she has earned as part of her compensation. Her company is still private but when it goes public via an IPO, she knows she’ll be able to sell the stock for a big gain. Taylor is feeling pretty good about her financial health.

Diversify as a way to reduce risk

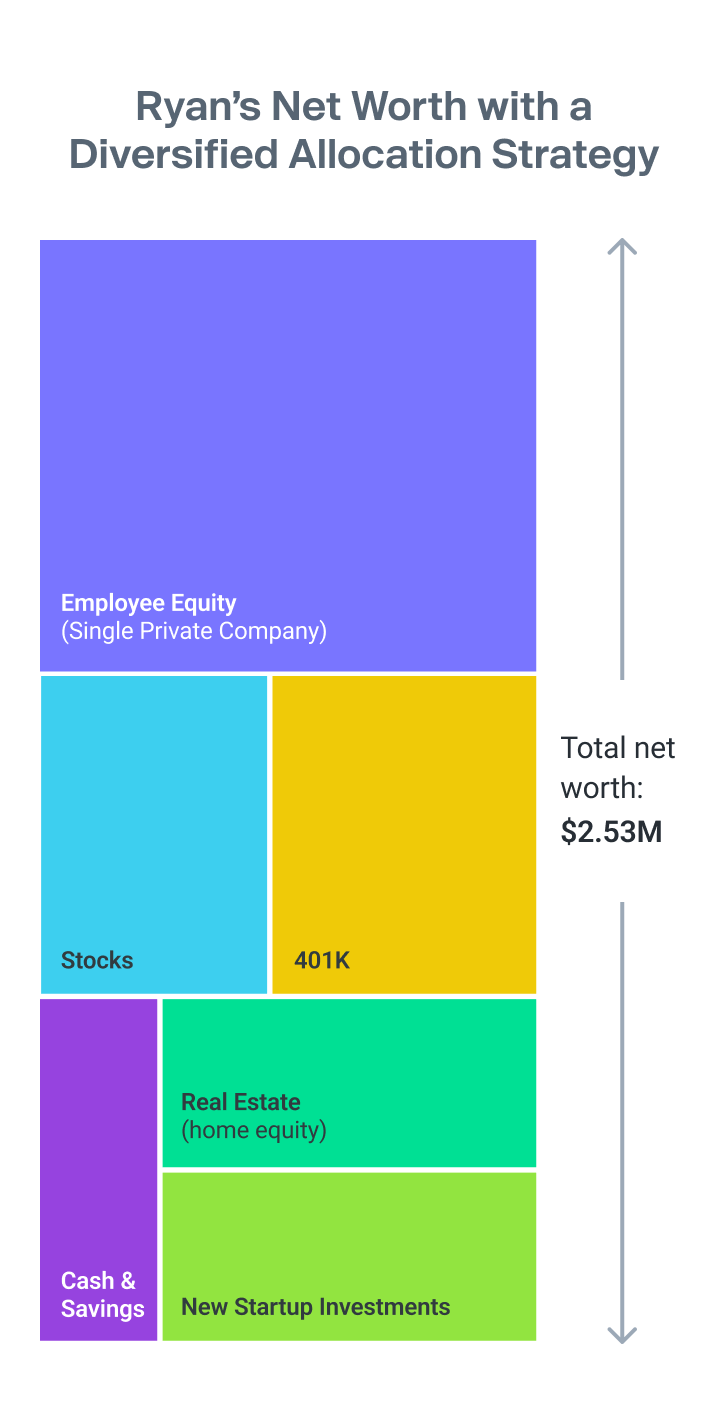

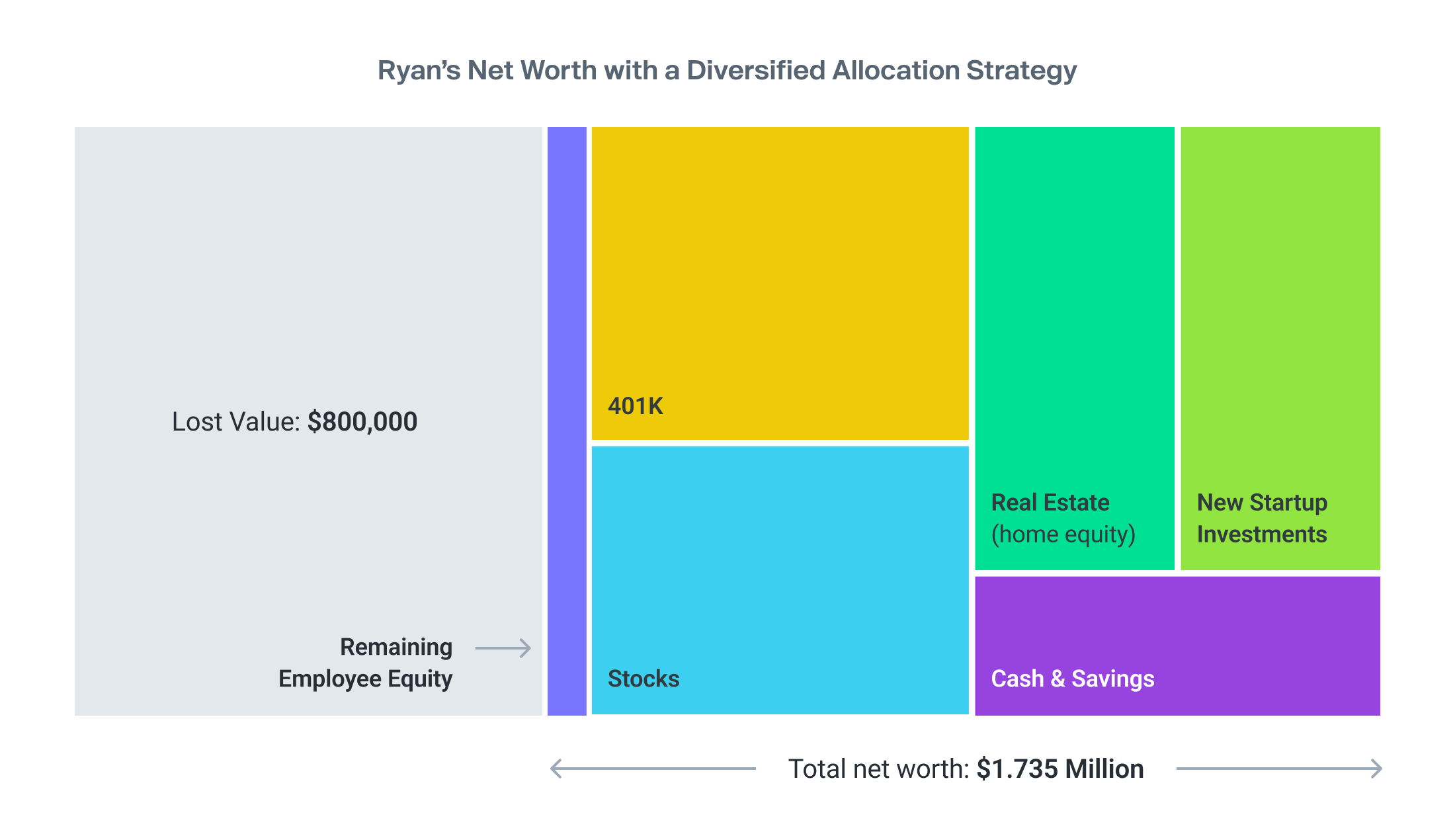

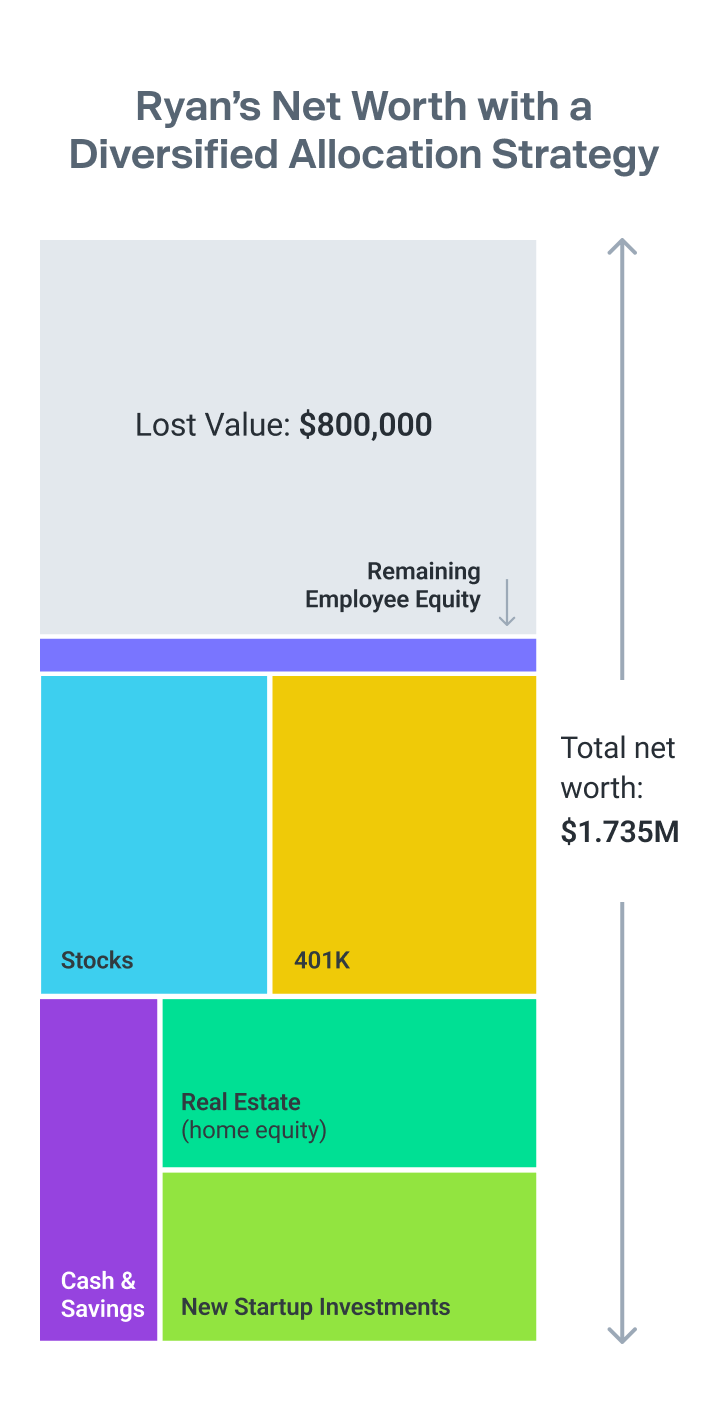

Meet Ryan. Ryan has worked five years at the same privately held company as Taylor. Ryan felt confident about her company’s IPO prospects but didn’t want to put all her eggs in one basket when it came to her financial health. She chose to sell 50% of her vested stock on the secondary market and use the proceeds to diversify her net worth. She added funds to her 401k and stock portfolio, and put a chunk into savings for a rainy day. She also invested some of the proceeds into several other promising startups via the secondary market. Ryan’s net worth is the same as Taylor’s, in this example, but is balanced across investment types.

Negative Market Conditions & Down Rounds

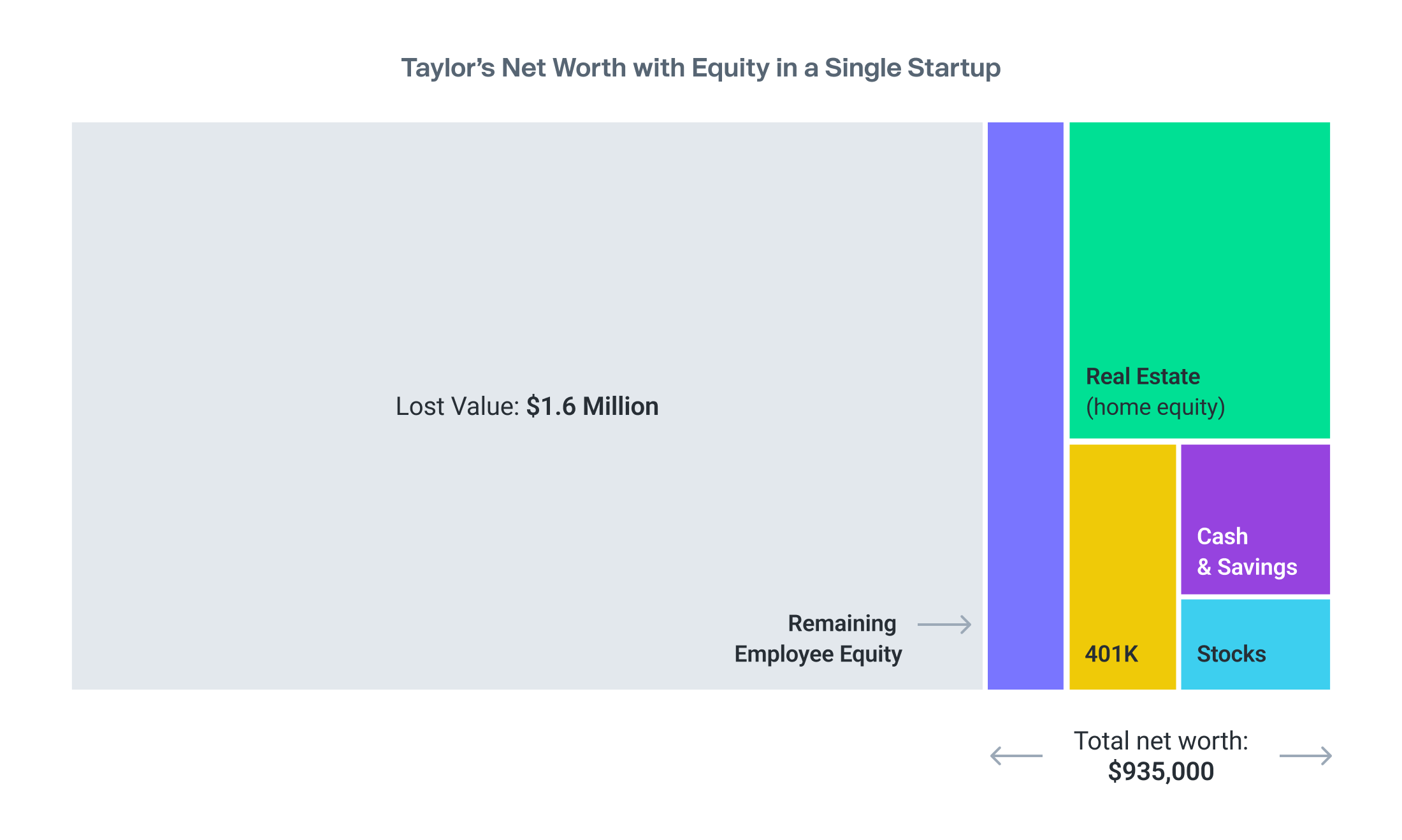

But now, let’s introduce a downturn into this scenario. Taylor and Ryan’s company begins to struggle in an increasingly challenging market. Her company needs to raise money quickly to ride out a downturn and conducts a primary financing round at a significantly reduced valuation.

Because Taylor’s net worth was made up mostly of her startup equity, she has lost $1.6 million in value, over 60% of her net worth. Taylor is obviously disappointed. But she doesn’t control the valuation of her company’s stock, so there was nothing she could have done. Or was there?

Let’s take a look at Ryan’s net worth during the same downturn. Ryan’s equity also suffers a significant loss and impacts her net worth. But because she had diversified, Ryan’s loss was limited to $800,000 leaving her net worth at $1.7 million versus Taylor’s resulting net worth of $935,000.

Now, of course the above is only a hypothetical example of a downturn. It’s possible of course for the company value to increase which would benefit Taylor who kept her large position in the stock. In this case, Ryan would have less upside potential. In a downturn, other asset types may also be negatively affected – stock portfolio, 401ks, real estate. It’s also important to point out that the above represents net worth and not liquid net worth. There are costs associated with liquidating any asset class (except for cash). Just like there are fees and commissions to sell your house, there are costs associated with liquidating private and public securities. For private securities, there is no guarantee that you can find a buyer and, in some cases, your company’s policy may place restrictions on stock sales.

How Forge can help you sell private company stock

If you’re interested in diversifying, Forge, the leading secondary market platform, can help you understand the current value of your private stock so you can get a sense of how much of your equity, if any, you want to sell. If you decide to sell, we work to connect you with our network of more than 125,000 accredited investors and institutions who may be interested in buying your stock. To learn more about selling your private company stock, please see our blog “Can you sell shares in a private company before an IPO."

If you’re ready to get started listing your shares, create a free account on our platform today to see what your shares might be worth.