A quick guide to private company stock

Most people are generally familiar with what stocks are, but often that applies to shares of publicly traded companies. However, that’s not the only type of stock that exists. Private companies, which are simply those that are not publicly traded, also can have stock.

In this brief guide, we’ll take a closer look at what private company stock is, how it works and why it’s used.

What is private company stock?

Private company stock means equity (i.e., an ownership stake) in a privately held company. This differs from public company stock, which is stock publicly traded on a secondary market, like the New York Stock Exchange.

Generally, anyone can freely buy or sell public company stock, whereas private company stock can be harder to come by and to transact in. Think of the difference between investing in a publicly traded company like Amazon vs. a brand-new startup.

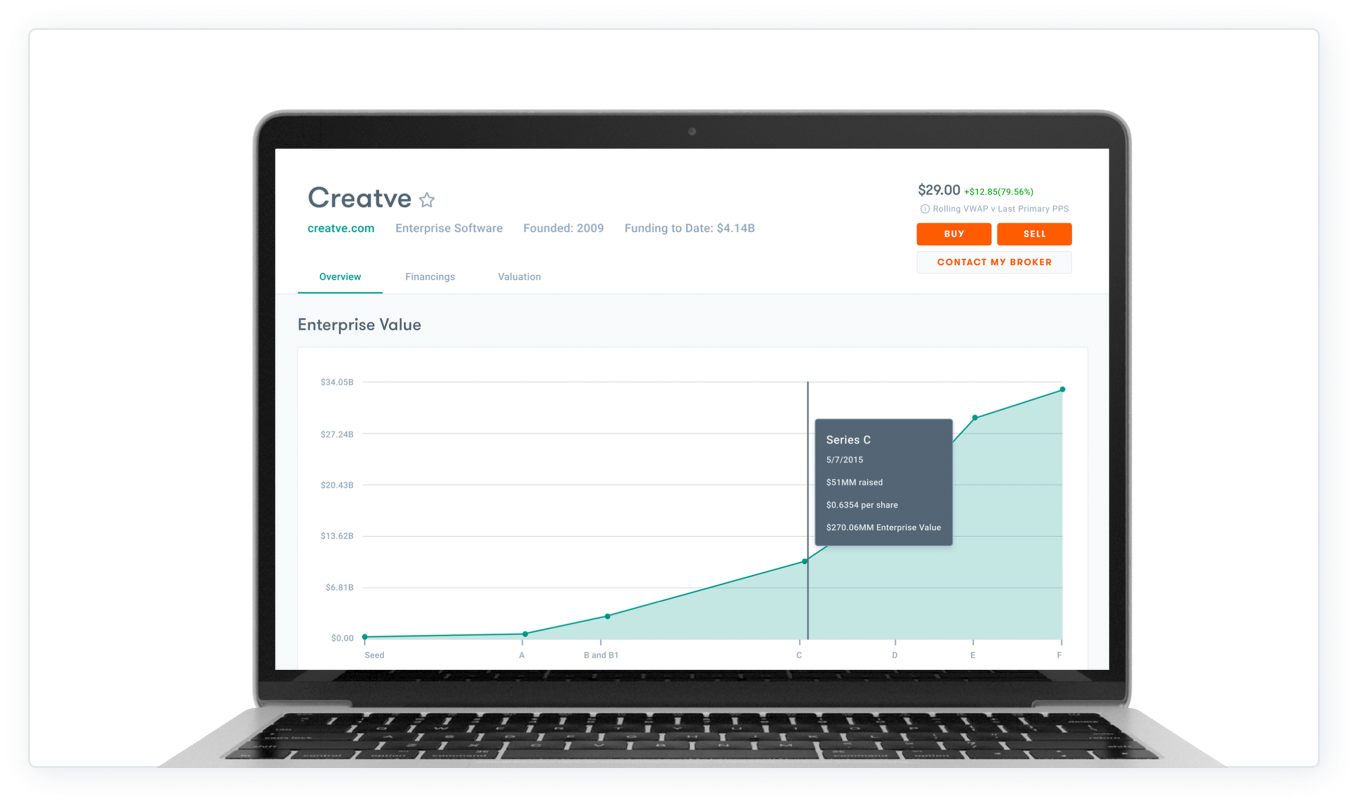

For the public stock, you could open a brokerage app and become a shareholder in a few seconds. But to obtain the private shares in the startup, you might have to take steps like persuading the owner to sell some of their equity, participating in a fundraising round, or buying employee shares through a secondary marketplace like Forge.

The latter often offers the most direct route for individuals to trade private stock, but the process can still be more complex than with public stock, and private stock buyers typically need to be accredited investors.

How does private company stock work?

Generally, securities sold in the U.S. need to be registered with the Securities and Exchange Commission (SEC), but private companies can often engage in what’s known as private placements and follow Regulation D to be exempt from registration. So, a founder might initially own 100% of a startup, but to raise capital, they might sell private shares to other investors, like venture capital (VC) or private equity funds, via a private placement.

Private companies can also issue private stock to employees, often in the form of employee stock options. In that case, employees aren’t shareholders right away but have the option to purchase shares down the road at a set price. An employee might be able to exercise stock options at a relatively low price and then perhaps sell the stock if it increases in value, either pre- or post-IPO. If an employee sells stock pre-IPO, they would be selling private stock, such as to another individual who’s an accredited investor and wants to gain access to private markets. If the employee held the stock until after an IPO, then it would become public stock.

Why is private stock used?

Issuing private company stock can be a good way for privately held companies to raise money without going into debt. Giving employees stock or stock options can also be a good recruitment and retention tool. A startup might not be able to match the salary of a larger company, but the stock could have more potential upside, thereby enticing employees.

Meanwhile, investors in private company stock might like the idea of trying to buy in early, before a company becomes public. Or, they might want diversification from public stock holdings, as private stock might not be exposed to the same headwinds, like pressure from quarterly earnings seasons.