Forge is excited to announce the latest features that enable investors to better engage with the private markets. Today, Forge is announcing that the Last Closed Trade details and the volume-weighted average price (90-Day VWAP) for trades facilitated by Forge are now available upon login for hundreds of privately held companies—this brings more transparency to the private markets and empowers clients with critical price discovery tools.

Explore the new pricing features

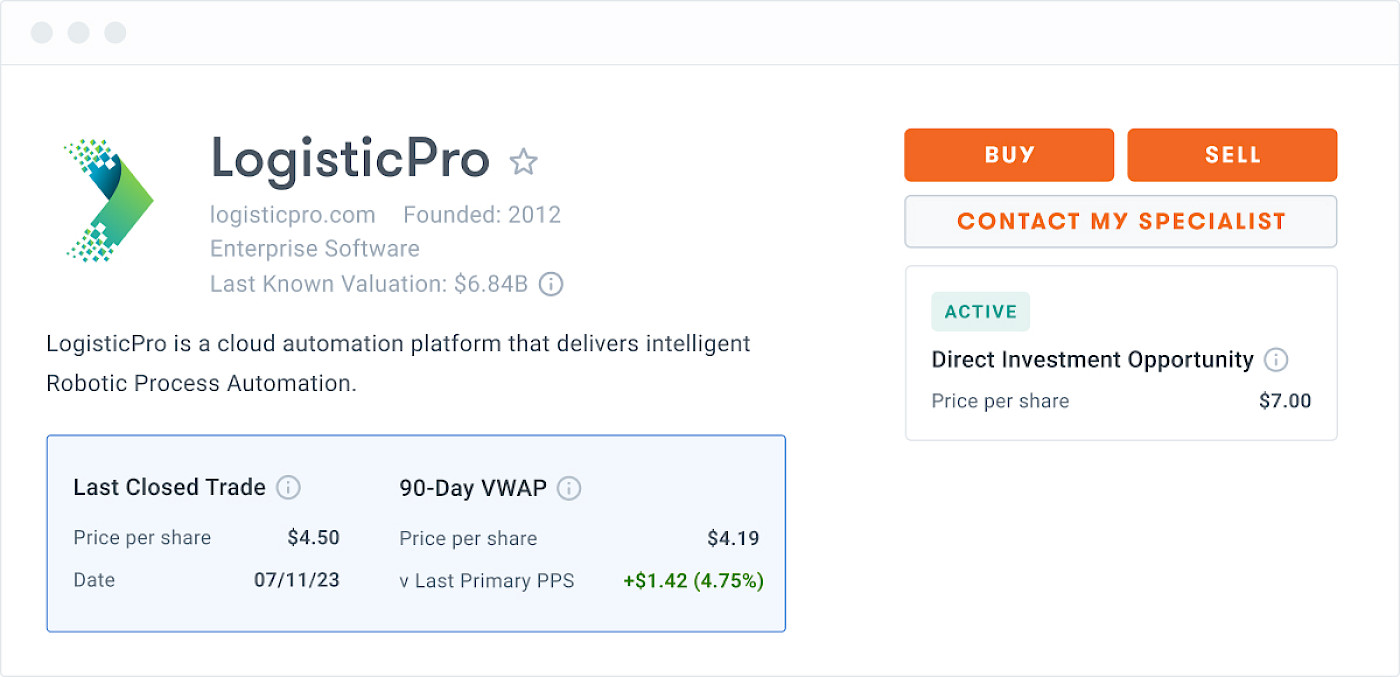

With the new “Last Closed Trade” details, investors receive the price per share of the last closed trade on Forge’s platform, and the specific date of that transaction. This data point can be utilized by investors seeking the latest market conditions and recent transaction values, providing an anchor from which they can engage in price discovery for a historically opaque market.

The 90-day VWAP allows investors to understand how the market for a given company is developing from a broader perspective. This feature represents an aggregated view over a longer period, smoothing out short-term fluctuations and providing a more comprehensive understanding of a security's average price over time. Forge also provides an additional contextualizing data point—the change from the company’s last primary fundraising round (in price per share terms) to the current VWAP. This highlights the potential benefit of having more pricing data available other than just the last funding round price, as private markets can be volatile, and the last funding round price can be outdated.

As a reminder, Forge calculates 90-day VWAP from transactions on Forge Markets in the preceding 90 days with the following formula: Σ(Price * Volume) / ΣVolume during the time interval of the last 90 days.

Both the Last Closed Trade and the 90-Day VWAP is available on the company's page below the company's name and description.

With the release of both Last Closed Trade price and 90-day VWAP, Forge is enabling investors to make more informed decisions when approaching the private markets through its commitment to drive the private markets to be more transparent and accessible.