After a record breaking year, the IPO window has closed

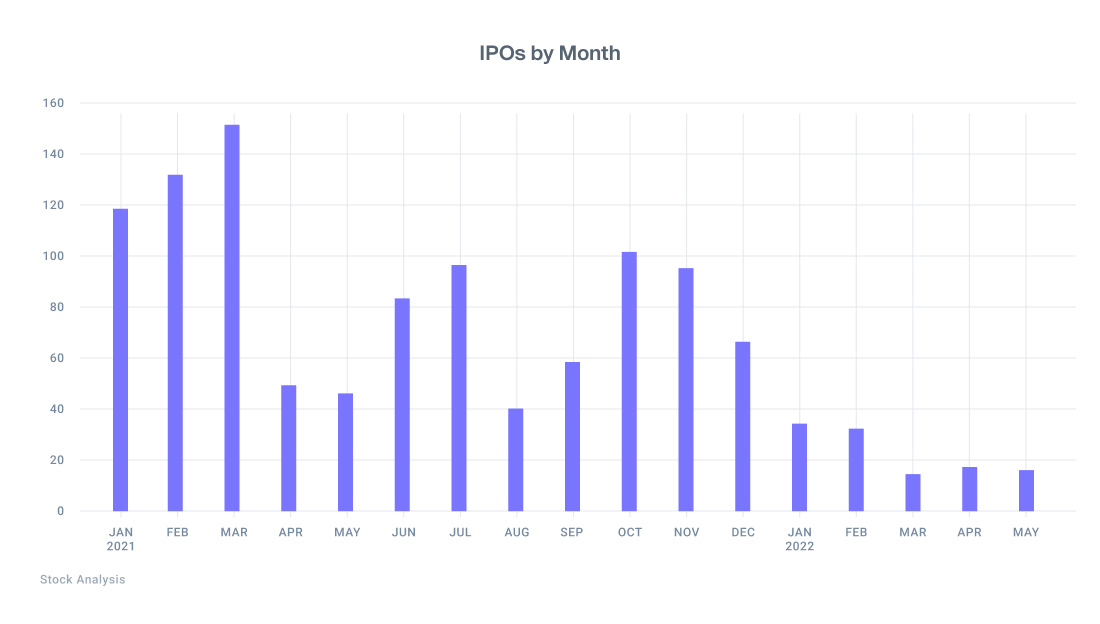

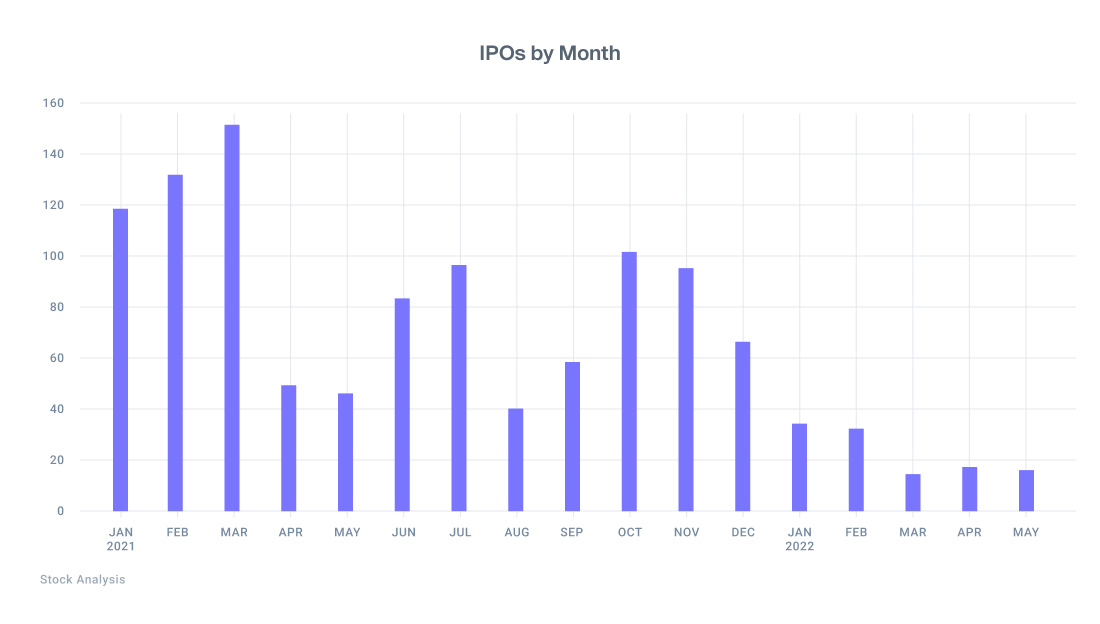

2021 was a record-breaking year for IPOs. With stock market performance exceeding expectations, companies were going public in remarkable numbers. 1035 companies held IPOs on the U.S. stock market in 2021, soaring past the previous record of 480 in 2020 1. IPOs raised $142.4 billion in 2021, an 82% increase from the $78.2 billion raised in 2020 2.

2022, on the other hand, is shaping up to be a tighter year for IPOs per data through the end of May. Lingering pandemic anxiety, supply chain slowdowns, geopolitical conflict, and inflation are all contributing to a tech stock sell-off, with the tech-heavy Nasdaq Composite Index down 24.5% this year as of June 1. Private companies are taking note, with many deciding to pause or postpone their public offerings. There were just 80 U.S. IPOs in Q1 of 2022; in Q1 of the previous year there were 401 3.

If you’re an employee with stock options in a private company that had plans to go public, this may not be welcome news. But don’t worry — it’s still possible to sell your pre- IPO shares. Keep reading to find out how Forge can help you navigate the process of selling your private company stock on the private market.

Build a Private Market Strategy with Forge

Private, or secondary, markets are playing an increasingly prominent role in the global financial system. One recent study estimates that private markets will include approximately $13 trillion in assets under management by 2025, as asset managers and owners continue to allocate more funds every year 4. This trend presents an exciting new opportunity for employees, as it’s never been easier to liquidate private company stock options without waiting for an exit event.

This is great news, but trading in the private market is more complicated than selling stock on a public exchange. Federal regulations, company policies, as well as the process of valuing private shares and finding buyers present unique challenges for anyone who wishes to sell on the secondary market. That’s where Forge comes in: our private market experts are here to help guide you through every step of the selling process.

When you register with Forge, you’ll be assigned a Private Securities Specialist who will leverage Forge’s proprietary data platform to help you value your shares and connect you with interested buyers from our network of more than 125,000 accredited investors and institutions. You’ll also have access to data-driven market insights, company data, and more.

As a seller, what can I expect from the current market?

More employees than ever are looking to the private market as a way to unlock the funds in their stock option plans. In March and April of 2022, Forge saw the highest ever number of unique sell-side Indications of Interest on the platform. Forge has also recorded an increase in buyers to match the growing number of sellers, with data suggesting that the two sides are well-balanced.

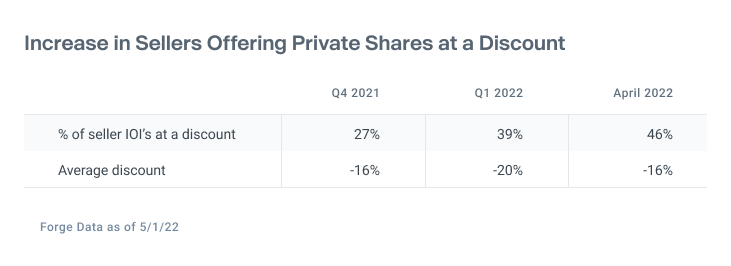

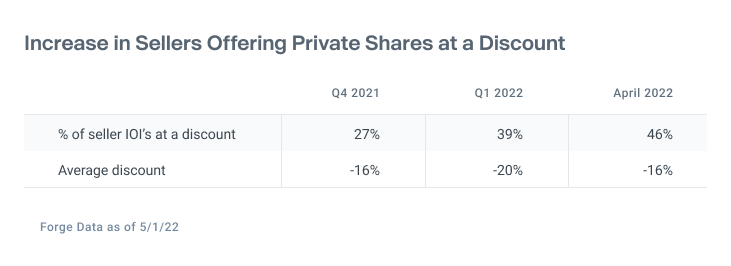

But what about those factors that are putting the brakes on the public market? Do they affect the private market as well? To some extent, yes. But while private stock prices aren’t exempt from the broader market drawdown, they appear to be less sensitive to external factors. Although Forge saw an 8.9% decrease in prices of private company stocks traded on the platform from Q4 2021 to Q1 20225 , this number is substantially lower than the 31% price decline recorded by the Renaissance IPO ETF, an index of U.S. IPO performance.

So while sellers are increasingly offering their shares at a discount, the size of those discounts appears to be holding steady, remaining smaller than those we’re seeing in the public market. For more on the current status of the private market, take a look at Forge’s June Private Market Update.

Create a free account with Forge today, and begin the process of selling your employee shares. Experience the full financial rewards of your hard work, without waiting for a public offering.