This year has been like no other in recent history. The dynamics that had dominated the economy since the start of the century changed in a matter of months. The result has been increasing risk and uncertainty in the marketplace. Bonds have taken a direct hit from rising interest rates, while growth stocks have suffered from a drastically revised multi-year earnings outlook.

In this environment, the information institutional investors typically rely on to inform their decision making has become scarce. Helping to fill this void, mutual fund marks (see sidebar) have emerged as an increasingly important data source that can shed light on the valuation and direction of private equity investments.

- Inflation has reached levels not seen in 40 years and is proving to be more persistent than many had expected.

- Interest rates are on the rise. Prior to this year, the US Federal Funds Target rate had not been over 3% since January of 2008. Since the start of the millennium, the Fed Funds Rate has been below the Fed’s 3% target the majority of the time.

- Geopolitical risk has risen worldwide, sparked by the war in Ukraine and the threat of escalating tensions between Russia and NATO countries.

Declining deal flow causes data drought

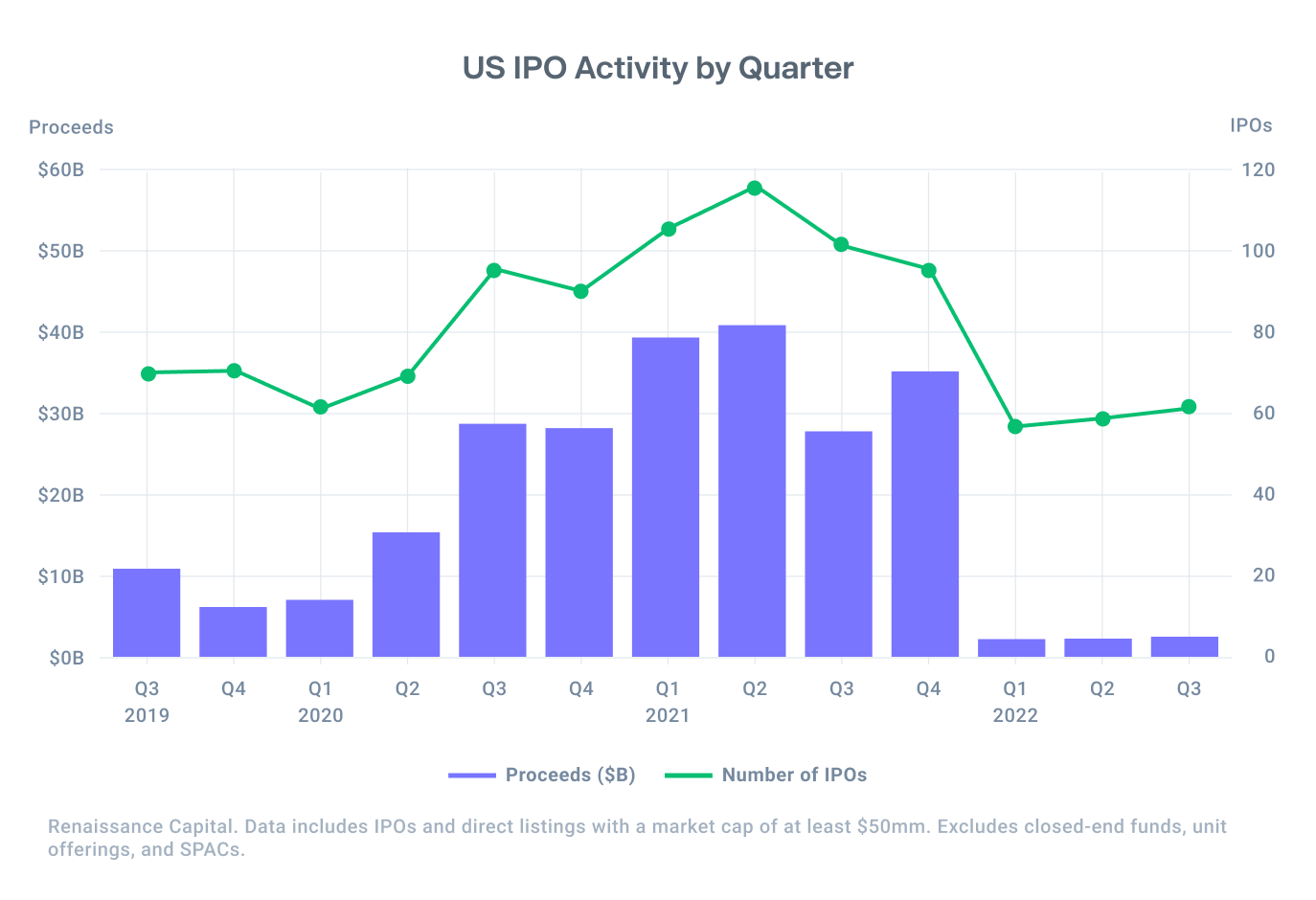

Increasing risk and negative sentiment have put a damper on both the market for IPOs and VC funding rounds, reducing liquidity in the marketplace and limiting the number of pricing data points available today. The chart below shows this year’s steep decline in the number and size of IPOs.1

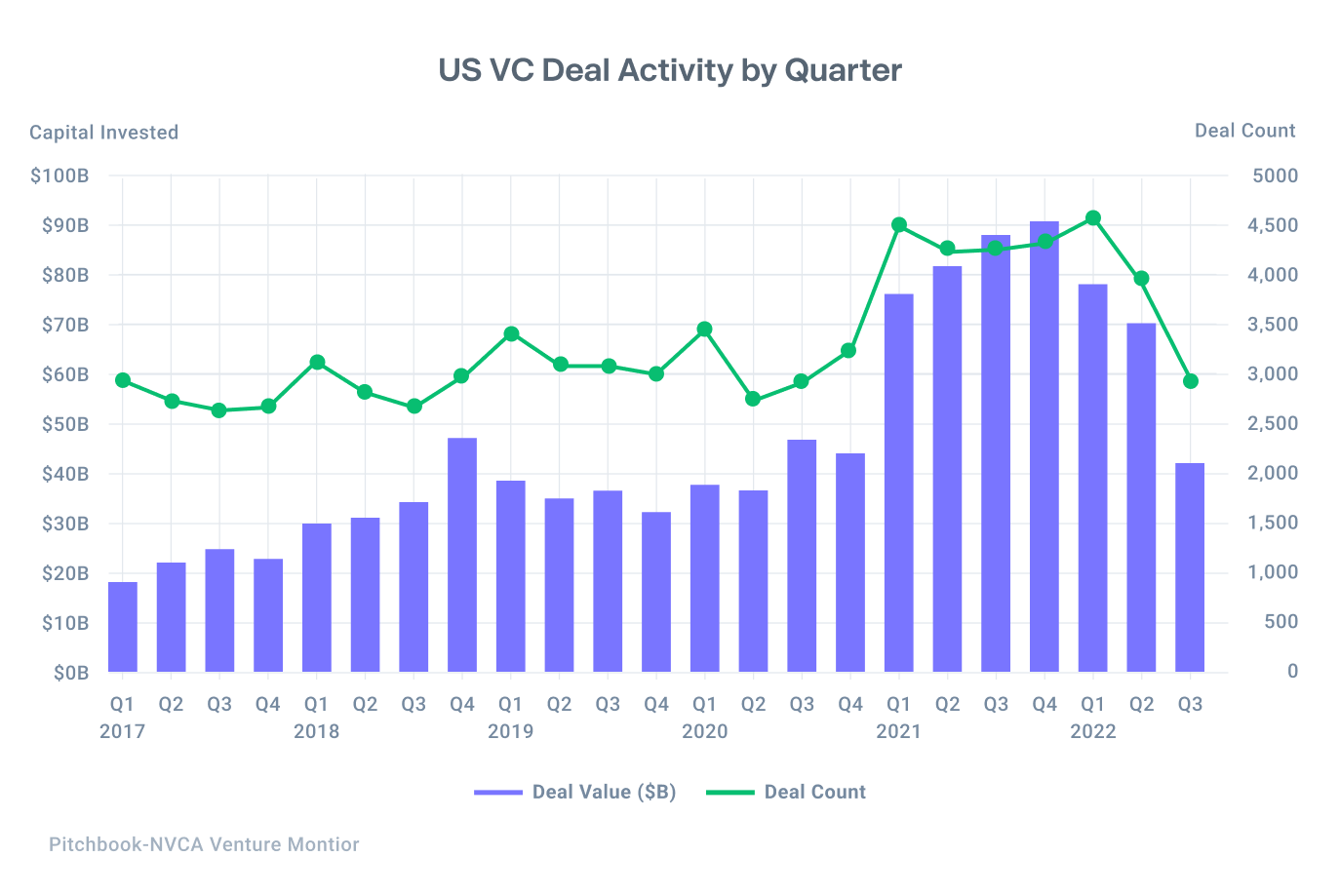

While overall VC deal count has been relatively high (see chart below), the value of those deals has fallen in each of the last three quarters, reflecting an overall slowdown in the market.2

Better data for smarter decisions: Mutual fund marks

As an investor, your next decision is only as good as the data that backs it. With the volume of IPOs and VC funding rounds on the decline, investors are finding it increasingly more challenging to identify data sources that accurately reflect the current valuations of their less liquid private holdings. That’s where mutual fund marks can help.

Mutual funds are required to report the price per share value of each of their private company holdings quarterly, and in some cases, monthly. These “marks,” which represent the price expressions of some of the largest, most well-informed institutional investors, are emerging as an additional metric that can be used by other investors to more accurately value their private holdings.

Importantly, because the funds that report mutual fund marks are oftentimes participants in primary funding rounds, they are on the cap table. That means they may have access to additional information from the company’s board that could potentially make their pricing decisions even more informed. As such, mutual fund marks may provide private market participants with an information edge in increasingly uncertain times.

As of September of this year, mutual funds held more than $15 billion in private-firm equities.3 Each of those positions is regularly marked to market by the fund manager. The aggregation of that data can potentially reveal the trend of those private investments as a whole, by sector, and by individual name. That information can then be used by market participants as a key input into their investment processes as it represents the most up-to-date pricing views expressed by a group of informed of institutional investors.

Current trends reflected in mutual fund marks

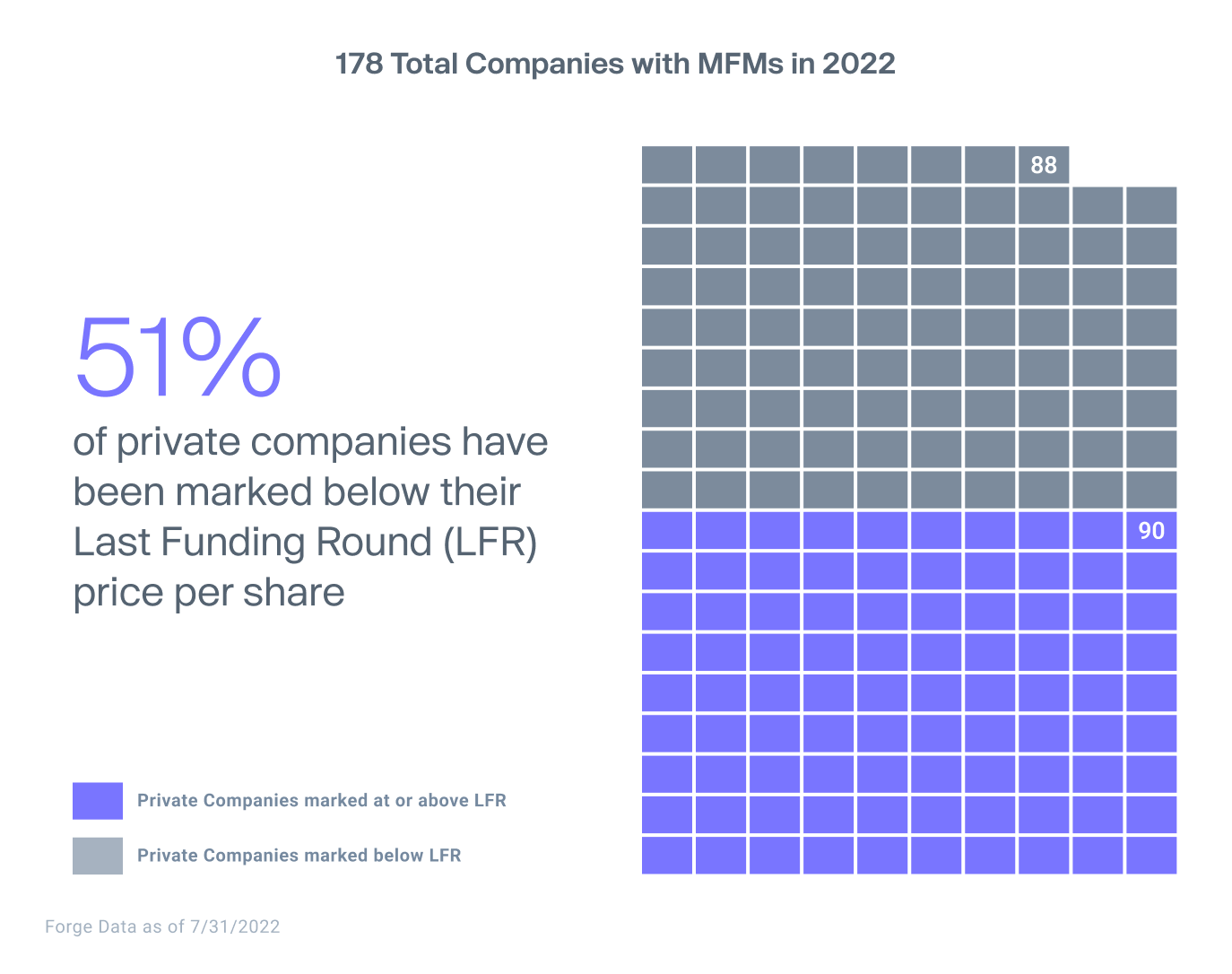

The latest mutual fund mark data reflect downward pressure in the marketplace. Of the 178 private companies with mutual fund marks on Forge Data, 51% (90) have been marked down below the price per share of their last funding round.

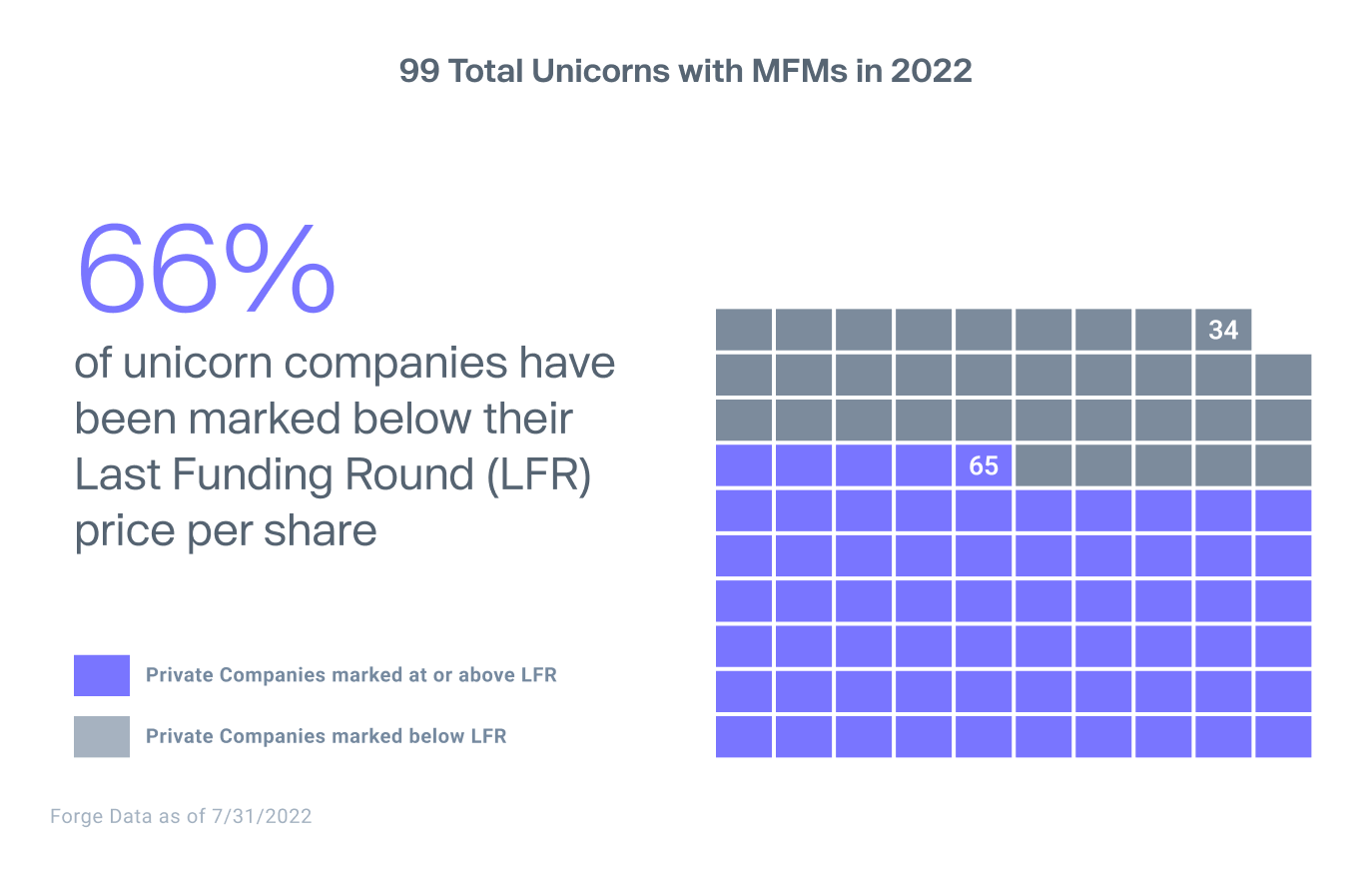

The mark-down effect is more pronounced among larger companies. Looking solely at the universe of 99 unicorns (private companies valued at more than $1 billion), 66% (65) have been marked down below the price per share of their last funding round.

In a world in which the landscape of opportunity and risk is rapidly changing, access to new sources of information can potentially provide a competitive advantage. As deal flow slows in response to rising uncertainty, mutual fund marks have emerged as an increasingly important dataset to shed light on the value and direction of private investing.

Forge Data maintains one of the largest aggregated mutual fund mark datasets in the industry. The data Forge collects is aggregated from some of the largest asset managers in the world, including Fidelity, T. Rowe Price, BlackRock and Capital Group. Our database currently includes more than 15,000 mutual fund marks for over 300 private company names. Learn more about Forge Data