The IPO – as we’ve all known it – is dead.

From alternative and creative exit structures to rapid innovation in the private markets, companies headed for the big stage have far more options than ever before to create the bespoke exit experience they want, and to choose who will benefit from their success and when.

In a traditional IPO, access to listing day shares — and therefore the benefits of a successful public debut — have generally favored a narrow band of bankers and investors. But that’s changing. Case in point is Robinhood’s innovative IPO that hit public markets in late June. By withholding about a third of shares for its own customers (those trading on the Robinhood app) to buy into through the Robinhood platform, and by allowing employees to sell as much as 15% on Day 1, Robinhood stayed on brand (it’s whole ethos is about democratizing access to public market investing) and demonstrated that status quo for the IPO is no longer en vogue. It’s public market debut, despite a choppy performance in its first week, epitomizes how founders and executives creating bespoke exit strategies can strive to reward the people who helped their company succeed.

And this is just the beginning.

Exit innovation

Those who follow the private and public markets know that the traditional IPO is facing massive disruption. Founders and company executives have more choices with new solutions that democratize the benefits of successful company ascents, spreading more wealth to a broader pool of stakeholders than ever before.

The hybrid auction model, tested by Airbnb and DoorDash, attempts to get company equity holders a better price for their IPO shares. Meanwhile direct listings often eliminate or reduce the lockup period, allowing equity holders to optimize their share sales at the debut instead of having to wait.

Additionally Robinhood was the latest to test the “IPO profit sharing” model that companies such as Airbnb and Uber piloted before -- reserving shares for clients, superhosts and drivers to buy at the IPO price – so they can participate in the upside that they helped these companies create through their customer loyalty.

Along with Robinhood, companies like telehealth provider Doximity which recently went public reserved 15% of IPO shares for doctors on its network, and companies like Acorns and others are following suit.

This innovation in how companies approach exits is inspired by a desire to broaden access to that value creation -- and it doesn’t just start with public listings.

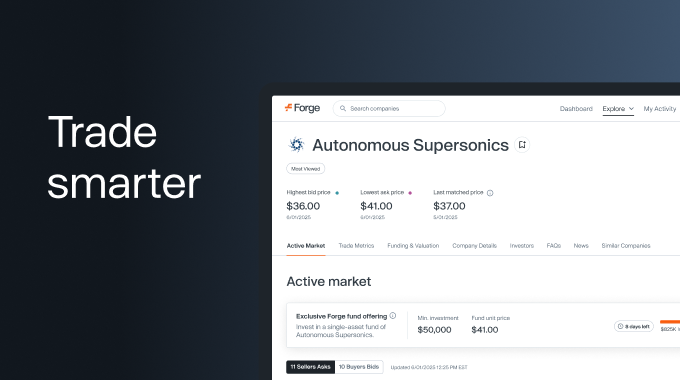

Companies are starting earlier -- often through private marketplaces like Forge, which allow equity holders to get cash for their shares pre-IPO and allow accredited investors to access shares in potentially fast growing private companies – a privilege once reserved for the narrowest band of VCs and PE firms.

This changing dynamic is being championed by a new breed of founders including Matt Mullenweg, CEO of Automattic, who has embraced the benefit in rewarding employees and early investors for their contributions by allowing for liquidity while still private.

Said Matt in a recent blog post: “...Some of Automattic’s employees and former employee shareholders have been part of our journey for a very long time. Selling a bit of their equity holdings could have a significant impact on their lives. Automattic was founded 16 years ago and is still private, so it’s important for us to try to provide liquidity to any shareholder who wants it.”1

Spectrum of choice, greater control with the private markets

The acceleration of the private markets is also giving companies more choice in how and when to approach an exit – with more options to run liquidity programs for employees, raise primary and secondary capital, let VCs cash out early, understand market-based reference prices, and ultimately better control exit timelines.

All of this means companies have options about when, how and if to make their public debuts at all, and can leverage a broad pool of interested private investors, and offer incentives that can keep them well capitalized and well staffed until the timing to exit is right. And when that time comes, they have more control in determining how they’ll approach the process – from a better understanding of what the market will bear for their stock, to better equity-based incentives to provide to employees and stakeholders to alleviate pressure on going public as the singular wealth-generating event.

Visit Forge Company Solutions to learn more about customized liquidity programs.