Indexing: one of the most powerful financial innovations of the last 50 years

Index investing has grown exponentially since its introduction in 1976. The benefits of low-cost structures, competitive or superior performance relative to active investing, and easy-to-use vehicles like mutual funds and ETFs have spurred index investing to grow into arguably the biggest investment innovation of the last 50 years.

Today, there are thousands of indices in the $44 trillion U.S. equity market and estimates range from 15% (when considering mutual funds and ETFs) to 37.8% (when considering direct indexing) of equity markets being covered by passive investing.1 2 Today, there are more indices than stocks in the public market, and this trend shows no signs of slowing down – especially as companies stay private longer and accrue more value in private markets.3

Indexing has spread to every corner of financial markets. Today, investors can find indices with long track records in developed, emerging, and frontier equity markets; all global fixed income markets; commodities, real estate, cryptocurrencies, and more.

Apple famously marketed the iPhone with the tagline “there’s an app for that.” For investors looking to put on a specific strategy or express a view, there’s an index for that.

Private markets: a rare segment of investing that has not been matured through comprehensive indexing

Private markets are growing, but they have not yet reached the maturity of public markets. Private markets lack the robust indexing and benchmarking tools that are commonplace in public equity, and consequently, passive investing has not come into focus in private markets.

But this is changing. More investors are turning to private markets for new sources of return and diversification, and private markets are becoming more efficient and transparent. All of this leads to more liquidity and data, which increases the opportunity for rules-based or index strategies similar to those employed in public markets.

Why prior attempts to index the private market have fallen short

There have been other attempts to index the private market in recent years. But as a leader in private market trading, Forge is uniquely positioned to use its transaction and pricing data to construct indices or models that investors can use to seek to replicate the risk and return characteristics of this growing asset class, or to measure and attribute their portfolio returns against a specific set of benchmarks.

Most private market indices today are comprised of private market funds. Consequently, they only reflect performance across funds with private exposure and lack transparency to the underlying companies held in the funds.

The few indices that seek to deliver private market exposure through underlying company performance have historically used primary round fund-raising data as the key input. But focusing on primary valuations introduces some challenges that can be suboptimal to index construction. Chief among them, primary valuations tend to be updated only when a company raises money, so often this data point can be stale, particularly in today’s market environment where primary funding activities are few and far between.

Made possible by the Forge Data platform, the Forge Private Market Index leverages the breadth and depth of Forge’s trading data and can be used by investors and private market participants to:

- Benchmark actively traded private companies with secondary liquidity.

- Measure the performance of venture backed, late-stage companies relative to other asset classes.

- Research new investment ideas and manage existing private positions.

Construction of the Forge Private Market Index

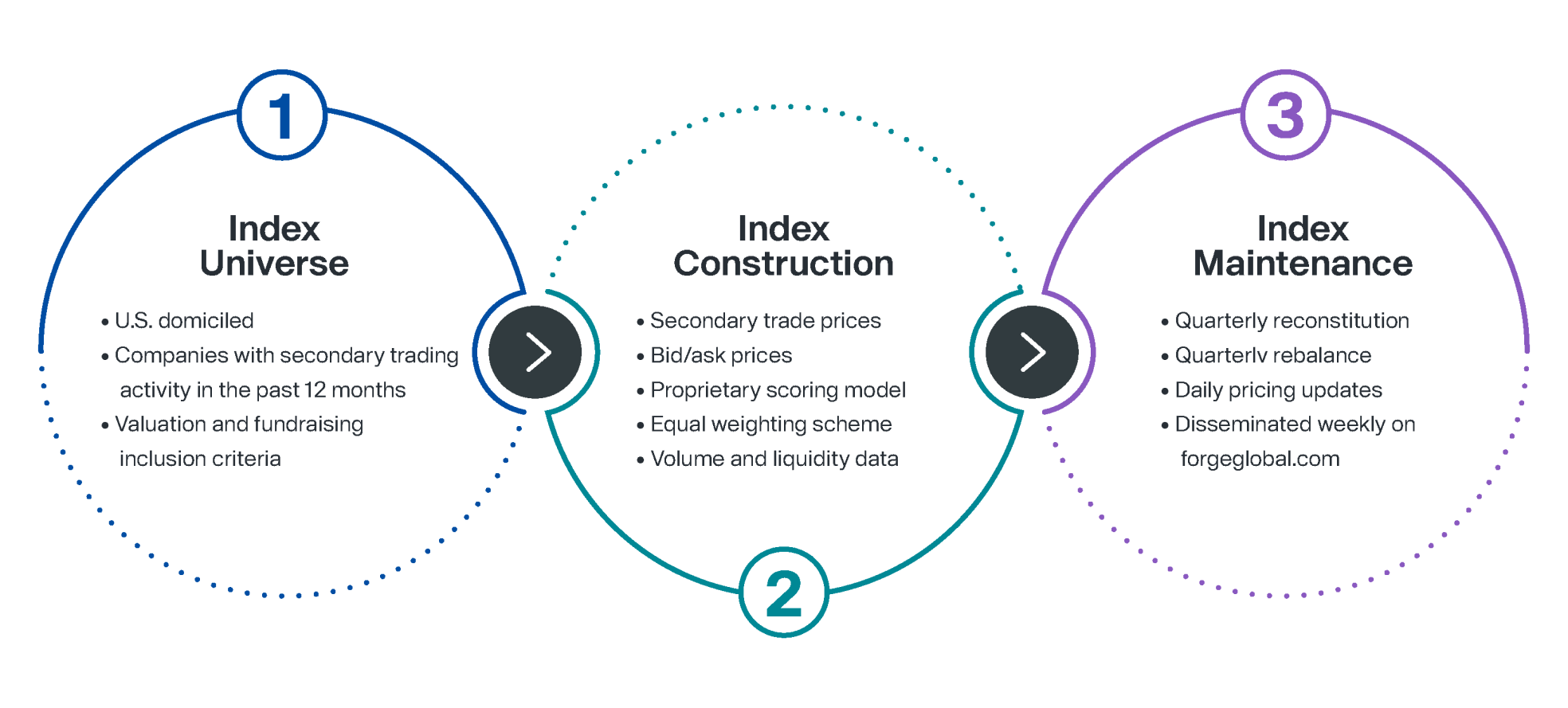

Unlike prior attempts to index the private market, Forge’s approach focuses on aggregating and structuring private market trade and pricing data from Forge and other private market platforms, and applying a pricing methodology that contextualizes private market transactions into an index model.

This aims to standardize the performance of private companies while ensuring that valuations are fresh. The resulting index consists of four years of index history through different market cycles, with up-to-date performance information on 75 late-stage, venture-backed companies across key industries in the innovation economy such as Data Intelligence, Cybersecurity, Adtech, and Digital Health.

The Forge Private Market Index aims to be the benchmark for actively traded private companies and marks a new milestone not only for Forge Global – but for the private market.