As consumers turn more toward non-alcoholic beverages1 and consider health factors like sugar content,2 Liquid Death has rapidly grown and become one of the most prominent independent beverage brands.

Since launching in 2019 with canned water designed to "Murder Your Thirst," Liquid Death has expanded to other product lines including sparkling water, iced tea, and hydration mixes, hitting triple-digit growth three years in a row.3

In addition to growing its sales, Liquid Death has also attracted a lot of investor interest. In just five years, the company went from a small Seed round of $2.65 million (valuing the company at $6.64 million at the time) to a Series F of over $67 million, bringing Liquid Death's valuation to $1.4 billion.4

Meanwhile, speculation has been bubbling up about a potential Liquid Death IPO, although previously reported plans from 20235 have not yet resulted in any SEC filings to go public.

That said, accredited investors may still be able to buy Liquid Death stock pre-IPO, or retail investors may get similar exposure through other publicly traded companies.

Here, we'll take a closer look at how to invest in Liquid Death stock pre-IPO.

Liquid Death: Company background

Liquid Death is the doing-business-as (DBA) name of Supplying Demand, Inc., based in Los Angeles. The company was started in 2019 by Mike Cessario, a former advertising agency creative director who worked on campaigns for Netflix.6

Early investors included prominent entrepreneurs, including Biz Stone, co-founder of Twitter; Jen Rubio, co-founder and CEO of luggage company Away; and Michael Ryan Dubin, co-founder of Dollar Shave Club. Venture capital firm Science Inc. was also part of the Seed round in 2019.7

The company started with its flagship canned still water product, with clever marketing that evokes some of the spirited styles typically seen in the alcohol and energy drink spaces. Selling water in aluminum cans has also been a key part of the company's branding, as it uses "Death to Plastic" messaging.

Since then, Liquid Death has expanded into flavored sparkling water, iced tea, and electrolyte drink mixes. In general, its products are meant to provide healthier alternatives to options like beer and soda, while still arguably having a "cool" factor to them.8

Liquid Death stock and funding history

Liquid Death has had seven primary funding rounds since starting in 2019. That year, its Seed round raised $2.65 million at a price per share of $0.26 and a valuation of $6.64 million.9

In 2020, it raised over $12 million in a Series A and A-1, bringing its stock price to $1.25 and valuation to nearly $50 million. That Series A was led by Velvet Sea Ventures.10 It also had its Series B in September 2020 and Series B-1 in May 2021, the latter of which brought its stock price up to $2.62, with entertainment investors like Live Nation Entertainment and Wiz Khalifa bringing the valuation to over $150 million.11

Liquid Death reached unicorn status in 2023, with a $76.5 million Series E round that brought the share price to $9.66 and valuation to $1 billion.12 A little less than a year later, in March 2024, Liquid Death completed its most recent primary funding round, a $67.6 million Series F-1 that brought the stock price to $12.87 and valuation to $1.4 billion. That funding round included celebrity investors such as actor Josh Brolin and football player DeAndre Hopkins.13

How to buy Liquid Death stock

As of now, Liquid Death remains a private company, so its stock is fairly limited. In 2023, The Information reported that Liquid Death hired Goldman Sachs to lead a potential IPO, but so far that hasn't materialized into any definitively announced plans to go public.14 That said, CEO Cessario told Bloomberg in March 2024 that Liquid Death wants to keep the IPO option open.15

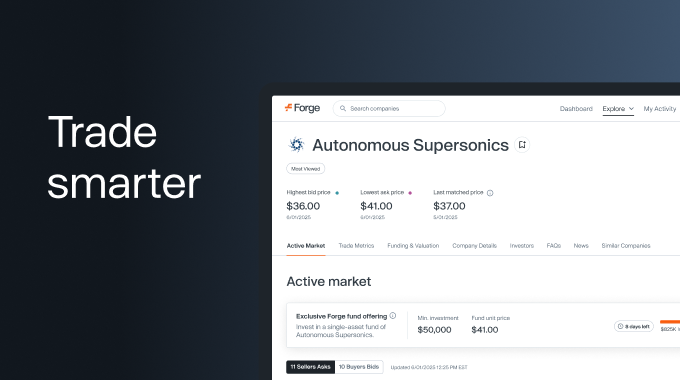

For now, outside of primary funding rounds, investors may be able to buy private stock of Liquid Death if existing shareholders, such as early investors, decide to list shares for sale on a secondary marketplace such as Forge. However, the availability of these shares may be limited.

Who can invest in Liquid Death pre-IPO?

As a private company, investment in Liquid Death is generally restricted to investors like venture capital firms and high-net-worth individuals that the company accepts for its primary funding rounds. Individual accredited investors and institutional investors may also be able to find Liquid Death shares for sale on a secondary marketplace such as Forge, but that is dependent on existing shareholders deciding/being able to list their Liquid Death stock for sale.

However, if Liquid Death does follow through with an IPO, as has been speculated, then investment in Liquid Death stock would open up to the general public.

Where to buy pre-IPO Liquid Death stock

Accredited investors may be able to buy pre-IPO Liquid Death stock through a secondary marketplace such as Forge. However, this is dependent on existing shareholders wanting to list shares for sale on a private exchange, so availability may be limited or not come to fruition at all. Interested investors may wish to create an account and speak with a Private Market Specialist to stay informed about whether Liquid Death shares become available through Forge.

Alternatives for unaccredited investors who want to buy Liquid Death stock

Although unaccredited investors can't directly buy Liquid Death stock while it remains a private company, you may be able to get some exposure to Liquid Death or similar companies through other publicly traded stocks.

For example, Live Nation Entertainment is a publicly traded company, and since Live Nation is a Liquid Death investor, buying Live Nation stock means you could potentially be getting some exposure to Liquid Death. That said, Liquid Death is just a small slice of Live Nation, as the company's core business is concerts.16

In particular, investing in beverage companies that could benefit from similar trends that could lift Liquid Death stock.

For example, Coca-Cola and PepsiCo, while in many ways being competitors that offer different types of products than Liquid Death, could still benefit from consumers purchasing more drinks like sparkling water. That's a trend that could lift all of these businesses, particularly if it means consumers are spending more on drinks. Other publicly traded beverage brands like Monster could also benefit from consumers buying more beverages, rather than simply consuming tap water or lower-cost options at home.

That said, Liquid Death is arguably meant to provide an alternative to many of these well-established brands, whose portfolios often include high-sugar options. So, investors might prefer to instead wait to see if they can get direct access to Liquid Death by investing if it eventually has an IPO.

Meanwhile, for broader exposure, investors could also choose mutual funds or ETFs that invest in consumer staples or specifically food and beverage companies. Again, this might not provide exactly the exposure you're looking for, but if you think there's a good chance consumers will spend more on what they eat and drink, then it could make sense to invest in these diversified funds.

How to analyze Liquid Death stock

While private companies don't report their financials in nearly as much detail as public companies, investors can still analyze Liquid Death stock, such as by looking at how its stock price and valuation have changed over the past few years based on what the company reports — e.g., hitting $263 million in retail scanned sales in 2023.17

From there, you can compare Liquid Death's stock price and valuation to other private companies using Forge Data, such as others in the food and beverage space, to get a sense of whether it's trading above or below what you think is a fair price, based on its growth and future potential.

That said, this method of analysis is highly subjective, and investment in any private company typically carries additional risks, such as limited liquidity.

Get started investing in Liquid Death on Forge

If you want to invest in Liquid Death pre-IPO if/when shares become available, create an account with Forge marketplace to access our deep marketplace of private market securities.

When you create a free account, you'll be connected with a Forge Private Market Specialist to determine your eligibility, and from there you can potentially buy and sell private market shares in Liquid Death and other startups.

Forge stands out for its transparency into what can otherwise be an opaque private market, and as a publicly traded company itself, Forge provides a regulated, proven way to invest in the private market.