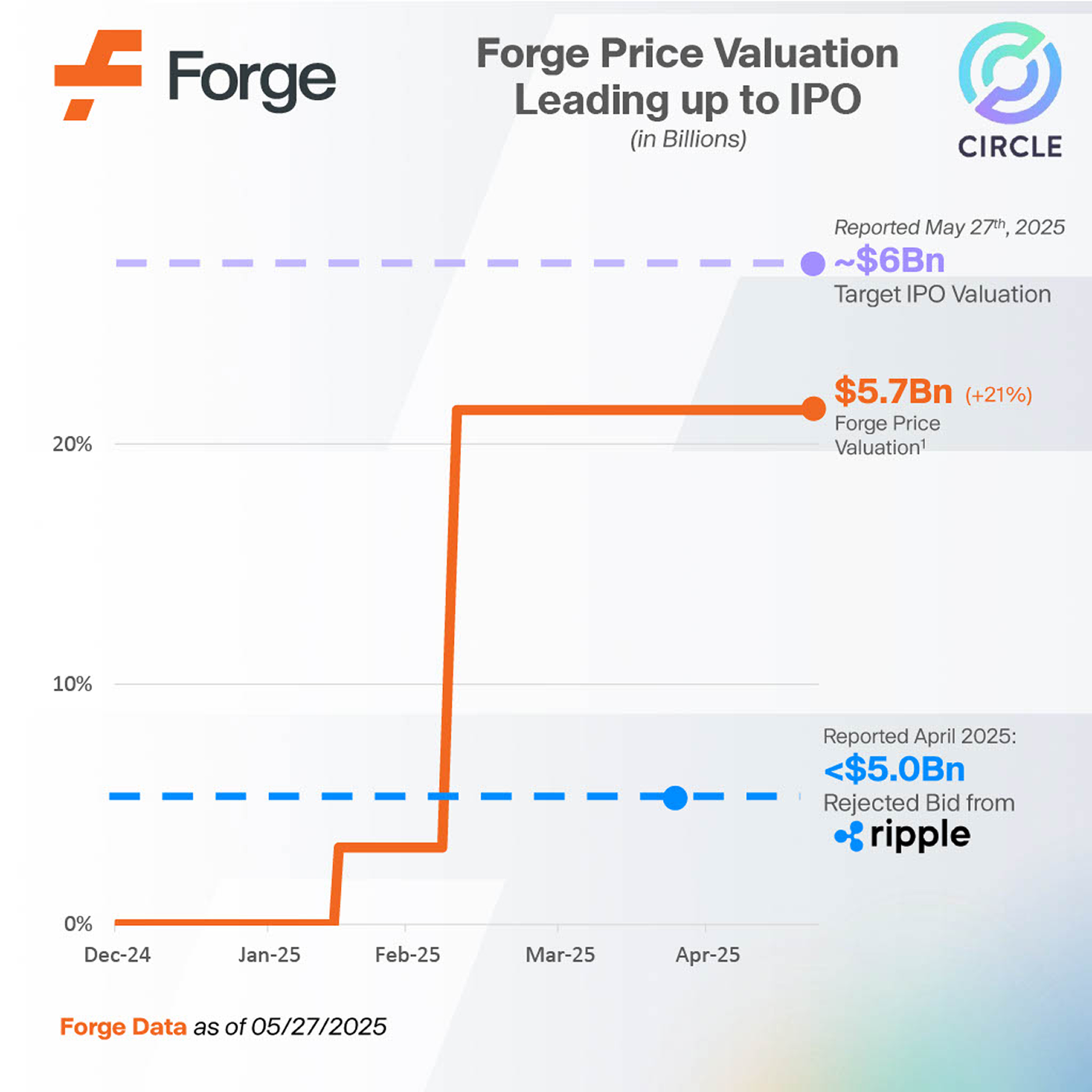

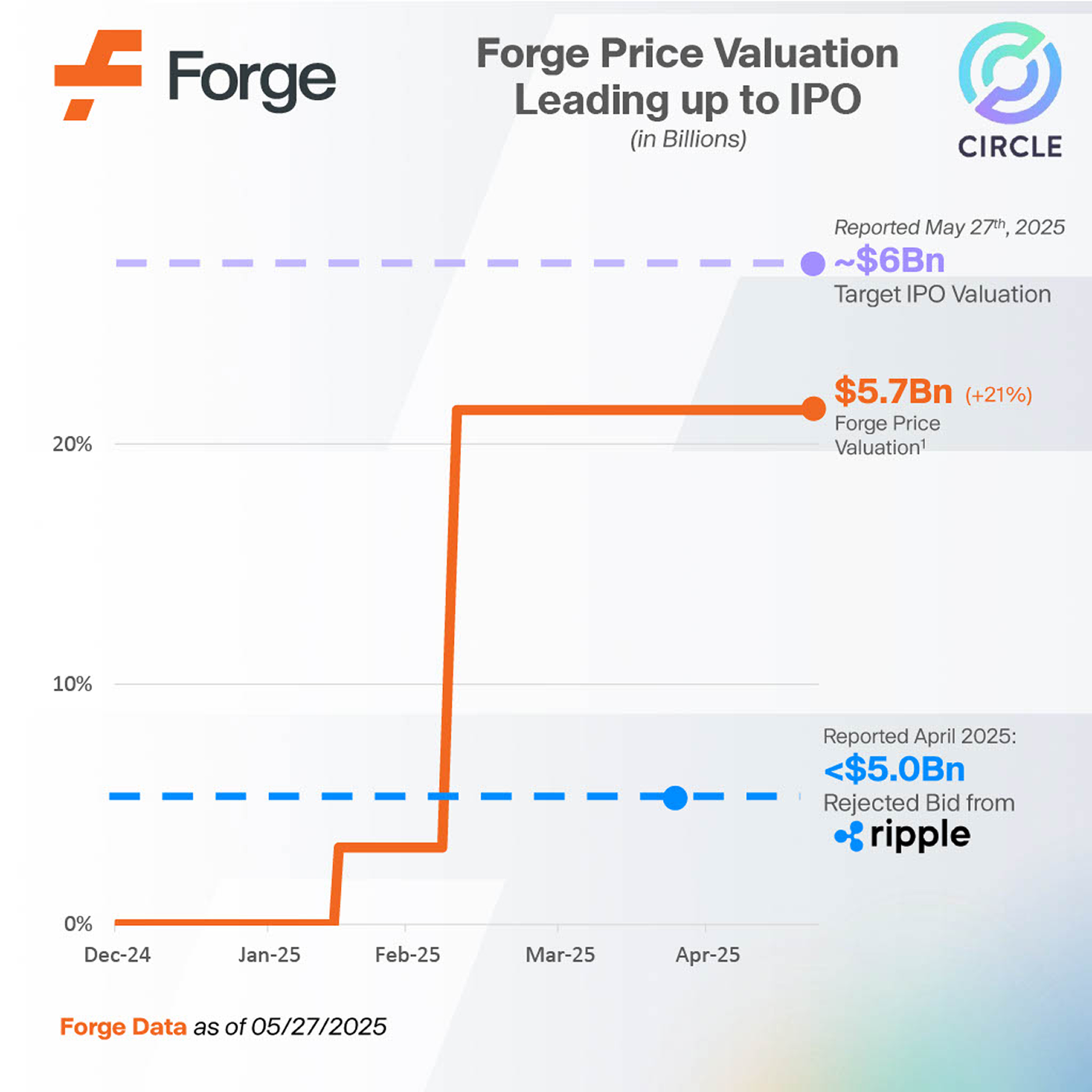

On May 27, 2025, Circle Internet Group Inc., said it was targeting a nearly $6 billion dollar valuation in its anticipated New York IPO, as the stablecoin giant looks to tap into growing optimism around cryptocurrency.1 This move represents a significant moment for the cryptocurrency industry, as Circle may soon become a major crypto-native company to enter the public market.2

Anticipated IPO details: Offering structure and valuation

Circle is offering 24 million Class A shares priced between $24 and $26 each, aiming to raise up to $624 million.3 Of these, 9.6 million shares are being offered by Circle, while 14.4 million shares are being sold by existing shareholders, including Accel and General Catalyst. The IPO could value Circle at up to $6 billion on a fully diluted basis. Notably, ARK Investment Management, led by Cathie Wood, has expressed interest in purchasing up to $150 million in shares.4

The offering is being led by major financial institutions, including J.P. Morgan, Citigroup, and Goldman Sachs, underscoring the growing integration between traditional finance and the crypto sector.5

Circle’s offering comes in the wake of Ripple's April effort to purchase the company for up to $5 billion,6 which Circle rejected.

As of May 27, 2025, Circle’s Forge Price valuation is $5.7 billion, as noted in the chart below.

Financial performance: Revenue growth amid profit decline

In its S-1 filing, Circle reported revenue and reserve income of $1.68 billion for 2024, a 16% increase from the previous year.7 However, net income declined to $155.6 million, down from $267.5 million in 2023. The decrease in profitability is attributed to higher operational costs, including significant distribution payments to partners like Coinbase.8

The company's revenue is primarily derived from interest earned on reserves backing USDC, which are invested in short-term, yield-bearing U.S. Treasury securities.9

This lack of liquidity is particularly problematic in a high-demand industry like AI, where professionals frequently receive competing offers. If a competing firm offers immediate cash bonuses or more liquid equity, employees may be tempted to leave their existing roles, even if they believe in their current employer’s mission. As a result, companies that fail to provide liquidity solutions risk losing top AI talent to competitors with more attractive compensation structures.

Strategic positioning: Strengthening U.S. presence

As part of its IPO preparations, Circle announced plans to relocate its headquarters from Boston to New York City, aiming to strengthen its presence in the U.S. financial hub. The move to One World Trade Center is seen as a strategic effort to align more closely with traditional financial institutions and regulators.10

Circle's decision to pursue a traditional IPO, after a failed SPAC merger in 2022, reflects a more cautious and conventional approach to entering the public market. The previous SPAC deal, which valued Circle at $9 billion, was terminated amid regulatory uncertainties and market volatility following the collapse of FTX.11

Market implications: A turning point for stablecoins

Circle's anticipated IPO is poised to have significant implications for the broader cryptocurrency and fintech sectors. By becoming a publicly traded company, Circle aims to enhance transparency and regulatory compliance, potentially setting a precedent for other crypto firms considering public listings.

The move also intensifies competition among stablecoin issuers, particularly with traditional financial institutions like PayPal entering the space. Circle's potentially stronger capital position post-IPO may enable it to offer improved infrastructure and services to institutional clients, further legitimizing stablecoins in the eyes of traditional finance.12

Final thoughts: A pivotal moment for the crypto industry

Circle's potential IPO marks a pivotal moment in the integration of cryptocurrency into mainstream financial markets. As the issuer of USDC, the second-largest stablecoin by market capitalization, Circle's anticipated public debut underscores the growing acceptance and institutionalization of digital assets.13

The company's forecasted journey from a startup to a publicly traded entity reflects the evolution of the crypto industry and its increasing alignment with traditional financial systems. As Circle embarks on this new chapter, its potential IPO will be closely watched as a barometer for the future of stablecoins and their role in the global financial ecosystem.