Last week, the U.S. Bureau of Labor Statistics announced that 4.5 million Americans quit their jobs in November for the eighth month of record resignations.1 Take a moment to let that sink in. That equates to 3% of the entire U.S non-farm workforce in a single month. In particular, tech workers are quitting their jobs at rapid speed, leaving companies scurrying for solutions to minimize the blow from ‘The Great Resignation.’2

During these historic times, companies are having to come up with unprecedented solutions to keep and find essential talent — and it could signal toward a longer-term shakeup in compensation models as we’ve known them, across both public and private markets.

Public tech companies such as Uber, Google, Coinbase, and Lyft are reassessing their compensation models already. Some are shortening up traditional vesting periods, which are typically around four to six years, and allowing employees to unlock equity grants much sooner. Google, for example, introduced a model for new hires that pays out two-thirds of the initial equity grant in the first two years.3 But whether that shorter-term schedule is better for employees’ long-term financial gain is up for debate.

Meanwhile, a growing number of private companies are exploring liquidity-as-a-benefit – i.e. the ability to cash out on some of their equity prior to their company going public. This is a way to reward employees for their hard work and support their more immediate financial goals with minimal effect to the bottom line.

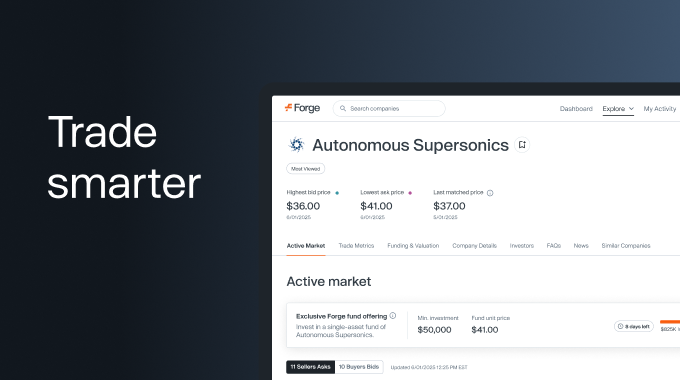

Having the right infrastructure in place to execute on these new models is more important than ever. For private companies specifically, Forge has the tech to help with exactly this.

How Forge can help

Company-sponsored liquidity can help motivate and retain existing employees and is an attractive benefit for prospective employees who won’t have to wait for an exit event to experience the reward of their hard work. The good news is that, with advances in technology, liquidity programs are mutually attractive for companies and founders.

Through Forge Company Solutions, private unicorn companies can manage customized liquidity programs that ultimately incentivize and support employees and investors, raise capital and provide insight into market-based pricing. And what’s more, liquidity programs offer an attractive incentive to company employees -- who could perhaps be lured by greener pastures of pre-IPO companies promising shorter timelines to exits and liquidity.

In addition to the more seamless administrative function, Forge can bring its marketplace to bear for the benefit of equity holders, who can access a diverse investor pool and auction-based pricing that has the potential to put more money in employees’ pockets than perhaps a traditional tender offer might.

And in the age of the Great Resignation, the companies that can deliver the most employee-friendly liquidity programs, will have a powerful tool to reward and retain employees.

Visit Forge Company Solutions to learn more about customized liquidity programs.