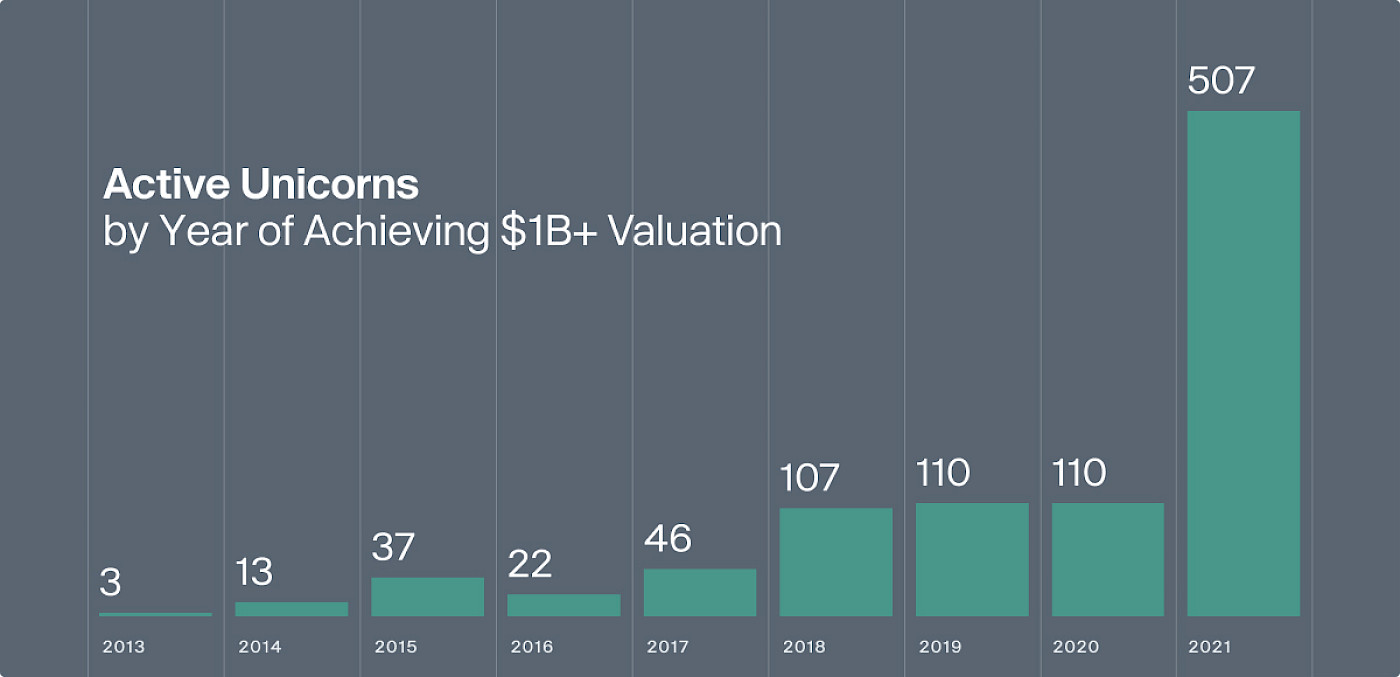

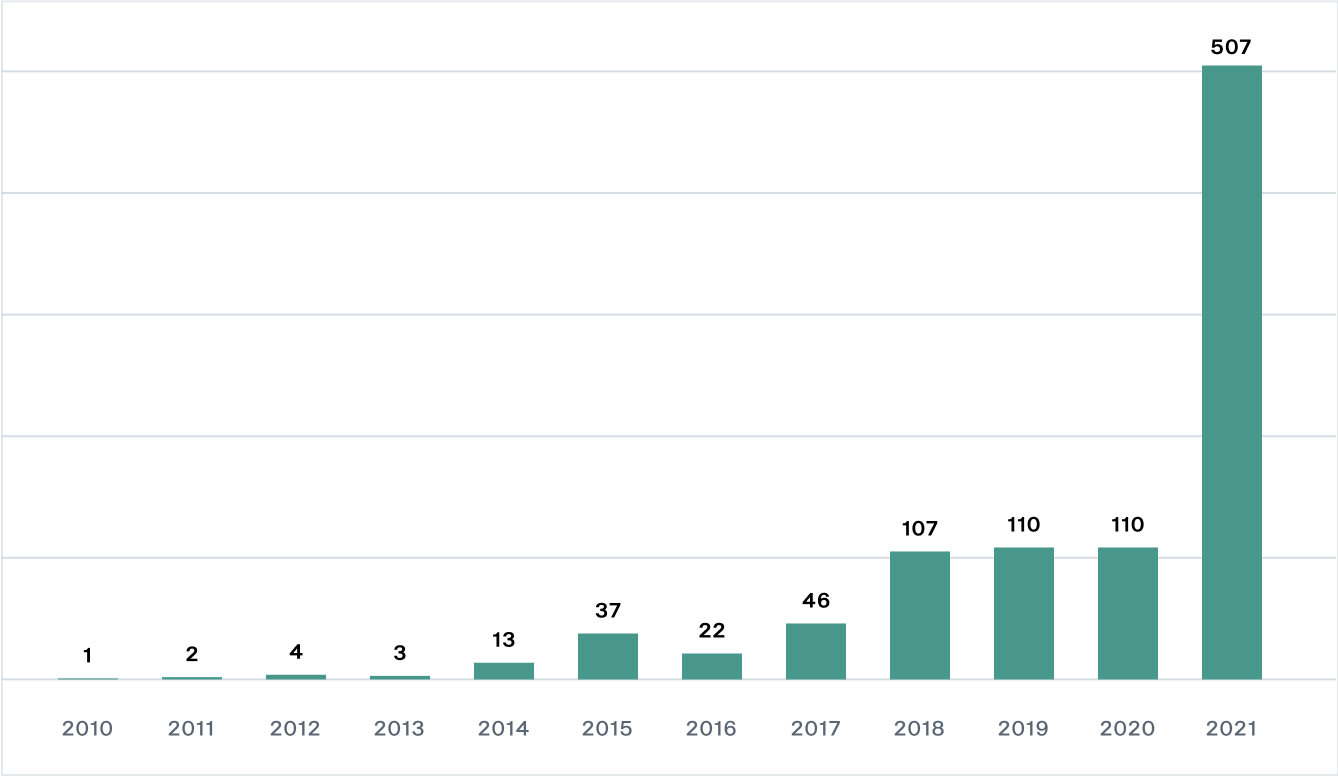

2021 has been a record-shattering year for the private markets – with a 360% year-over-year increase of unicorns created.1 Backed by innovative technology and the increased desire to revamp traditional financial and operating models, the private market seems to have taken a giant step forward.

This growth is occurring at an unparalleled pace. 507 unicorns have emerged on the private markets this year, compared to the 110 that made the list in 2020. What’s more, there have been more unicorns created this year to date than in the last five years combined.

The private markets are now home to more than 958 unicorn companies with a cumulative market cap of over $3.1T, according to CB Insights. This is almost double the $1.6T cumulative market cap of all unicorns just 12 months ago in December 2020. It’s projected that, at this rate, the unicorn club is likely to break 1,000 by early 2022.2

Active Unicorns by Year of Achieving $1B+ Valuation

Data: Forge Data, CB Insights as of 12/29/21

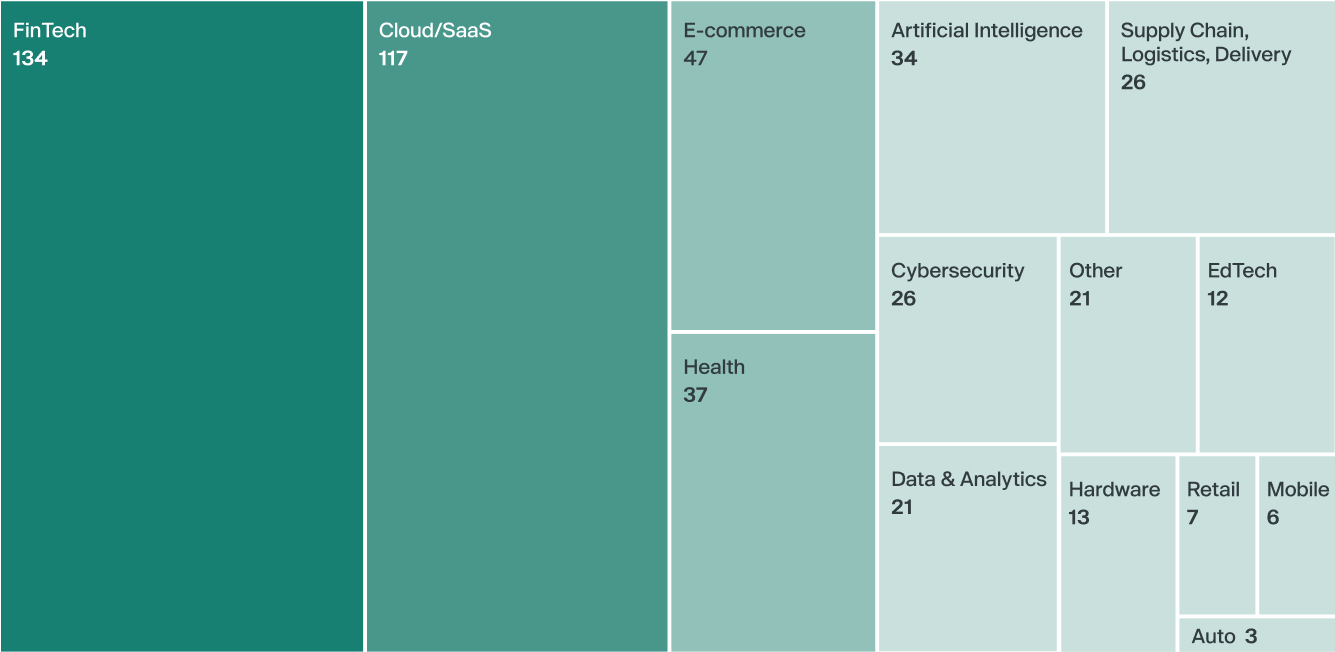

FinTech and SaaS lead the way

FinTech and SaaS account for half of all 2021 unicorns.

The challenges addressed and the opportunities created by FinTech innovators have catapulted investor interest to the next level, and the numbers back this up. 134 FinTech unicorns have been created in 2021 to date, including newcomers like SpotOn, Pipe, and Ethos Technologies, with an aggregate valuation of $311B.

Unicorns created in 2021 by Sector (507 total)

Data: Forge Data, CB Insights as of 12/29/21

The valuation of individual FinTech companies is also skyrocketing. Payment processing company Stripe joined the unicorn list in 2014, and this year, the founders doubled their total wealth to $22.8 billion after the company raised a new $600-million funding round.3 Stripe alone is now valued at $95 billion, nearly triple its last reported valuation of $36 billion from April 20204, and is on its way to becoming one of three hectocorns (private companies valued at over $100 billion), alongside Bytedance and SpaceX.

The SaaS market is the second hottest unicorn sector, with 116 unicorns accounting for a $219B valuation. Australian-based Canva achieved unicorn status in 2018, leading the category with a valuation of $40B, while US-based GoodLeap is one of the latest SaaS-sector companies to join the not-as-exclusive-as-it-used-to-be unicorn club with a $12B valuation.

E-commerce, healthcare, and artificial intelligence companies round out the top 5 unicorn-birthing categories.

Where there’s growth, there’s opportunity

With the speed at which unicorns are minted – about two to three new ones every business day as of 20215 – the list itself is now far outpacing the number that go public. The companies that do eventually go public on average take more than 12 years to do so.

This makes the population of unicorns significantly larger than it was in years past, meaning much of the growth and value that is created during high-growth companies’ formative years takes place in the private markets. This is driving demand for greater access to the private markets – and that creates exponential opportunity for equity holders, including employees, shareholders and early investors.