Palantir went public via direct listing on the NYSE on September 30th, signaling a significant milestone for the company, its employees and stakeholders eagerly awaiting this 17-year-old company's public debut. It also marked a seminal moment for the private markets -- where Palantir was an early test case for the benefits of broadening access to private stock and where trading in the Palantir stock had been robust for many years.

Palantir’s long private history of trading on the private markets gave investors unique access to shares prior to its debut. Shareholders, including employees and investors, were able to achieve liquidity over the past several years by selling portions of their shares to more than hundreds of investors who bought into the stock through the private markets in the lead up to Palantir’s direct listing – at prices ranging from $4.65 to $9.75 over a 4-year period.

Palantir disclosed private market trading pricing in its S1 in anticipation of its direct listing. Private market trading can ease volatility in share price in the lead up to public listings (as investors and potential investors can see a history of transactions) and can inform the price of direct listings as well as IPOs.

After rampant speculation and multiple updates to its S1, Palantir opened on the public markets at $10/share up from the $7.25 reference price published in the lead up to the first trades. The stock experienced an opening day high of $11.42 before closing the trading day at $9.50, up 31% from the reference price.

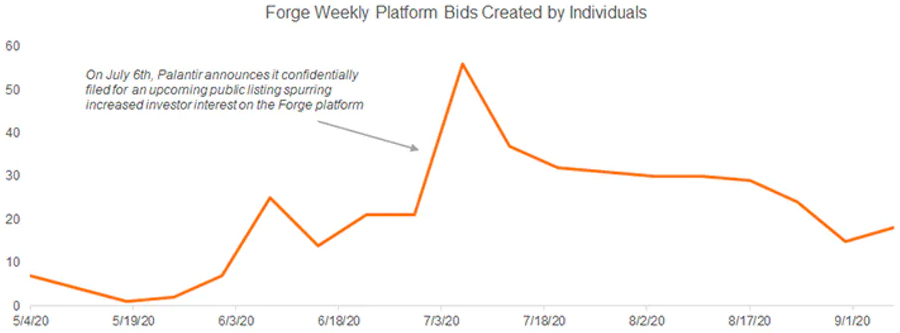

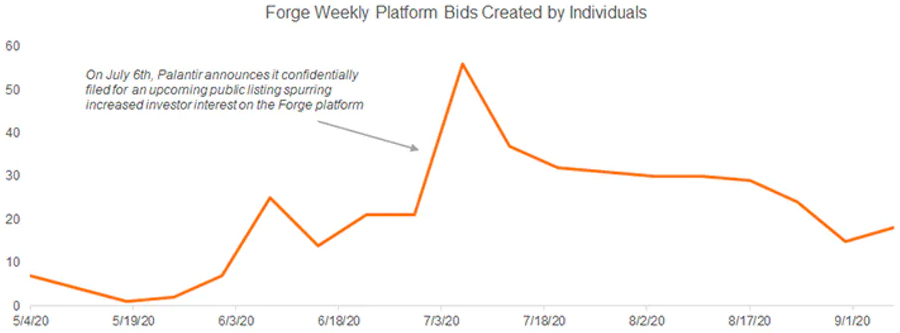

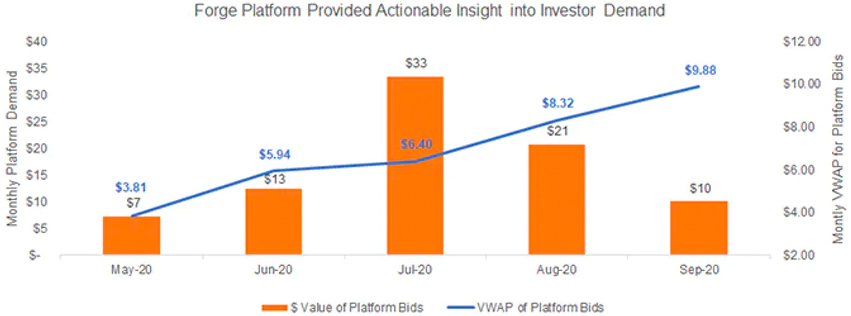

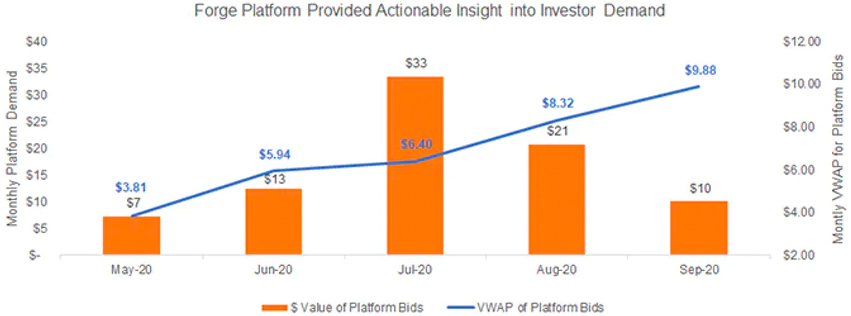

Peaks in Palantir’s trading volume in the private markets occurred in July 2020 when Palantir announced it had confidentially filed documents with the SEC for a public listing, and again in August when the company filed its S1. In those months, the Forge platform experienced massive pickup both in the notional value of interest in Palantir stock, but also in the implied price at which investors were willing to purchase Palantir shares.

After Palantir announced it would go public by direct listing, the Forge platform generated $64M in bid interest between July 2020 and September 2020. And prices investors were willing to pay (as indicated by the volume weighted average price of bids on the platform) trended up from $6.40 to $9.80.

Palantir may have been able to stay private so long in part because venture and private equity investors who got in in earlier rounds of Palantir stock traded large stakes through the private markets to other investment groups. Palantir demonstrated how some VCs are leveraging the private markets to get liquidity prior to public listing.

Palantir was founded in 2003 by a group of PayPal alumni and Stanford computer scientists including CEO Alex Karp and investor Peter Thiel. Since 2016, Palantir leveraged the private markets to provide liquidity for employees and investors as the company focused on driving innovation and growth.

Unlike previous direct listings, Palantir’s direct listing implemented a lock-up period to control the pace of their employees’ stock, which allowed existing investors including employees, venture capitalists and its founders to only sell up to 20% of their shares on listing day. The use of lock-up restrictions is usually relegated to traditional IPOs and is not as common for direct listings. For example, lockup restrictions were notably absent from direct listings for Spotify and Slack.

As more companies consider direct listings, Palantir’s history of private market trading shows that stocks traded robustly on the private markets can aid companies in setting pricing for listings and give investors the transparency they need to make informed decisions.

Forge knows that access to robust private market data changes the game for decision-making on private companies. Learn more here.