Opening the doors to the private market

Ideas demand investment

Every day, high-growth technology companies drive innovations that have revolutionized how we work and live. These advances demand enormous amounts of time, ingenuity and funding to succeed.

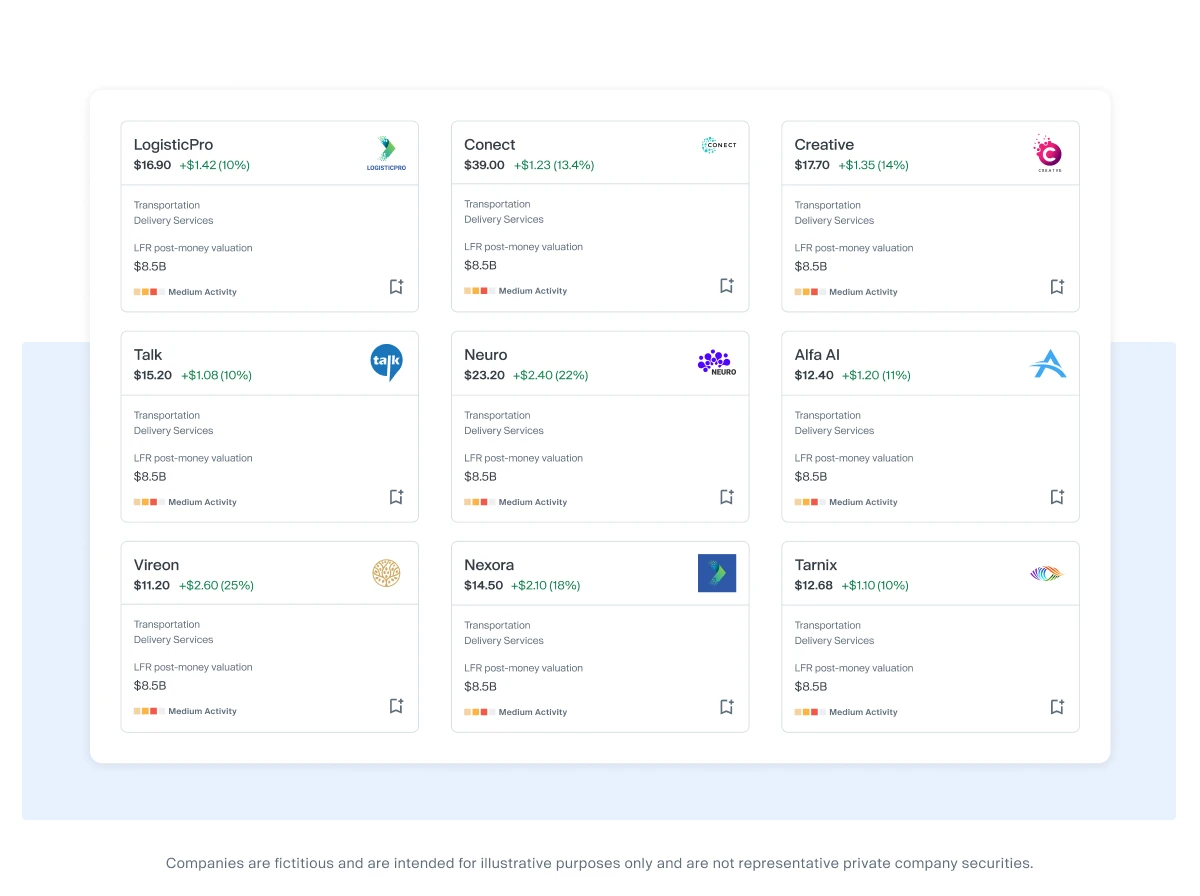

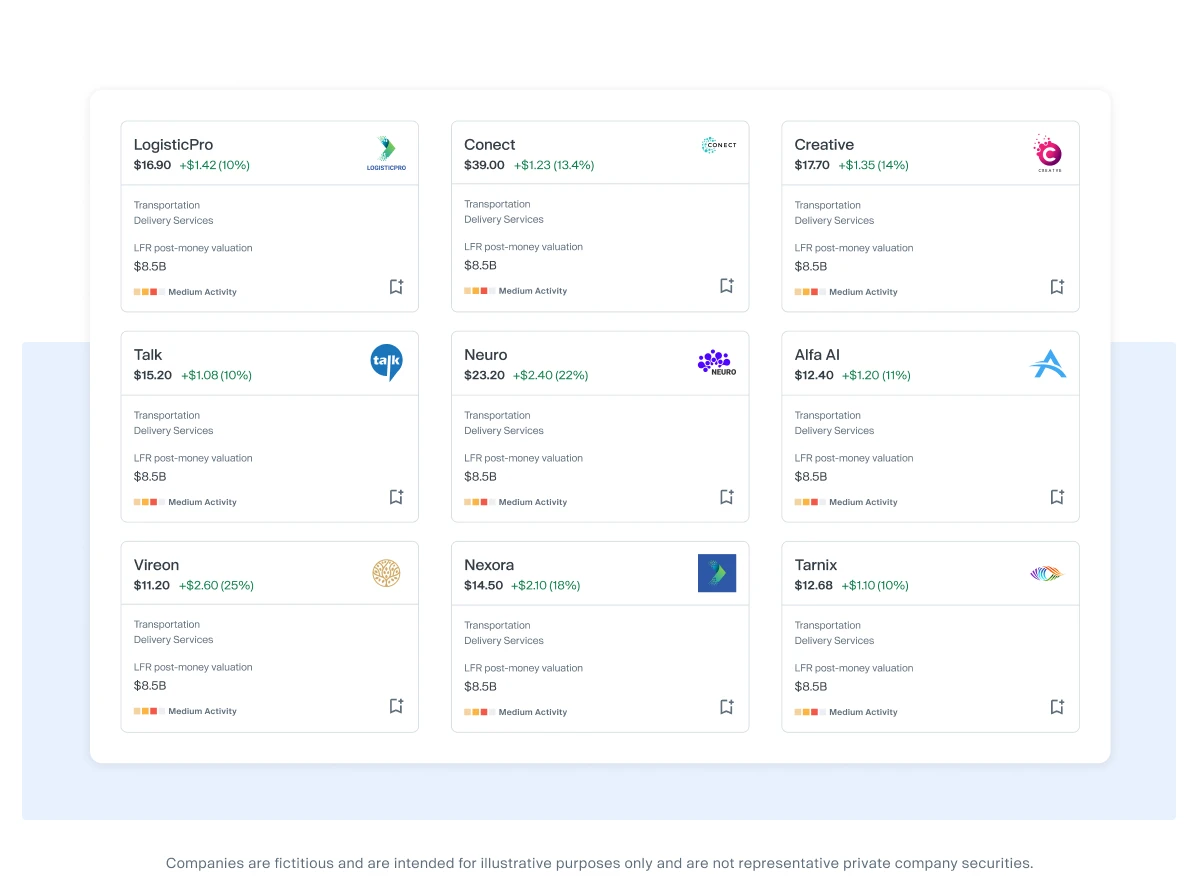

Investment requires capital

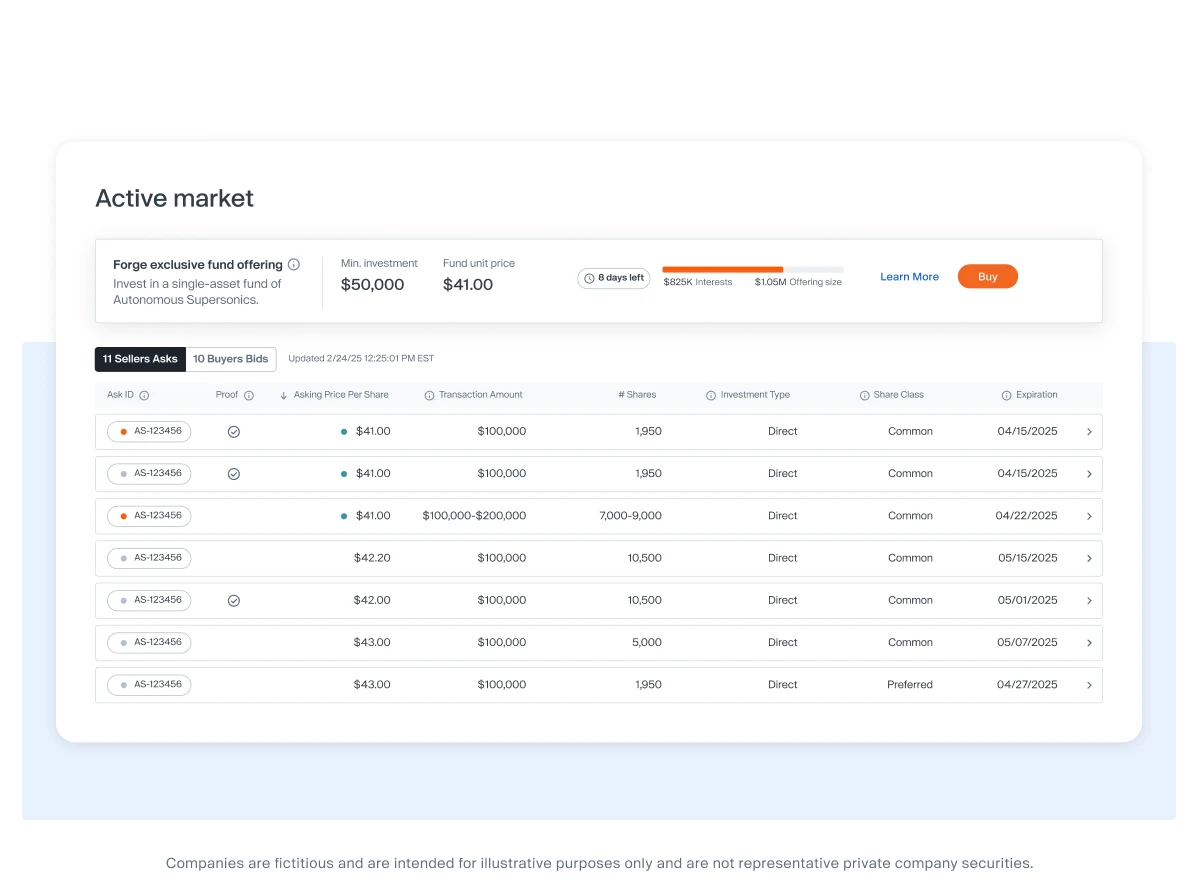

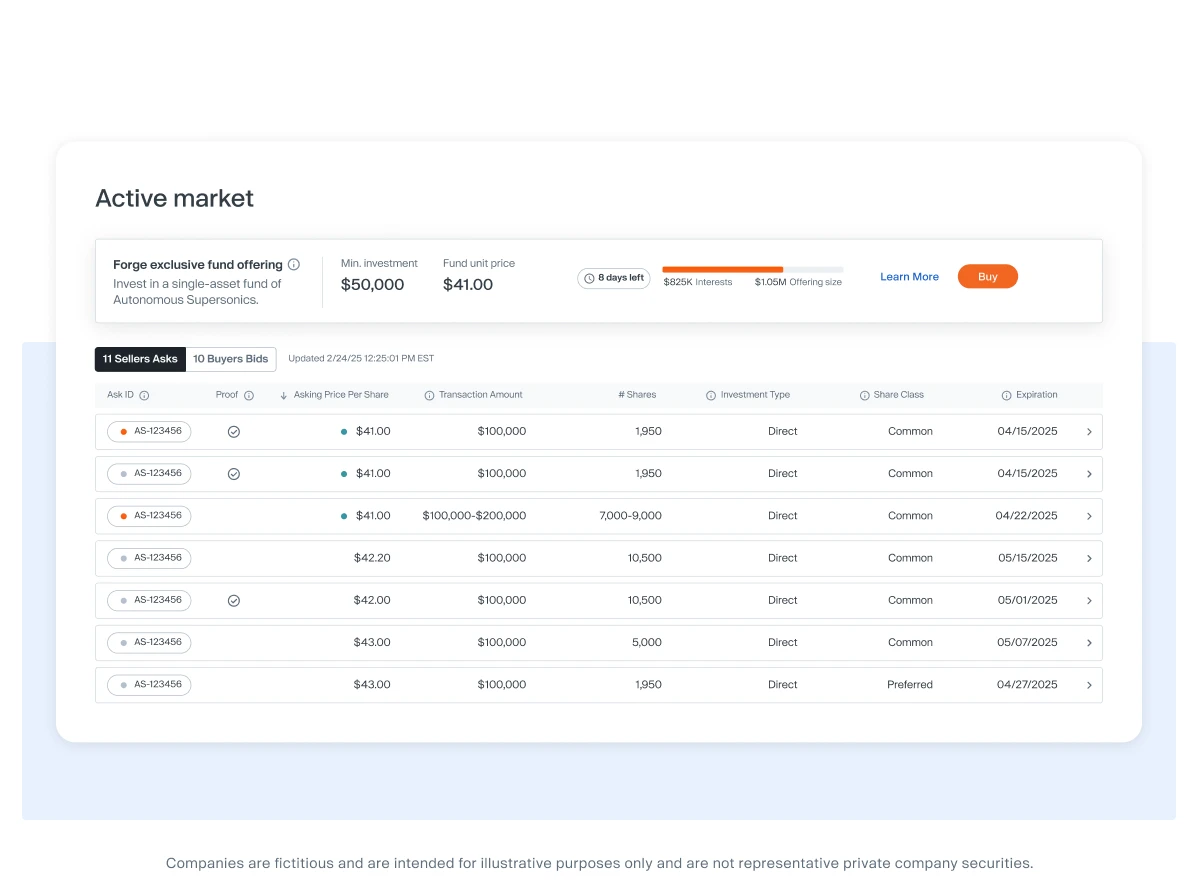

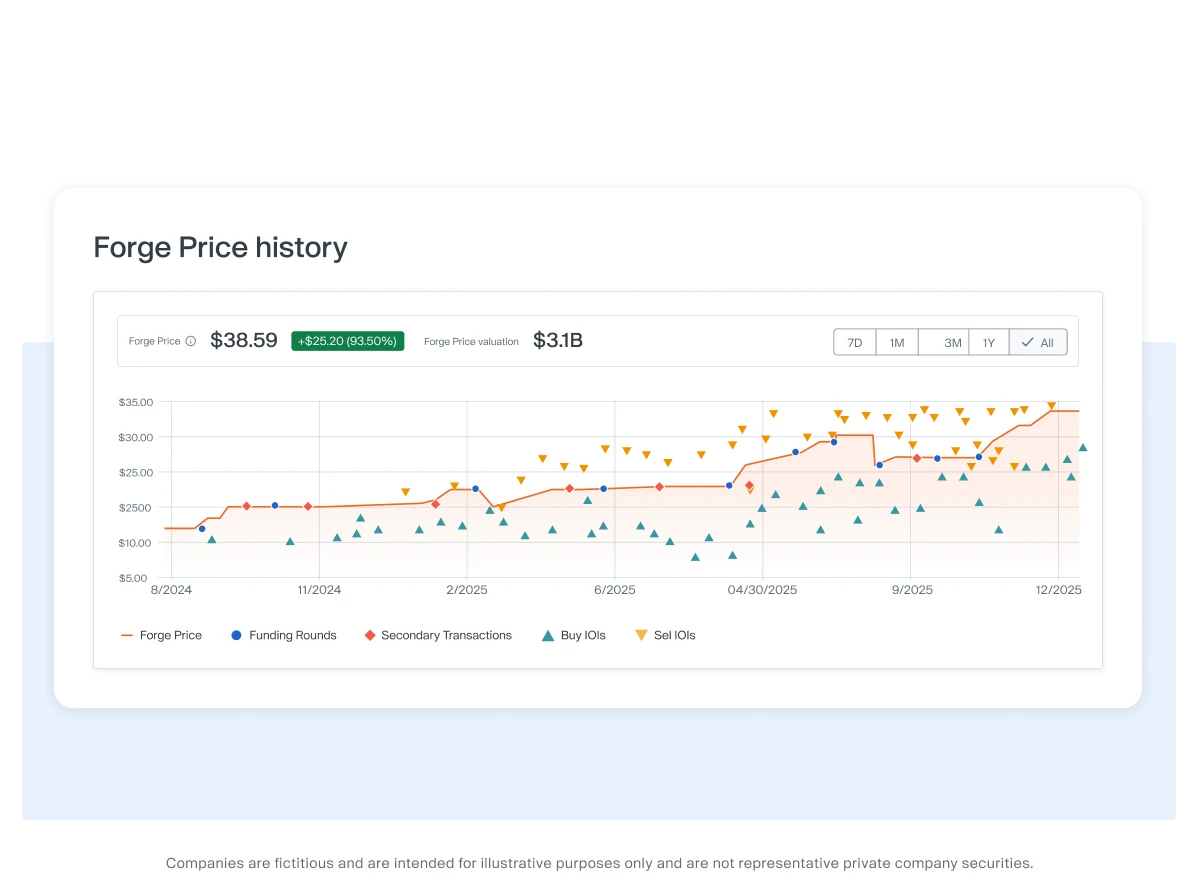

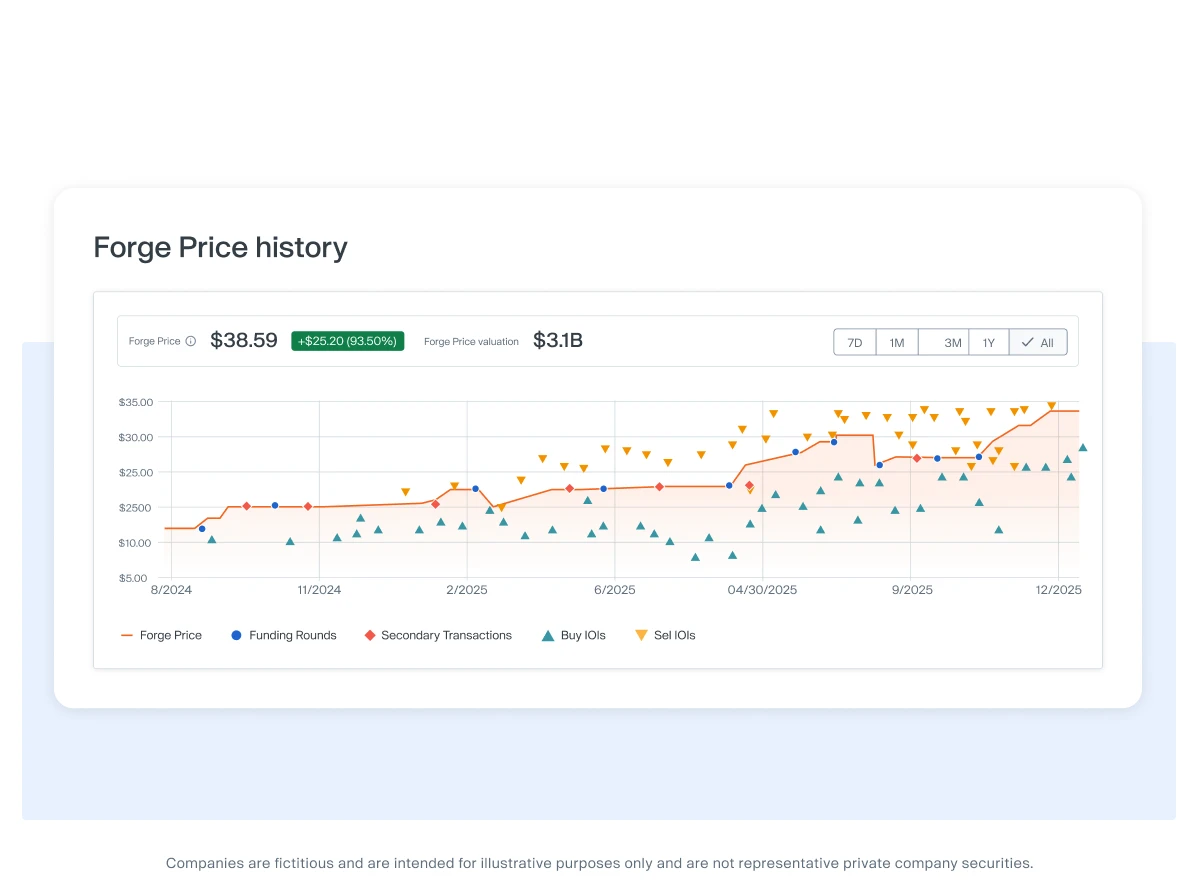

Forge is a gateway to pre-IPO investment opportunities, delivering exposure to private company shares and creating a more accessible and transparent private market.

Capital needs credibility

Forge’s technology, data and deep experience enables institutions, investors, companies and shareholders to access, gain insight into and participate in the private market. With innovative products and solutions, we are bringing new transparency and new possibility to this rapidly-evolving asset class.

A culture of innovation

Forge is built by people who value collaboration, growth and impact in everything they do.

Shape the future here

Bring your talents to the platform that is moving the private market forward.

Featured open positions

Forge leadership in action

Get to know the people spearheading access to the private market.

18+ years creating and executing innovative fintech technology strategy; former Head of Technology, Edge Systems, at Intercontinental Exchange, and Managing Director of IT at the New York Stock Exchange managing international teams.

25+ years of financial and capital markets experience, including most recently at the LSEG. He spent over a decade at LSEG in roles including Managing Director of the Funds, Research and Content business lines, Managing Director and Head of Data Solutions, and CFO and Managing Director of the Information Services division.

20 years scaling tech in the secondary markets space; former President of SharesPost Financial Corp., additional roles Silver Lake Waterman, New Evolution Ventures, Jefferies & Co. and Merrill Lynch.