Submitting a bid or ask in the marketplace

Our marketplace facilitates access to private market trading for investors and shareholders. Whether you’re buying or selling, submitting a bid or ask allows you to signal your intent, define your terms and participate in a transparent market where data drives decisions.

This guide walks you through the full experience—from selecting a company to entering your terms—so you can confidently engage with the marketplace.

Getting started—initiating a bid or ask

There are two primary ways to begin:

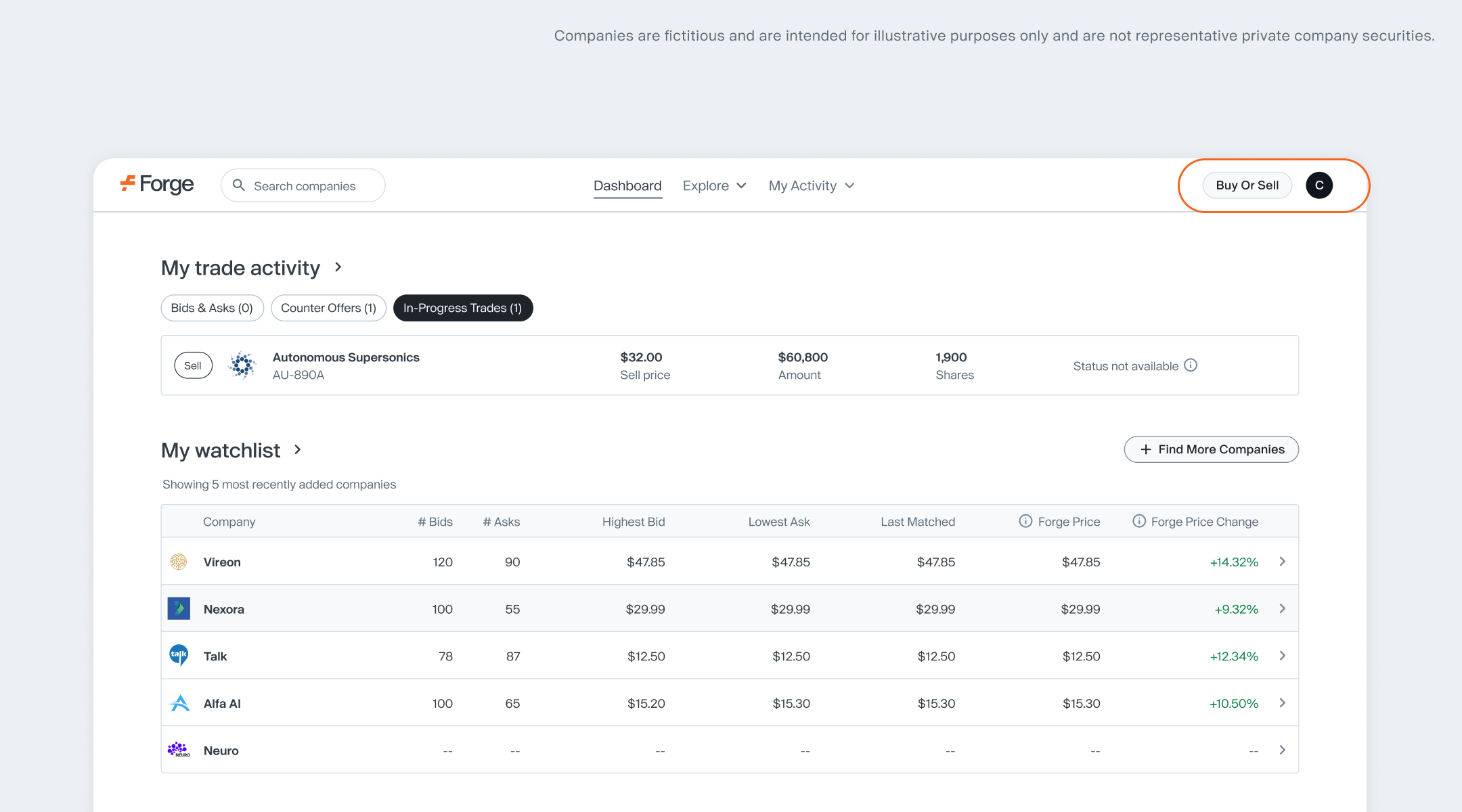

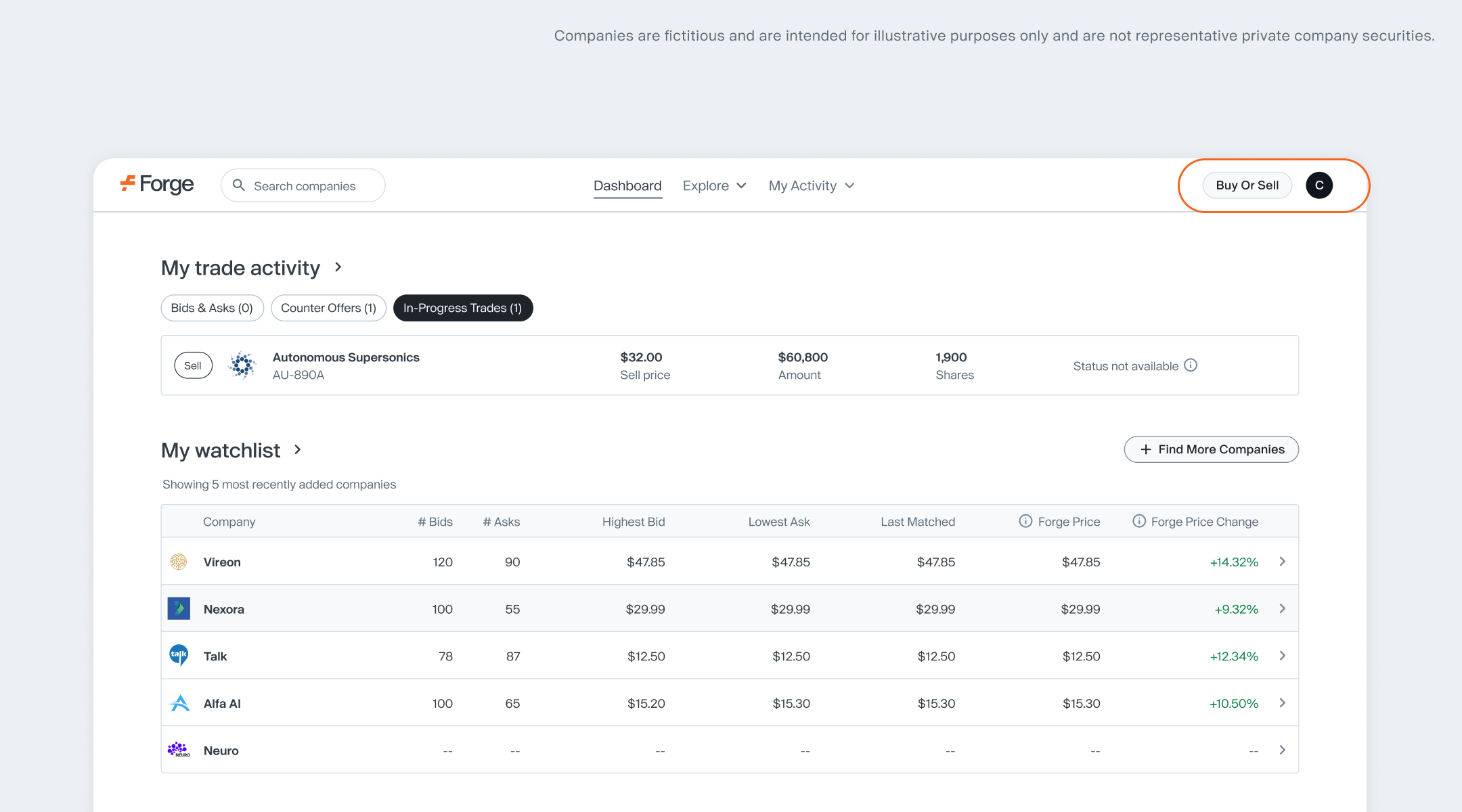

From the Dashboard:

After logging in, click the orange “Buy or Sell” button in the top-right corner.

- Select the company you’re interested in trading.

- Choose to either:

- Submit a new bid or ask—your bid or ask will be listed in the active market (i.e. live order book), visible to other market participants, or

- React to an existing bid or ask—accept an offer or counter with your own terms.

From a Company Page:

Each company page has dedicated “Buy” and “Sell” buttons. Clicking either takes you into the same flow, tailored to your intent.

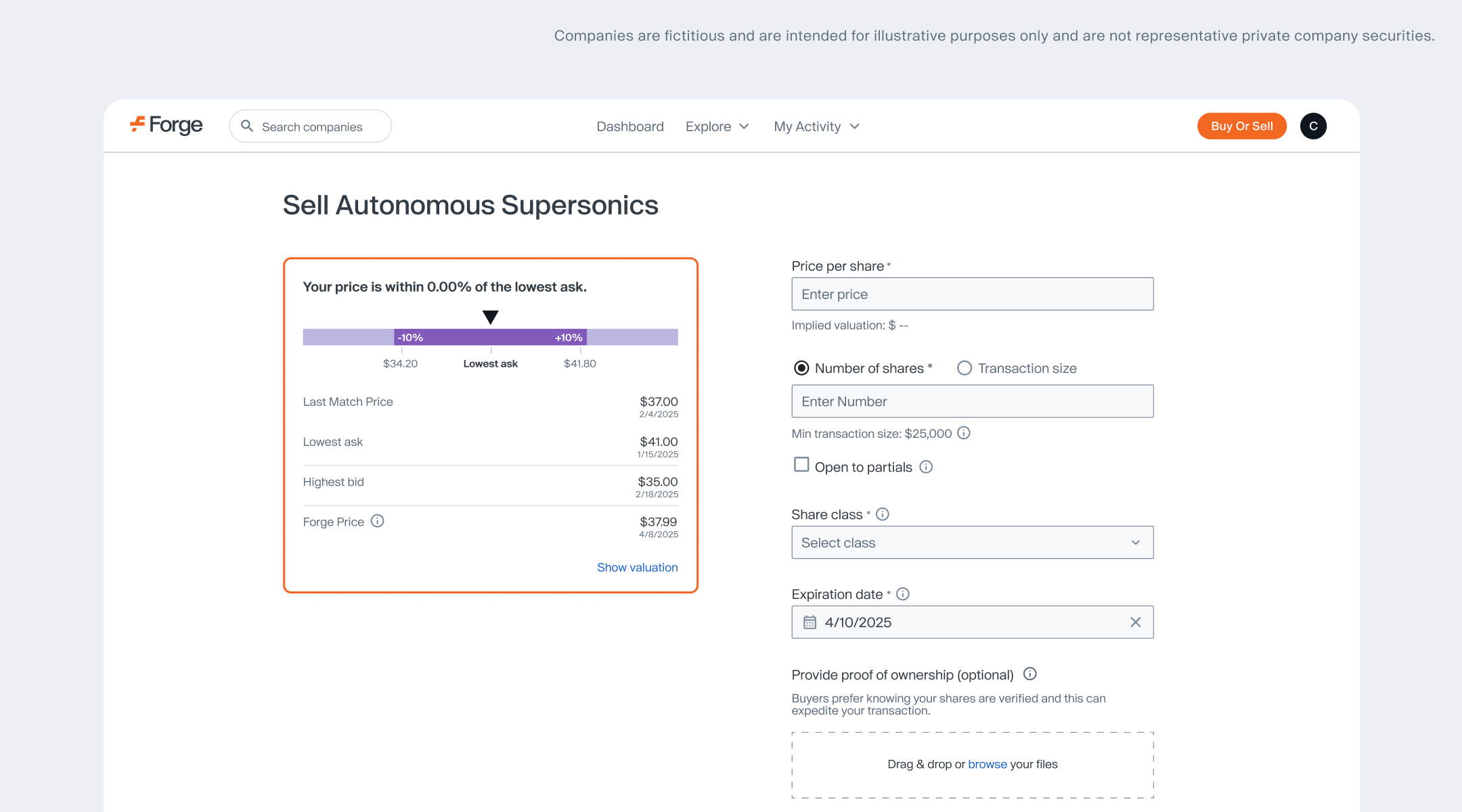

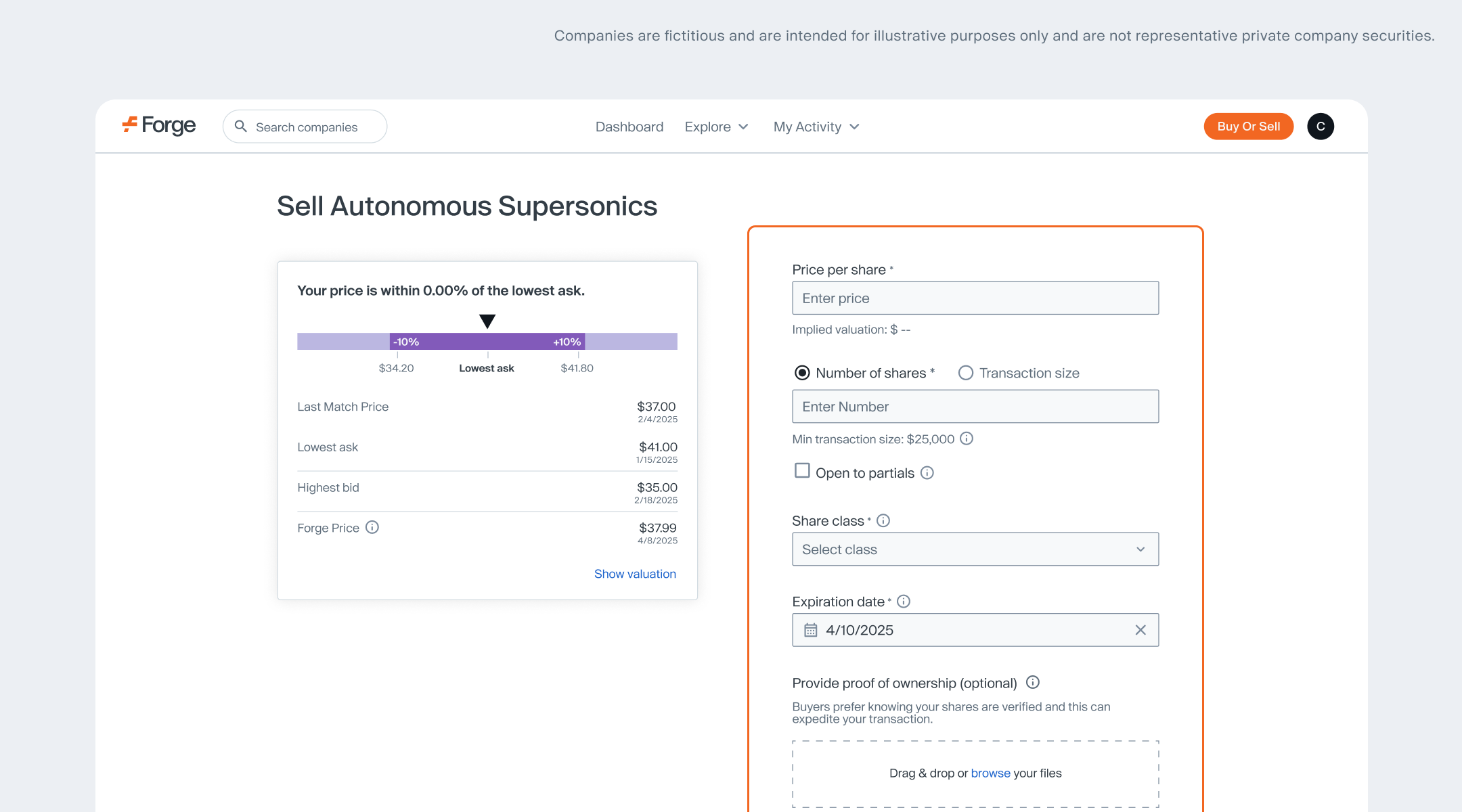

Submitting your bid or ask—fields and definitions

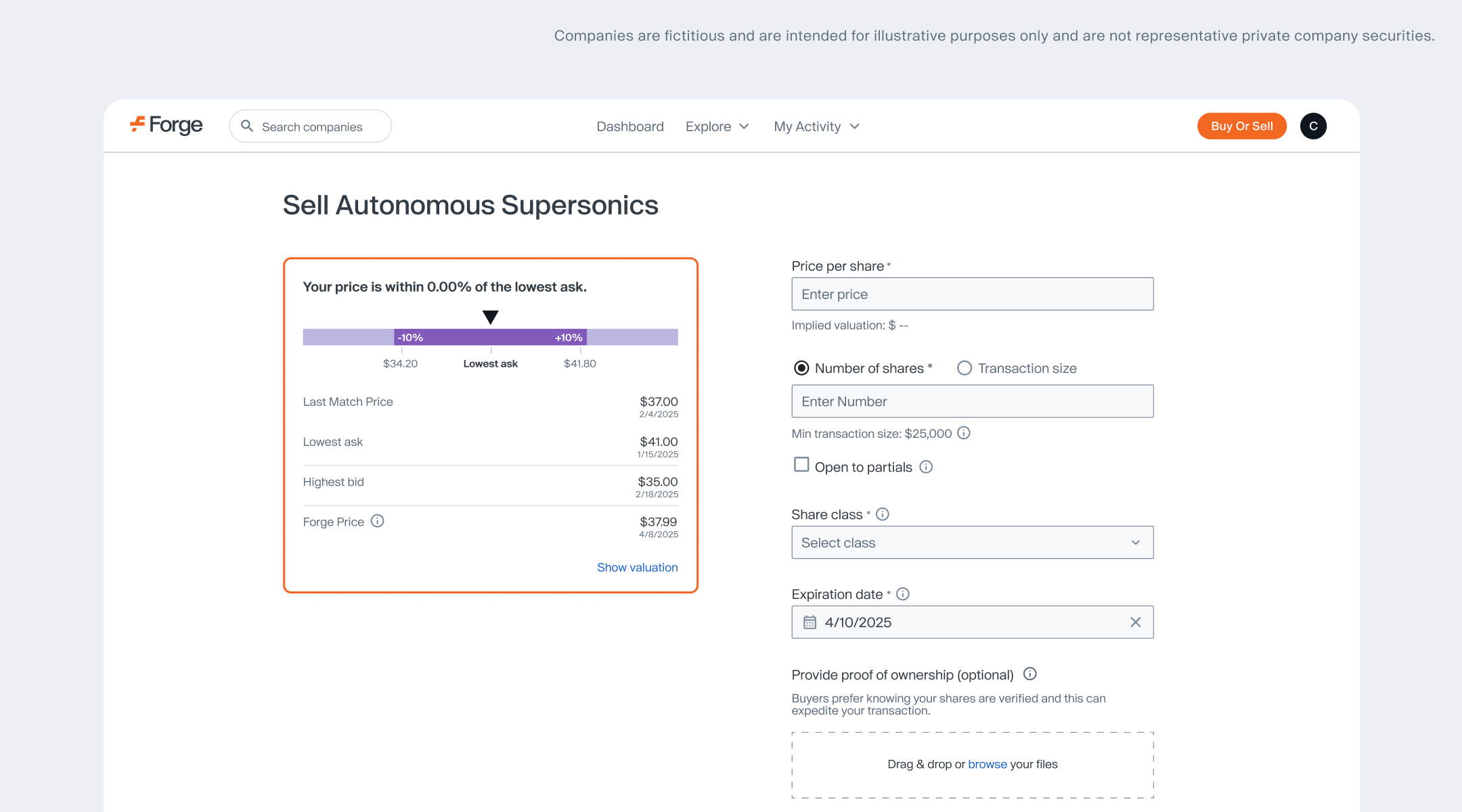

Once you've selected to submit a bid or ask for a specific company, you'll arrive at the bid or ask submission screen. This view includes real-time pricing data to help guide your decisions, along with a form where you'll define the key terms of your trade.

You'll be asked to complete the following:

- Price per share – The amount you're willing to pay (bid) or accept (ask) for each share.

- Number of shares or total transaction size – Define the scale of your trade.

- Partial fulfillment – Choose whether you're open to filling part of your bid or ask.

- Investment type – Select one:

- Direct: Purchase or sell shares directly with the issuer.

- Fund: Participate through a fund vehicle that holds shares in the company.

- Share class – Specify the type of equity (e.g., Common, Preferred).

- Expiration date – The date your bid or ask will expire and no longer be visible. You can extend this later if needed.

- Proof of ownership (sellers only) – Required to validate your ability to transact. "How to Upload Proof of Ownership” .

Note: Submitting a bid or ask closer to the Forge Price™ may increase visibility to other market participants, though execution is not guaranteed.

Understanding pricing context

The Forge submission flow provides relevant data to support smart decision-making. While it's your responsibility to conduct due diligence, these signals can be critical inputs:

- Forge Price – A daily, indicative price calculated using market data.

- Last matched price – The price of the most recent successful trade.

- Last transaction price – May reflect a different executed trade not matched on the platform.

- Highest bid / lowest ask – Real-time levels of market demand and supply.

Use these metrics to benchmark your own pricing and assess the competitiveness of your bid or ask.

After submitting—what happens next?

Once submitted, your bid or ask becomes visible in Forge’s active market. From there:

- Market participants may engage by accepting or countering your bid or ask.

- You may receive updates as interested counterparties interact.

Forge specialists are available to assist, especially with complex or high-value trades, helping source a match.

If your bid or ask is accepted:

- You’ll receive a confirmation email outlining next steps.

- Forge will facilitate the transaction—distributing paperwork, coordinating with the company and managing compliance checks.

- Once complete, ownership is transferred between parties and you'll receive a final confirmation.

Questions? Our team is here to help: [email protected].

Best practices from experienced users

- Do your research. Consider reviewing indicators such as Forge Price and Last Matched Price to inform your own investment decisions.

- Be strategic with pricing. Bids and asks priced closer to the current market may have a higher chance of execution.

- Keep your Watchlist updated. Set alerts to track pricing changes and jump in when conditions align with your strategy.

- Choose partial fulfillment if flexible. This can increase the chances of partial execution in low-liquidity environments.

- Evaluate transfer restrictions. Some shares have unique compliance needs.

Ready to engage the market?

Log in and submit your bid or ask today