Exploring a company page and initiating trades in the Forge marketplace

Forge’s next generation marketplace empowers investors with the tools, data and control they need to confidently trade private company stock. One of the most powerful entry points into this experience is the company page—your command center for exploring a company’s market dynamics and taking action.

Accessing a company page

You can access a company’s page in a few ways, depending on your workflow:

Log into the marketplace which brings you to your dashboard and either:

- Use the search bar at the top to type in the name of the company.

- Or, if you have added the specific company to your Watchlist, you can access it there.

Tip: Power users often pin companies to their Watchlist—this allows them to get regular updates via email to enable faster monitoring of market activity, trade opportunities and pricing shifts.

Understanding the active market, trade metrics and other intelligence

On each company page, you can monitor current market activity and pricing trends, learn about the company’s background and funding history, see who’s invested, browse related FAQs and explore similar companies—all in one place to help you build a full picture before trading.

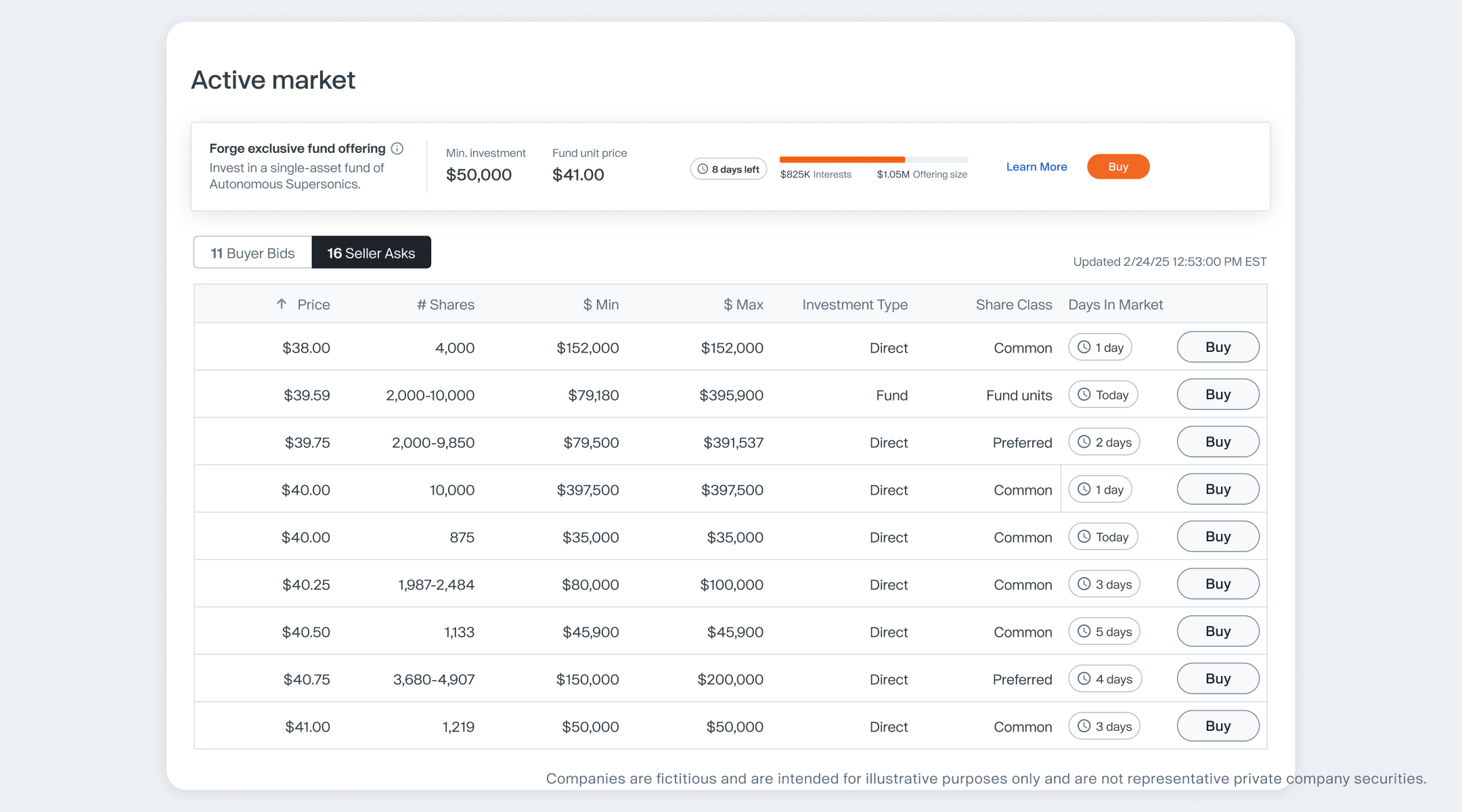

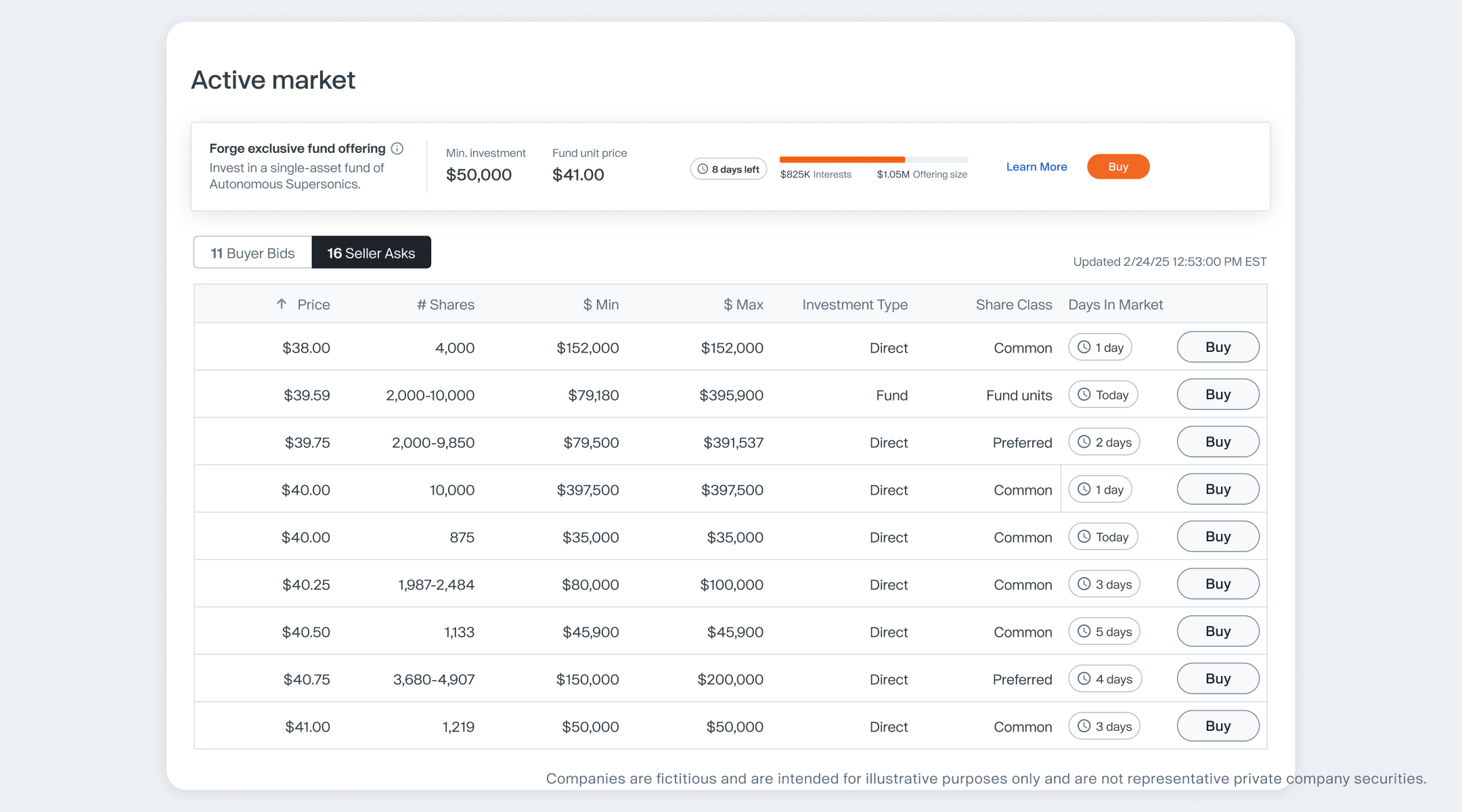

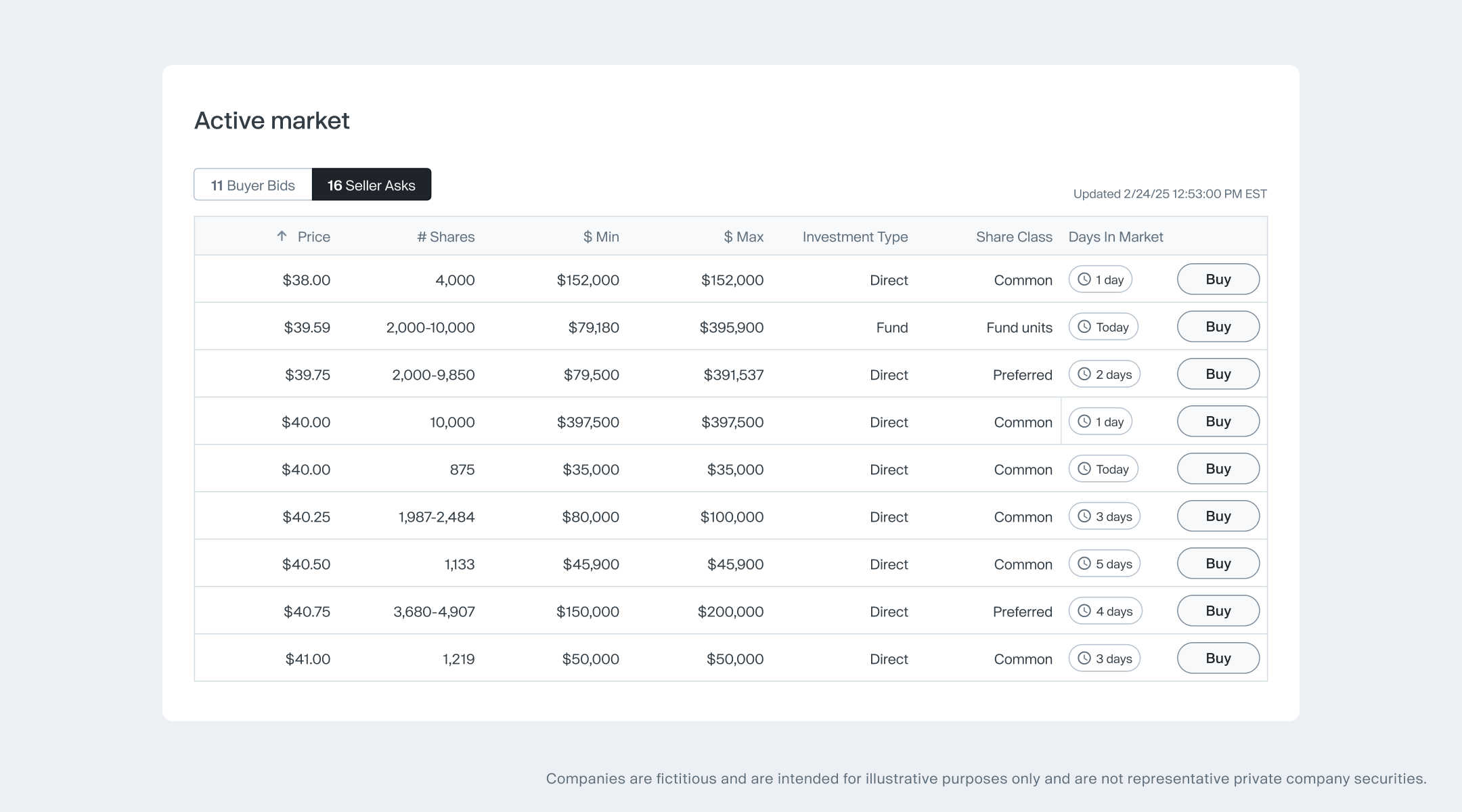

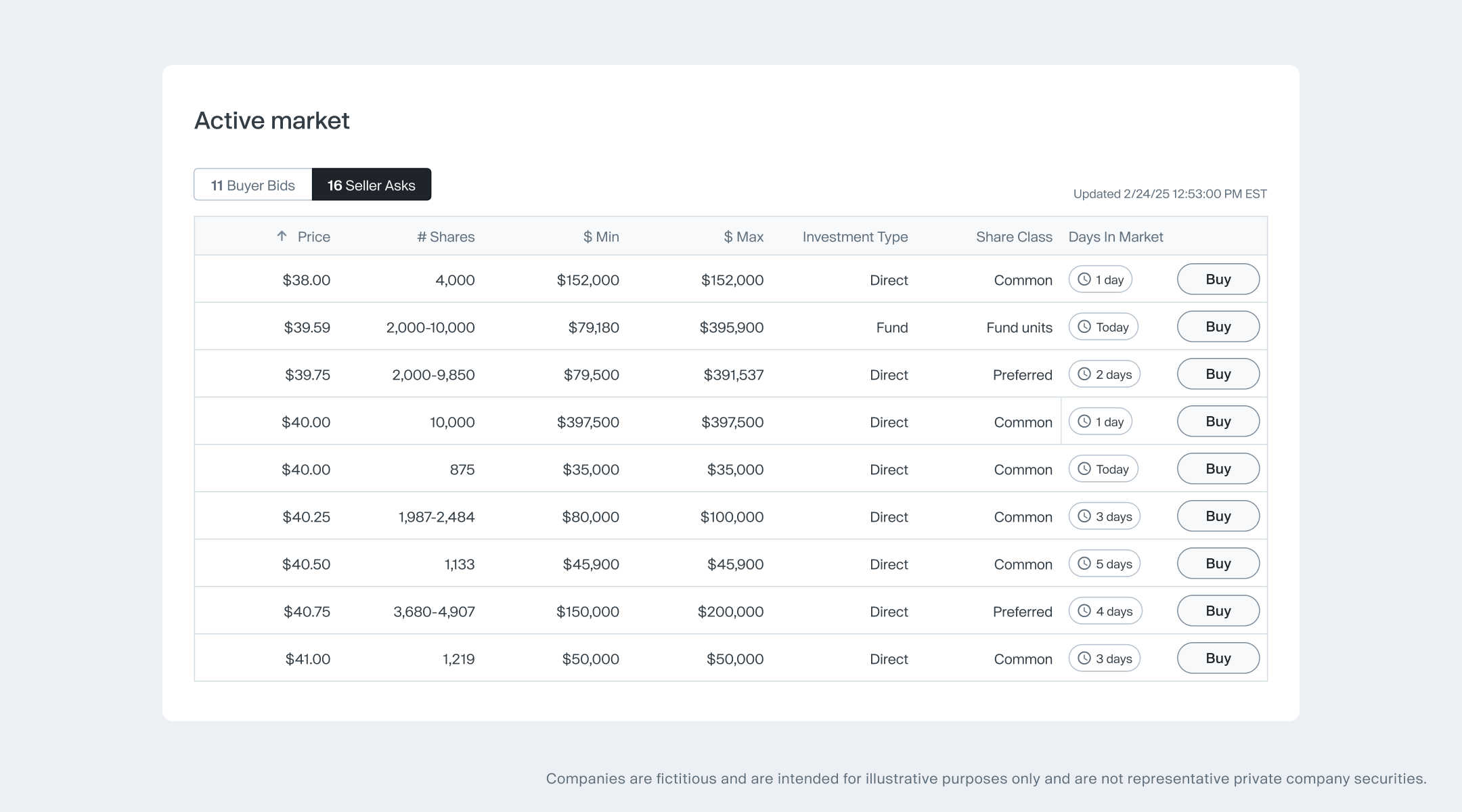

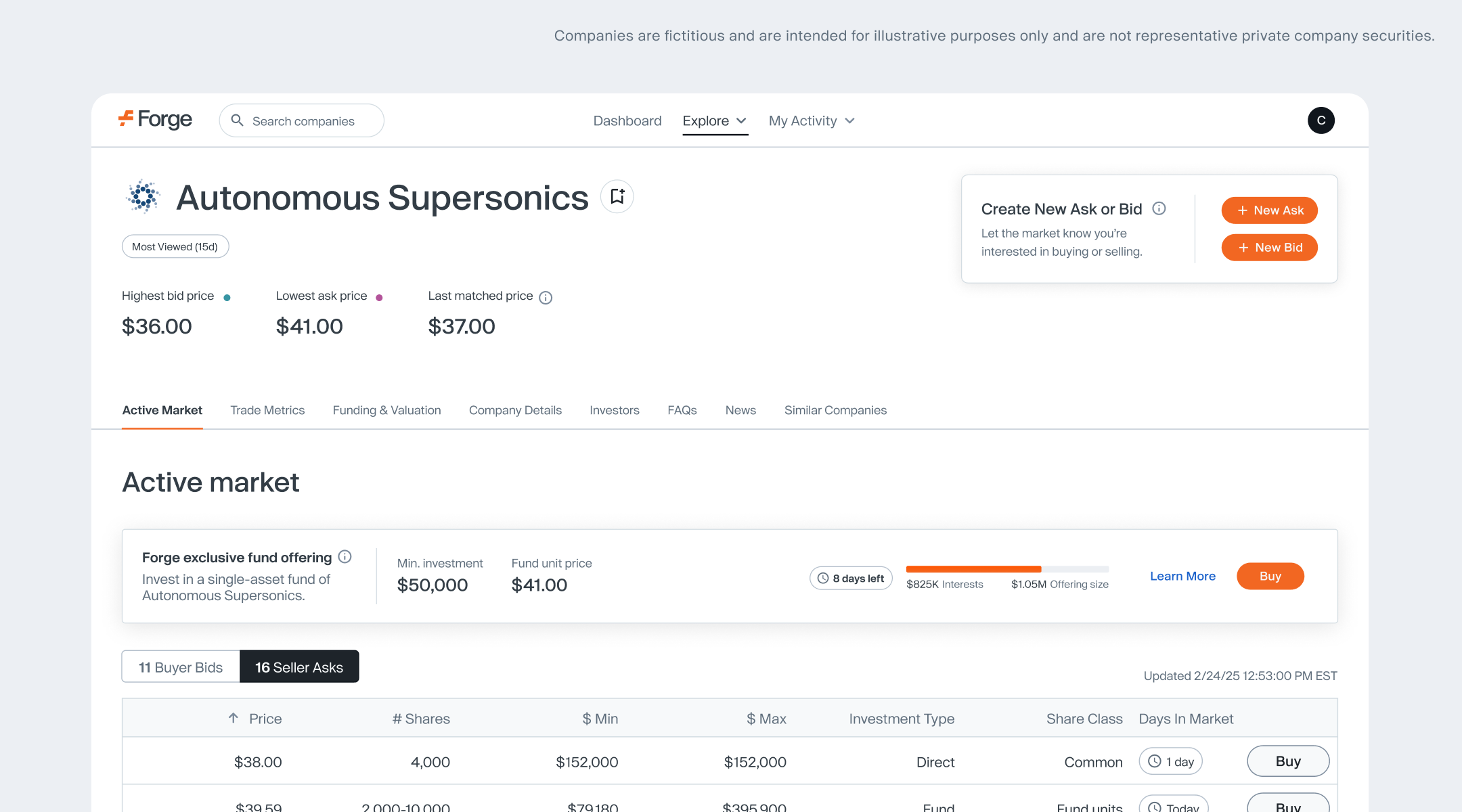

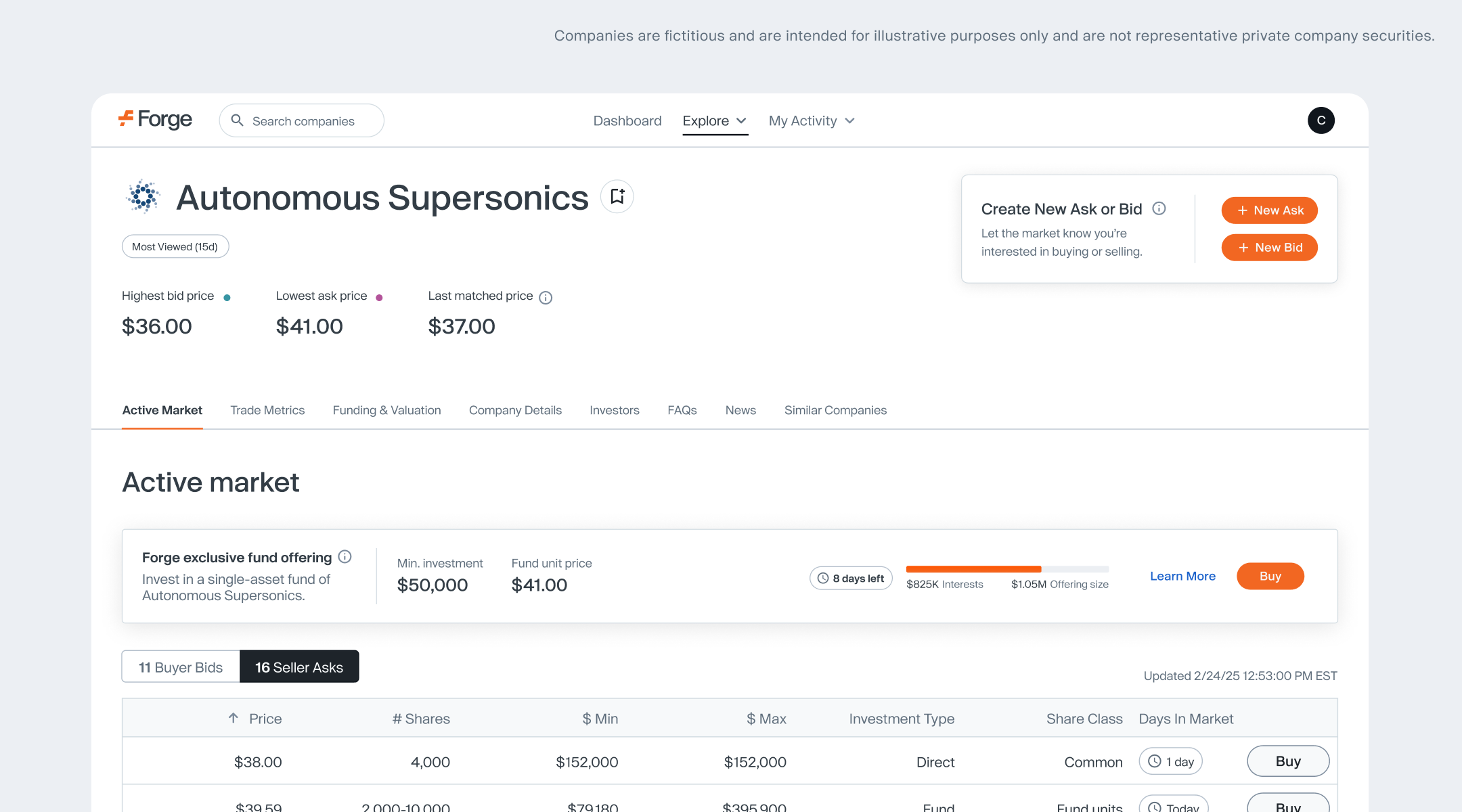

Active market (Live order book)

The live order book is a critical tool for understanding current market sentiment. It displays the most current bids and asks for a company, allowing you to see what buyers are willing to pay and what sellers are asking—updated continuously. By analyzing this live data, investors can gauge demand, assess market depth and make more informed decisions about when to buy or sell. Whether you're looking to accept an existing order, submit your own, or negotiate, the order book helps ensure your actions are grounded in actual market activity.

Why it matters: This is your pulse check on investor interest.

Forge Price™

Forge Price is a derived, indicative price, calculated daily for approximately 200 pre-IPO venture-backed late-stage companies. It provides a more timely and relevant reflection of company value and price discovery—a potential competitive edge for private market participants.

Investors and shareholders might use Forge Price as a benchmark to validate trade opportunities, time market entry or exit and track valuation trends over time. It could be used to try to identify momentum shifts, to spot pricing dislocations, and to align negotiation strategies with actual market conditions—not just anecdotal or outdated valuations.

Forge Price availability for a company depends on multiple factors, like company status in that Forge Price covers primarily late-stage venture-backed companies with activity in the private market, as well as data availability—companies must have sufficient data from secondary transactions, funding rounds and indications of interest to calculate a Forge Price. Forge Price coverage is continuously expanding as new companies become eligible based on the above factors.

Last Matched Trade

The Last Matched Trade Price represents the most recent price at which a buyer and seller agreed on terms for a transaction for a company’s shares on Forge. It’s a concrete signal of where real market consensus was achieved.

Investors and shareholders may use this price as a validation point—comparing it to current bids, asks and Forge Price to assess momentum, price stability or emerging gaps in valuation. It can help determine whether current market activity is aligning with recent trading behavior or if conditions are shifting.

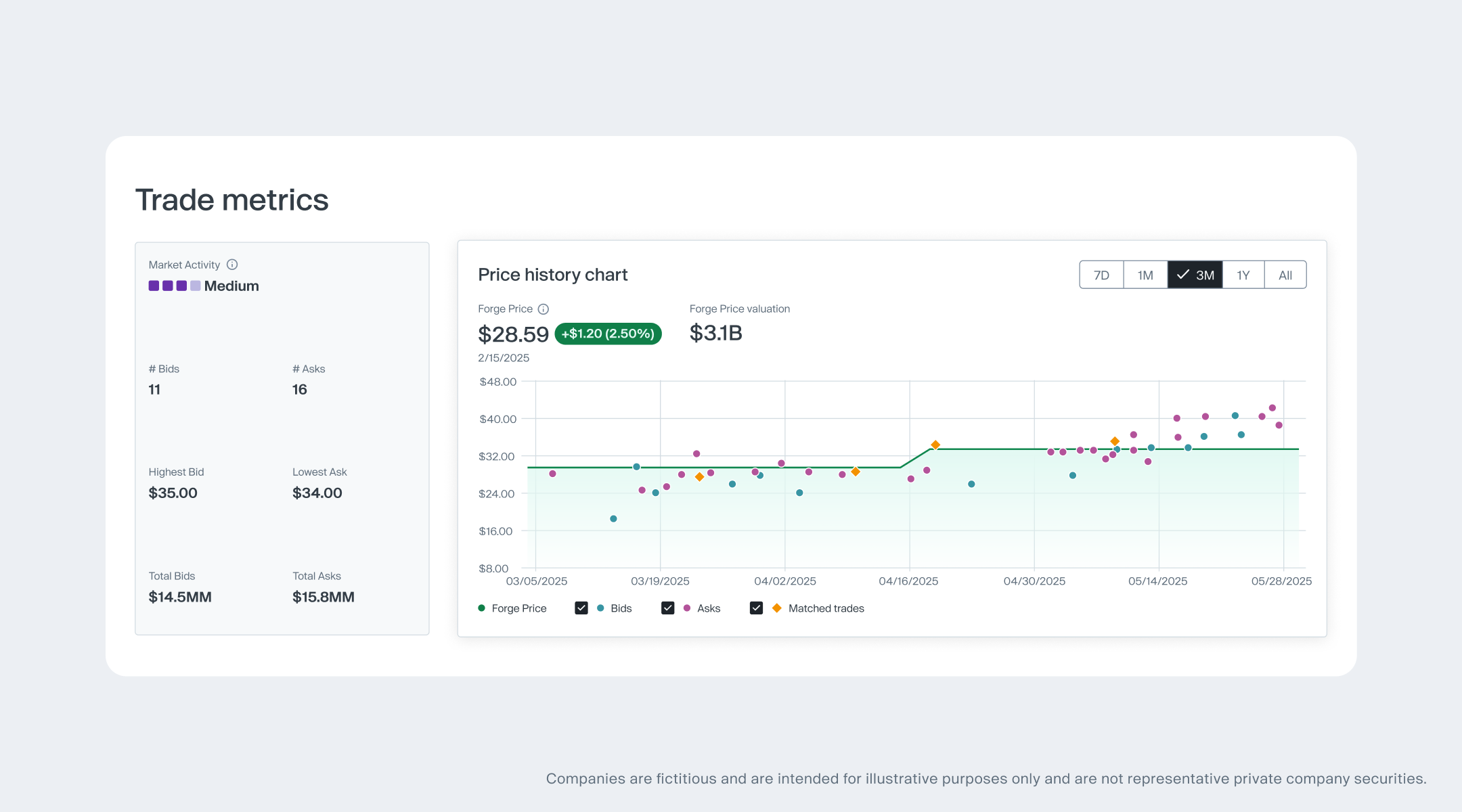

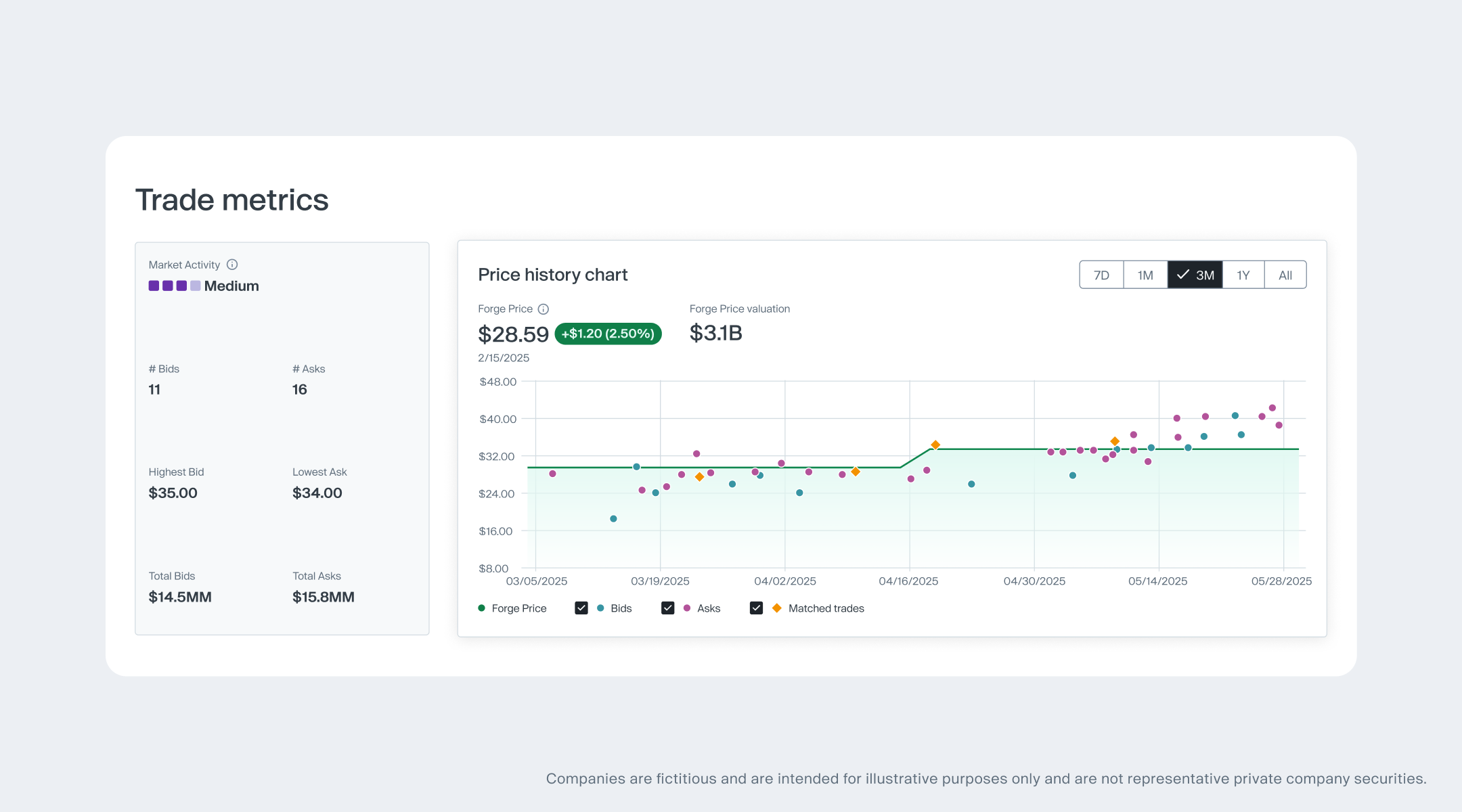

Trade metrics: Historical pricing chart and other trade metrics

The trade metrics section gives investors a deeper view into how a company's private market activity has evolved over time.

A dynamic time-series chart plots historical Forge Price, along with past bids and asks, helping you visualize valuation trends, shifts in investor sentiment and market consistency.

Additional trade metrics—such as the Market Activity (high, medium, low), current bid/ask counts and total liquidity—offer a snapshot of demand, deal velocity and overall market engagement. Investors can use this data to assess whether a company is in a period of active price discovery or relative inactivity, spot periods of tightening spreads or rising interest and evaluate execution potential before submitting or countering an order.

Descriptions of each of the metrics:

- Market activity: Indicates the level of activity for a company based on recent indications of interest (IOIs), secondary transactions and pending transactions on Forge.

- # of bids and asks: The total number of unique buy (bid) and sell (ask) orders currently placed for the company’s shares, which gives a sense of how many participants are in the market and how competitive it may be.

- Highest bid and ask prices: The highest price a buyer is currently willing to pay (bid) and the lowest price a seller is willing to accept (ask) for the company’s shares, which defines the current market range and guides decision-making for accepting, countering, or submitting new orders.

- Total bids and asks: The total dollar value of all current buy and sell orders combined, representing the available liquidity in the market for this company. High liquidity can make trades easier to execute; low liquidity may require negotiation or patience.

- Last matched trade price: The most recent price at which a buyer and seller agreed on terms for a transaction for a company’s shares on Forge. This is a real-world signal of where buyers and sellers recently found agreement, often used to validate current pricing.

- Price history chart: A time-series graph showing how Forge Price and bids and asks have changed over time for the company. It helps you identify valuation trends, historical momentum and pricing consistency—helpful inputs when you’re evaluating a potential trade.

The remaining sections provide essential company context to help you evaluate investment potential beyond just price.

- Funding: It shows historical funding rounds and valuation milestones, giving insight into how the company has grown and how investors have priced it over time.

- Company details: It provides a snapshot of the business, including a brief company overview, its sector and sub-sector classification, founding year, leadership team and board members—giving you essential context about who the company is and who’s steering its direction.

- Investors: It lists the firms and individuals who have invested in the company and also highlights other companies in the marketplace that each investor has backed—helping you understand the cap table and identify patterns in investor behavior across the private market.

- FAQs: It answers common questions about trading this company’s shares, and may include transfer restrictions or corporate actions that may impact execution.

- Similar companies: It helps investors discover other potential opportunities with comparable sector exposure, stage, or investor profile—supporting both diversification and discovery strategies.

Taking action: How to participate in the market

Once you’ve reviewed the data, you may be ready to engage with the market. There are three ways to express interest or take the first step to executing a trade:

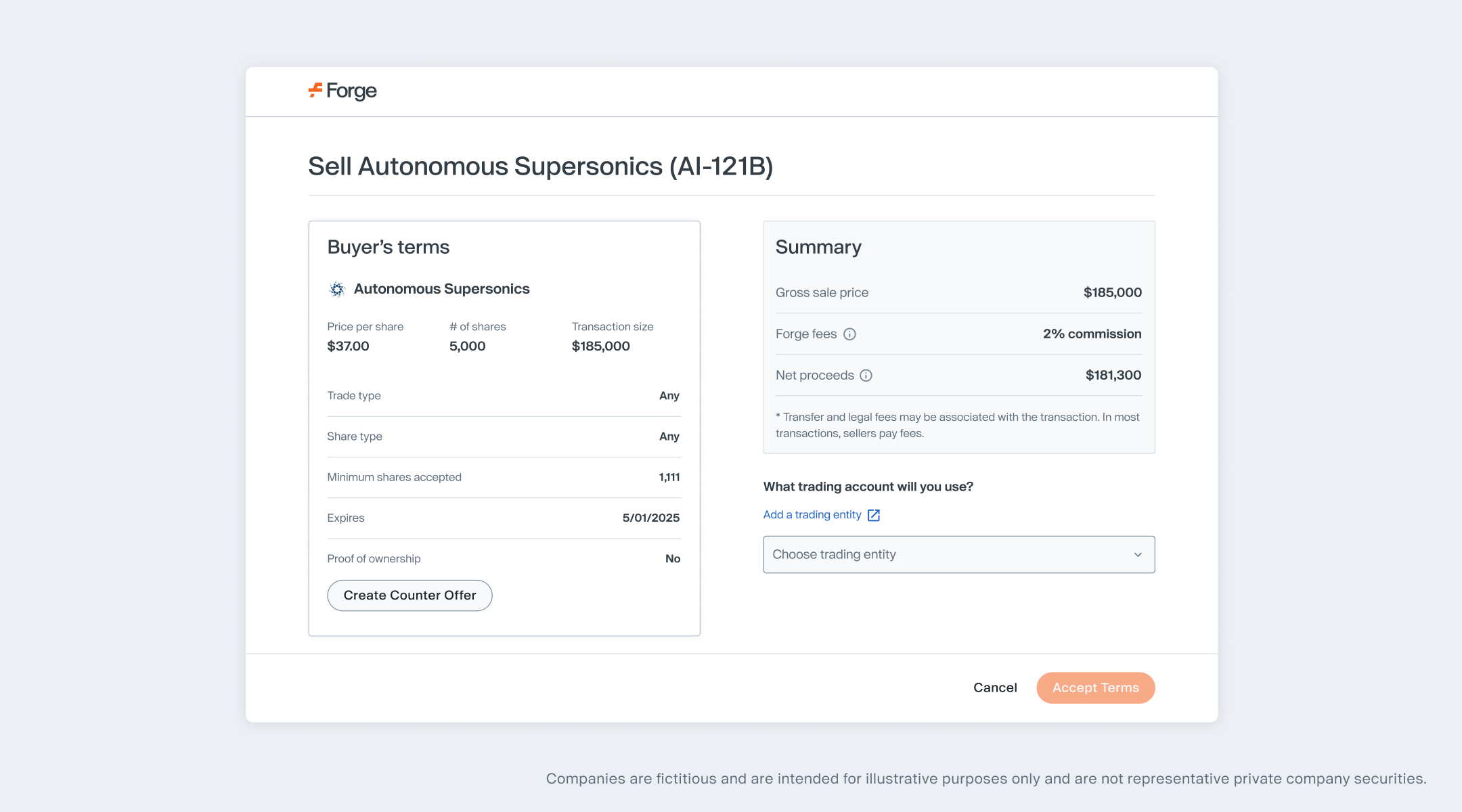

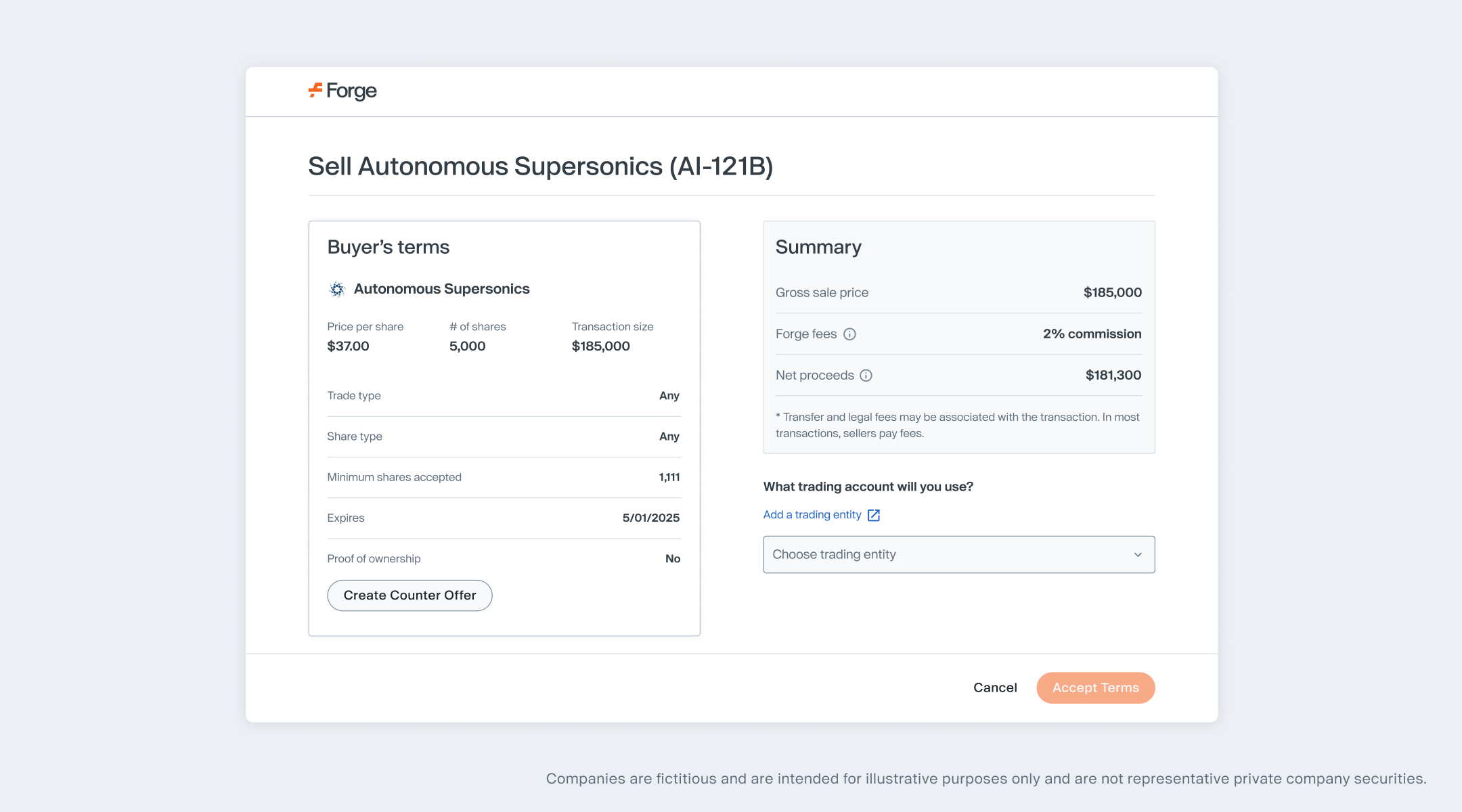

1. Accept an existing bid or ask

If a price already meets your target, accept it to move directly into trade execution.

- Most direct route to transact

- Accepting existing terms may lead to quicker execution

2. Counter an existing order

Prefer different terms? You can submit a counter-offer.

- Engage in direct negotiation with the counterparty

- Use data like Forge Price and the existing active market to inform your move

3. Submit a new bid or ask

Start fresh—define your own terms and post them to the marketplace.

- Specify your own price and quantity preferences

- Attract attention from other interested parties

Best practices from experienced users

- Combine your Watchlist with Alerts to be notified of price changes so that you can know the moment a price hits your target.

- Use the Forge Price chart and active market / live order book to time your bid or ask with market momentum.

- Check the Last Matched Trade price before countering to ensure your terms are competitive.

- Don’t forget to evaluate transferability notes — some shares may come with restrictions.