Forge Investment Outlook Q1 2025

Increased Private Market Optimism and AI’s Continued Surge

The private market landscape in Q1 2025 reveals a nuanced investment environment shaped by emerging technologies, surging interest in artificial intelligence (AI), and ongoing valuation adjustments in the wake of the Great Reset. While the private market has long been an attractive avenue for growth-oriented investors, recent developments in the global economy and macroeconomic forces have introduced significant opportunities. Here, we take a look back at 2024 and explore the outlook for Q1 2025, including the key factors that are likely to define private market investing in the months ahead.

Key Takeaways

2024 AI investments surged significantly. In 2024, trading in AI and AI-related companies accounted for 34% of all private market trading volume, while it was 32% of all primary funding. 40% of the Forge Private Market Index (FPMI) was composed of AI and AI-related companies. In addition, similar to the Public Magnificent 7, the Private Magnificent 7 is almost entirely composed of AI and AI-related companies and the top performers on the Forge marketplace platform are all AI and AI-related companies, too.

In 2024, private company exits increased vs. the prior year, marked by a modest rise in IPOs. The Forge Private Market Index rose nearly 5% from January to November 2024, reflecting this positive trend. Notably, the first quarter saw high-profile IPOs, such as Astera Labs and Reddit, which contributed to the index's 4.5% increase during that period. Post-presidential election, ServiceTitan popped 42% in the cloud software vendor’s Nasdaq debut, which further bolstered public optimism for IPOs.

In the latter part of 2024, increased macroeconomic and political certainty fostered a more promising outlook among investors and businesses. Despite earlier concerns about a potential U.S. recession, the labor market demonstrated resilience, with a relative low number of layoffs contributing to sustained consumer spending. The soft landing the economy experienced suggested a more favorable economic environment than originally expected and gave way to new opportunities.

-

Three Key Takeaways from 2024 8

-

2024: Year in Review 9

-

Market Performance 12

-

Private Market Activity 19

-

Secondary Market Activity 25

-

Mutual Fund Marks 31

-

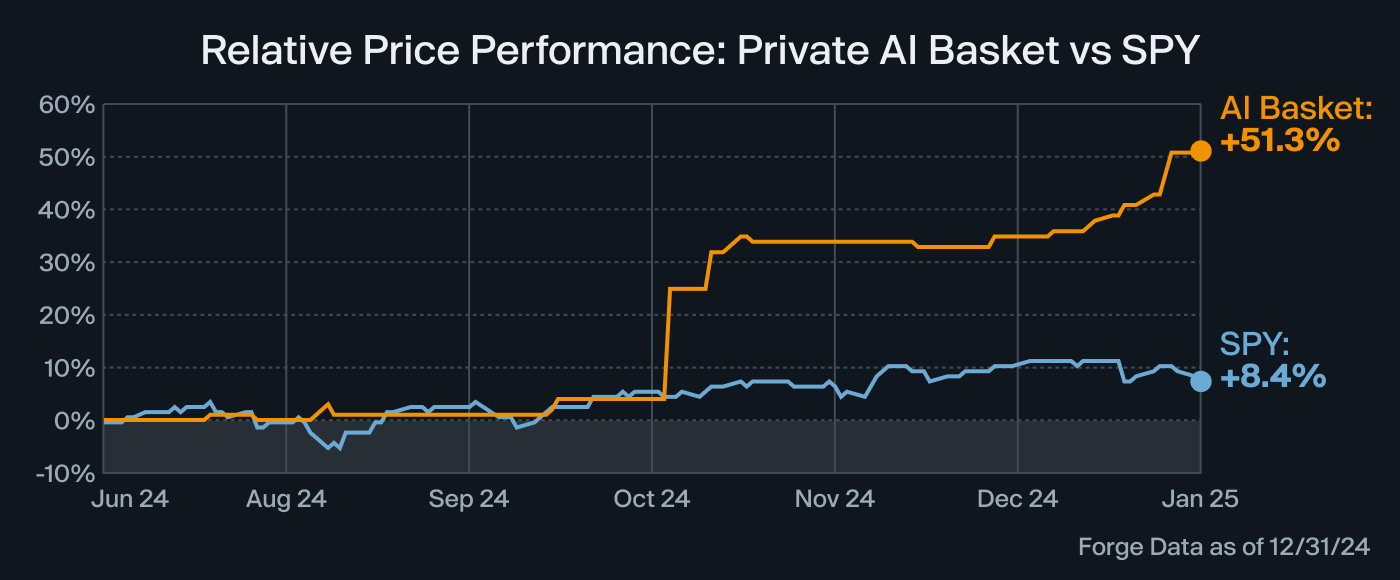

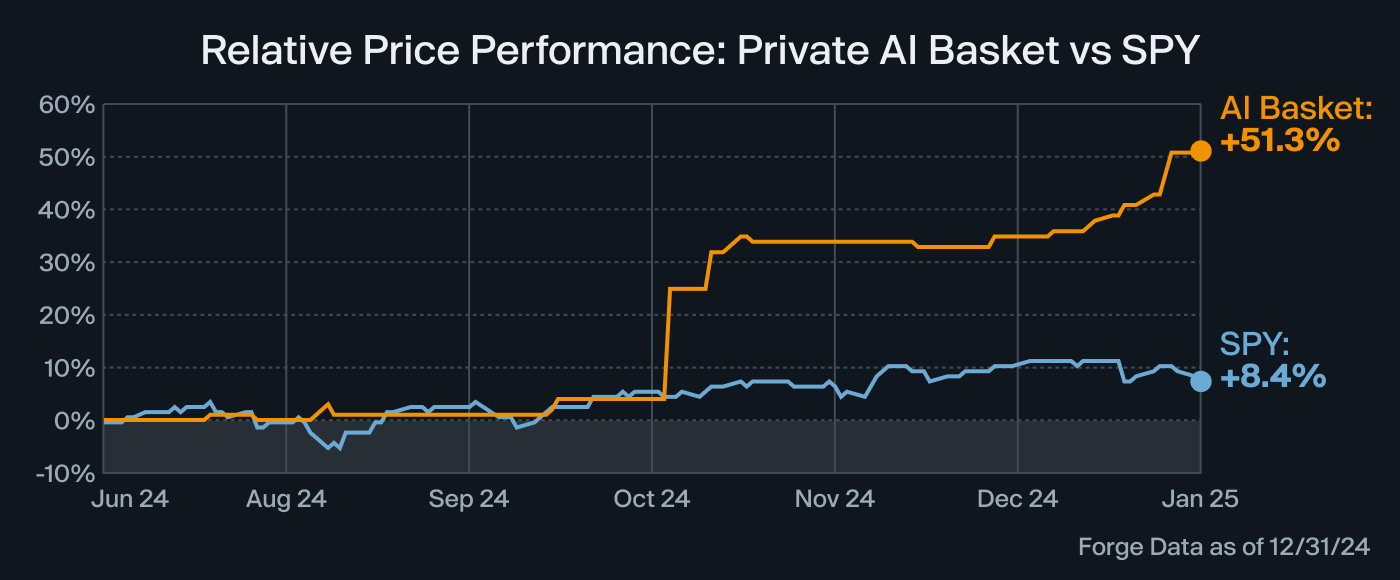

Exit Activity 34

Access the full report to see how Forge’s Private AI Basket of seven companies spiked to 51.3% in the second half of 2024 and outperformed the S&P 500 during the same period; ultimately, setting an enthusiastic tone for private market AI investments in early-2025.

Howe Ng is the Head of Data and Investment Solutions at Forge Global. Prior to Forge, Howe held senior roles at BlackRock and Barclays Global Investors, including in their iShares ETF and Systematic Active Equity Portfolio Management divisions. He also served as Chief Operating Officer at Nipun Capital, an alternative asset management firm focusing on EM and Asian strategies.

Andrew Alden, CFA, serves as Vice President of Quantitative Research at Forge Global, where he leads a research team focused on the private market. Prior to this role, Andrew launched Semantiqa, an investment management firm, which focused on the public-market growth equities space.

Lindsay Riddell is EVP of Corporate Marketing & Communications at Forge Global. Prior to joining Forge, Lindsay ran the Corporate & Executive Communications at Hotwire Global, a technology PR firm. She was a technology and financial journalist for 18 years, including at the San Francisco Business Times.

Louis is a Senior Data Analyst at Forge Global, focusing on valuations and private market trends. Before joining Forge, Louis worked in corporate finance at Initiative Media and was a startup founder.

Disclaimers

About Forge

Forge Global Holdings, Inc. (together with its subsidiaries, “Forge”) is a leading provider of marketplace infrastructure, data services and technology solutions for private market participants.

Legal Notices and Disclosures

© 2025 Forge Global, Inc. and its affiliates. All rights reserved. Investing in private company securities is not suitable for all investors, is highly speculative, is high risk, and you should be prepared to withstand a total loss of your investment. Private company securities are highly illiquid and there is no guarantee that a market will develop for such securities. Each investment carries its own risks, and you should conduct your own due diligence regarding the investment, including obtaining independent professional advice. Past performance Is not indicative of future results.

This is not a recommendation, offer, solicitation of an offer, or advice to buy or sell securities by Forge Securities LLC (“Forge Securities”) or any of its affiliates, nor an offer of brokerage services in any jurisdiction where Forge Securities is not permitted to offer brokerage services. Registered representatives of Forge Securities do not (1) advise any party on the merits of a particular transaction; (2) assist in the determination of fair value of any security; or (3) provide legal, tax, or transactional advisory services. Securities and investments are offered only to customers of Forge Securities, a registered broker-dealer and member FINRA & SIPC. Securities referenced in this article may be offered by Forge Securities, and certain Forge affiliates may act as principals in such transactions. See Forge’s Disclosure Library (Disclaimers & Disclosures and Form CRS) for additional disclosures.

Forge Price™ is calculated and disseminated by Forge Data LLC (“Forge Data”). All rights reserved. Forge Price™ is designed to reflect the up-to-date price performance of venture-backed, late-stage companies. Forge Price™ is determined based on a proprietary model incorporating the pricing inputs from primary founding round information and secondary market transactions, including indications of interest (IOIs).

Secondary market transactions are sourced from Forge Securities LLC (an affiliate of Forge Data), a leading market platform, and data collected from other private market trading platforms. The Forge Price™ is a mark of Forge Data. The Forge Price™ is solely for informational purposes and is based upon information from sources believed to be reliable, however Forge Data makes no assurance as to the accuracy or reliability of this data. Forge Data is not an investment adviser and makes no representation regarding the advisability of investing in any asset or asset class. Private company securities are highly illiquid, and the Forge Price™ may rely on a very limited number of trade and/or IOI inputs in its calculation. Brokerage products and services are offered by Forge Securities LLC, a registered broker-dealer and member FINRA/SIPC.

Neither reference to company names, nor calculation of Forge Price™ for a particular company(ies) implies any affiliation between Forge or its affiliates and any company, any endorsement or sponsorship of Forge or its affiliates by any company or vice versa, or any partnership, joint venture or other commercial relationship between Forge or its affiliates and any company. Rights with respect to any company marks referred to herein are, as between Forge and its affiliates and such company, owned by the company.

The information contained herein is based on currently available information, and Forge undertakes no obligation to update any of such information or to reflect new information or the occurrence of unanticipated events, except as required by law. While Forge believes such information forms a reasonable basis for the contents of this Investment Outlook, such information may be limited or incomplete, and this content should not be read to indicate that Forge has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. This Investment Outlook contains trademarks, service marks, trade names and copyrights of Forge and may contain those of other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products is not intended to, and does not imply, a relationship with Forge or any of its respective affiliates, or an endorsement or sponsorship by or of Forge or such affiliates. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Investment Outlook may be listed without the TM, SM, (c) or (R) symbols, but Forge will assert, to the fullest extent under applicable law, the right of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. The performance of the Forge Private Market Index with respect to the growth of $10,000 shown herein does not represent the performance of any actual investment, as you cannot invest in the index, but rather reflects the hypothetical growth of a $10,000 investment in a basket of securities based on the index. Additionally, the chart assumes reinvestment of dividends and capital gains in the constituent securities but does not reflect any fees or commissions that may be incurred in purchasing or selling such securities, which would lower the figures shown if included. Further, $10,000 may not be a sufficient amount to invest simultaneously in all securities contributing to the performance shown, which would further prevent an investor from matching the performance shown. The performance shown represents past performance, and past performance is not indicative of future results.

The Forge Private Market Index is calculated and disseminated by Forge Data LLC ("Forge Data") and is a mark of Forge Data. All rights reserved. The Forge Private Market Index is solely for informational purposes and is based upon information from sources believed to be reliable. It is not possible to invest in the Forge Private Market Index, and Forge Data makes no assurance that any investment products based on or underlying the Forge Private Market Index will accurately track index performance or provide positive investment performance. Forge Data is not an investment adviser and makes no representation regarding the advisability of investing in any asset classes or investment vehicles. Private company securities are highly illiquid, and the Forge Private Market Index may rely on a very limited number of trade and/or IOI inputs in its calculation. Brokerage products and services are offered by Forge Securities, a registered broker-dealer and member FINRA/SIPC. By downloading this content, you acknowledge that you have reviewed and are subject to the Forge Private Market Index disclaimers and disclosures which contains other important disclaimers, disclosures and restrictions related to the Forge Private Market Index. Additionally, if you are accessing this content away from forgeglobal.com, you acknowledge that you have reviewed and are subject to Forge’s Terms of Use with respect to use and distribution of information as if you were accessing this content on forgeglobal.com.