How to buy private shares on Forge: A complete guide

Overview

Many of the world’s most innovative companies are staying private longer. According to data from Morningstar and Pitchbook, in 2024, companies took an average of nearly 11 years before going public, compared to just under seven years in 2014.1 This trend has meant that some attractive potential investment opportunities have been difficult, or impossible, to gain access to, since they’ve been absent from the public realm. Forge’s private marketplace was created to change this dynamic.

When compared with trading publicly-listed securities on exchanges such as NYSE or Nasdaq, trading pre-IPO shares is more complex—often taking more time to execute and subject to more restrictions. Forge is designed to help you navigate the complexity of private share transactions.

This guide addresses key considerations for purchasing private company shares and outlines a step-by-step process for completing a purchase with Forge. Below, we attempt to address how most shares are typically traded on Forge. Please note that, because many private companies have idiosyncratic rules and varying levels of sophistication in issuing and trading shares, a buyer may encounter additional or different requirements when purchasing shares.

Timelines

Completing a private market transaction often takes a significant amount of time to finalize. In most cases, it takes approximately 45 to 60 days to complete the process after trade terms are agreed upon, though that time frame can increase or decrease depending on individual circumstances. This timeline includes multiple steps, including what is often the longest step: navigating the ROFR (right of first refusal) process. The fact that many private companies have a ROFR in place allows them to purchase stock from employees rather than let an external party purchase equity in their company. The ROFR process can delay transactions or potentially stop a purchase, so it’s important to understand these procedures (which vary from company to company).

In some cases, a single-company Forge fund offering that can be used by a group of investors to invest in private companies, which often speeds up the transaction process significantly (think: weeks not months). The Forge fund offering (otherwise known as an SPV, or special purpose vehicle) will hold the investment on behalf of the investors, allowing the investors to then own a portion of the SPV (known as a “membership interest”), with the SPV in turn owning a portion of the private company (or multiple private companies).

When choosing to purchase equity through a Forge fund offering, a buyer generally does not need to worry about a ROFR affecting the transaction, as that consideration has already been resolved as part of the fund agreement.

The timeline for funding a purchase will depend on the type of transaction that is sought. For a direct secondary transaction, the transfer of purchase funds to the seller happens at the conclusion of the process, usually (approximately) 30 to 45 calendar days after the trade terms are initially agreed to, after the ROFR period has elapsed and the stock transfer agreement has been executed.

For investment into a Forge fund offering, the transfer of purchase funds to the fund typically occurs within approximately one to five business days from execution of the subscription agreement.

Fees

Forge charges a fee for brokered transactions between direct buyers and sellers. In most cases, fees for buyers start at approximately 2% to 4% of the total transaction size, though some transactions may be eligible for lower or no fees depending on the circumstances, such as transaction size. Please note that you can see prospective fees upon submitting a bid, and Forge only charges fees on completed transactions.

For Forge fund offering transactions, shareholders sell shares to a Forge-managed special purpose vehicle (SPV), or a ‘single-company Forge fund offering,’ created to hold a private company’s shares. There is usually a one-time fee, typically 1% to 2% of the transaction size, paid when a buyer purchases units of a Forge fund. However, fees may be higher due to demand levels and a variety of other reasons, so it is important to read the prospectus and other fund materials closely and understand applicable terms and costs.

Minimums

Minimum investment amounts can vary based on the type and size of a transaction, among other potential factors. In many cases, a single-company Forge fund offering may accept transactions as low as $5,000. For other transaction types like direct trades, a company may require higher minimums, typically starting at $100,000, in order to approve the addition of a new investor to their capitalization (cap) table.

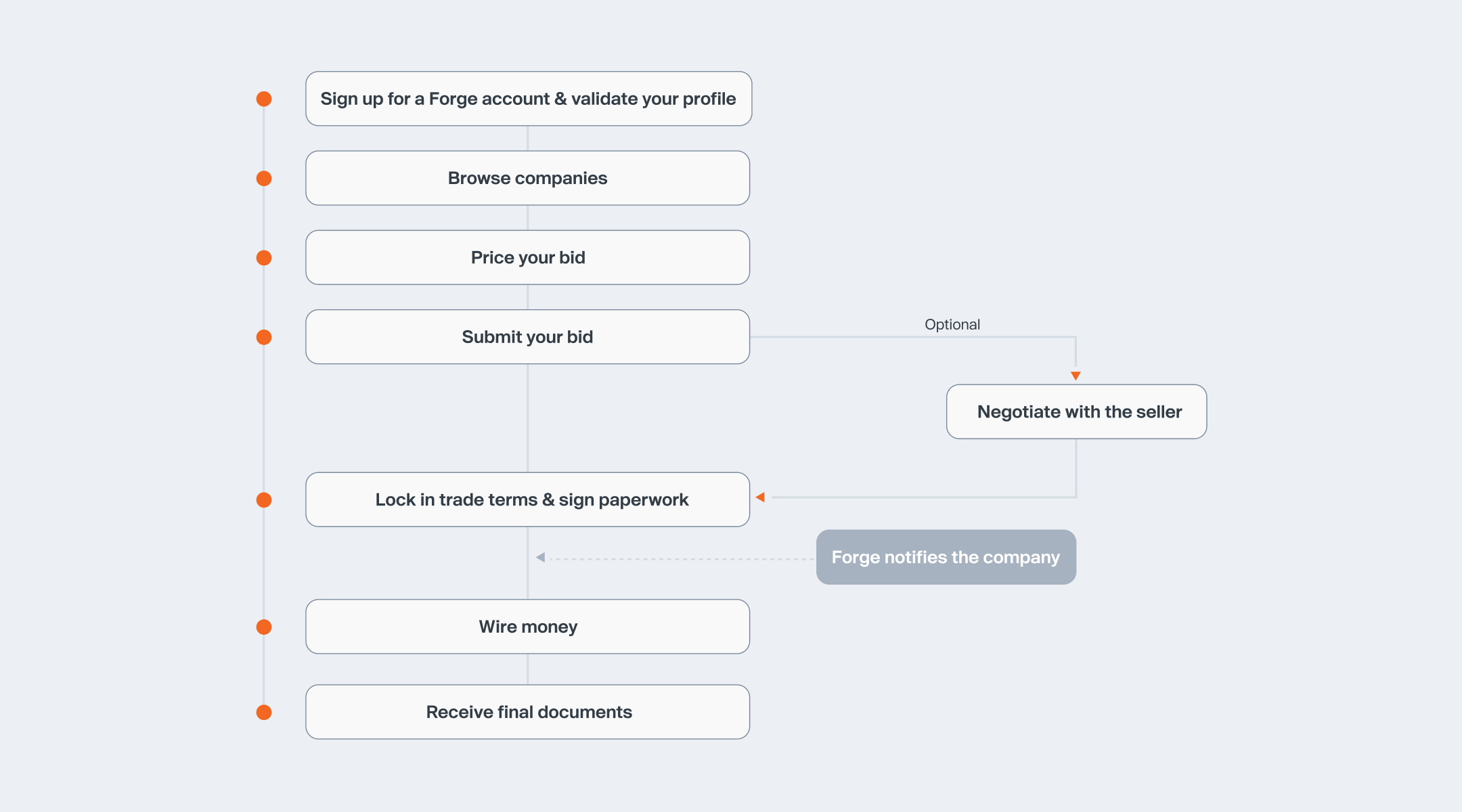

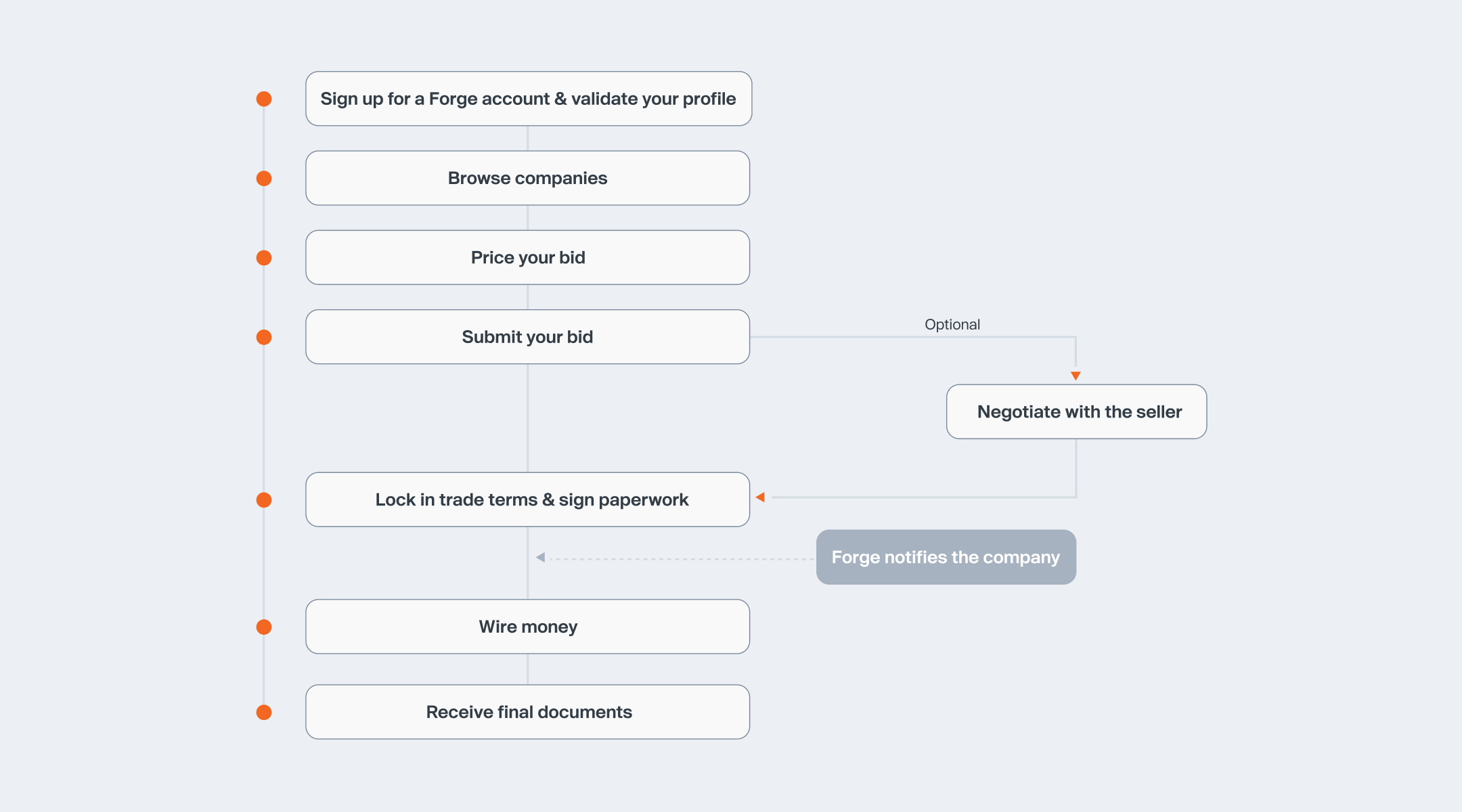

Buying private company shares: A step-by-step guide

Step 1: Register for Forge and validate your status as an accredited investor

To begin the buying process, you first need to create an account on Forge. Forge does not charge a fee to create an account or to access Forge’s marketplace and join our global network of buyers and sellers. Forge charges a fee upon the successful completion of a transaction.

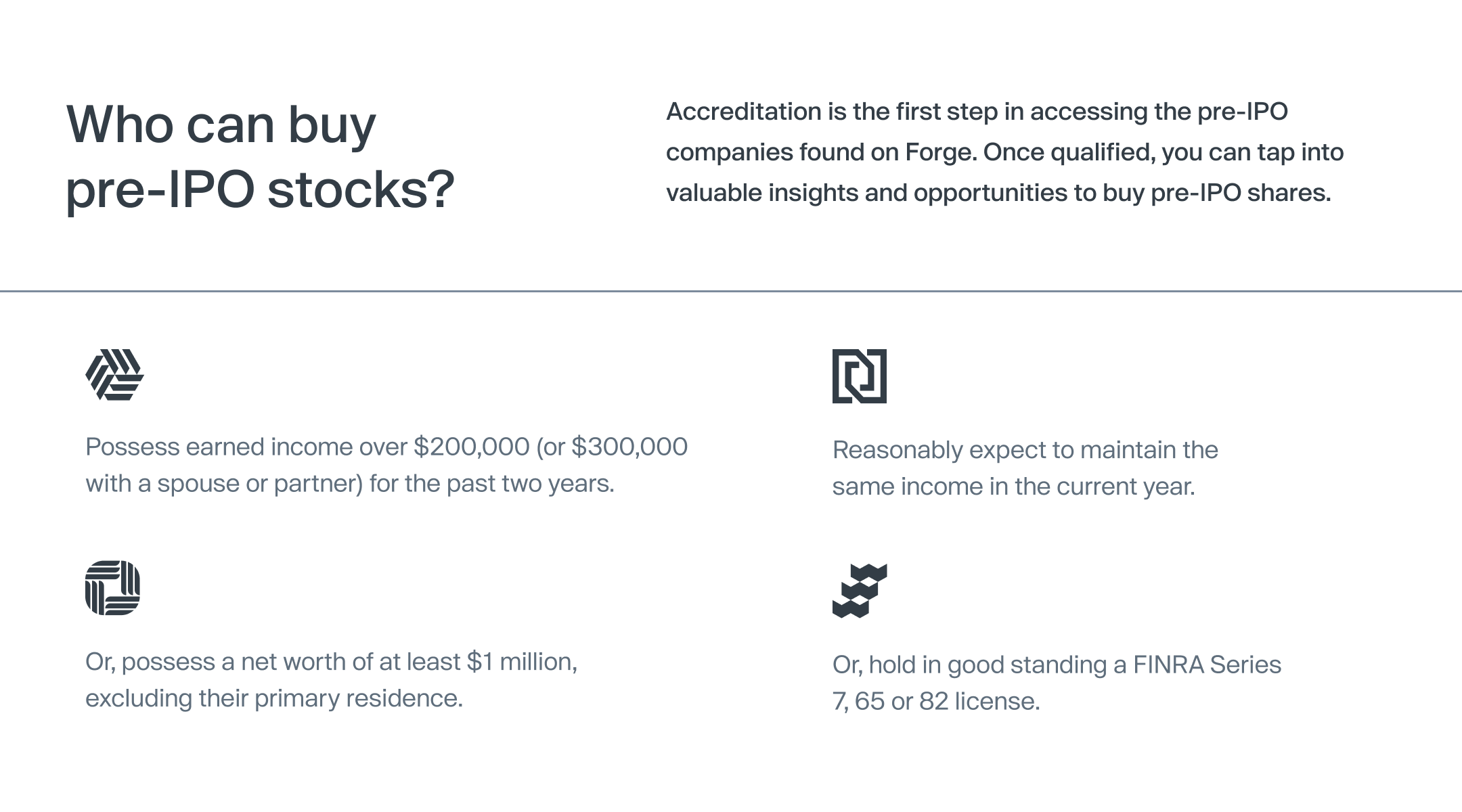

At this stage, you’re ready to dig deeper into Forge’s marketplace. However, in order to purchase equity in private companies, you must meet the qualification thresholds of being an “accredited investor,” as defined by FINRA and the SEC. Please follow the steps outlined during onboarding to confirm that you are eligible.

In addition, you’ll need to complete your investor profile, including confirming your identity by uploading valid identification. You won’t be able to see the active market of bids and asks until you complete this process.

These steps are key components to transact on Forge, as all buyers and sellers must be credentialed in order to complete a transaction. This means that the active bids and asks data you see on Forge have been submitted by credentialed users, helping ensure the quality and accuracy of data and leading to a potential greater likelihood of completing transactions.

Please note that these steps apply to individual investors. If you are looking to invest as a professional buyer (such as an institution or other entity), please create an account today.

Step 2: Conduct research on private companies on Forge’s marketplace

After you’ve successfully registered for Forge and completed the onboarding steps, it’s time to dig into the wealth of data available on the marketplace. Forge contains information on thousands of pre-IPO companies across a broad range of sectors and industries (though it’s crucial to note that you may not be able to invest in all companies on Forge at any given time). For instance, specific companies may not have buyable shares available at the time you’re looking to invest, even though data may be available for those companies on Forge.

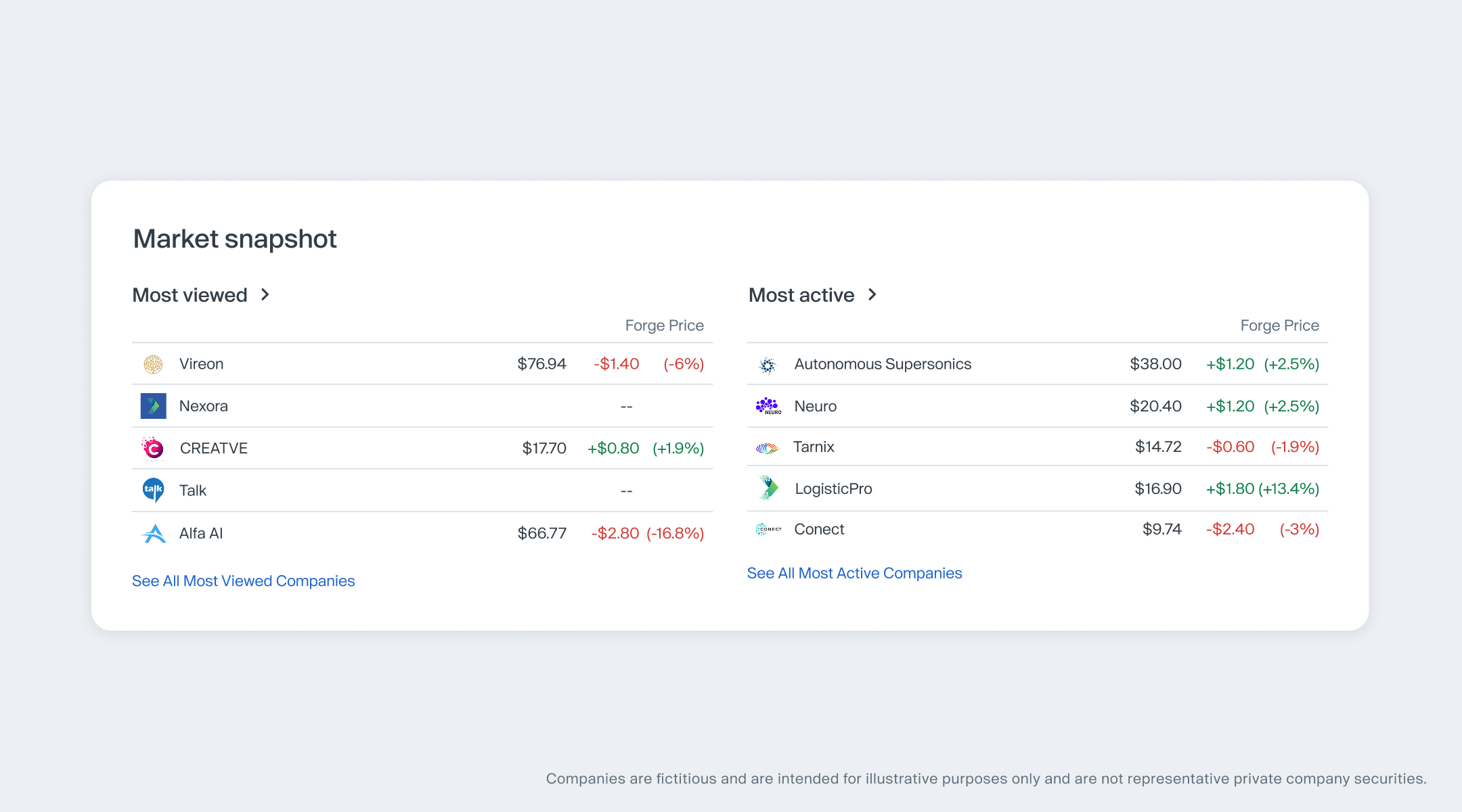

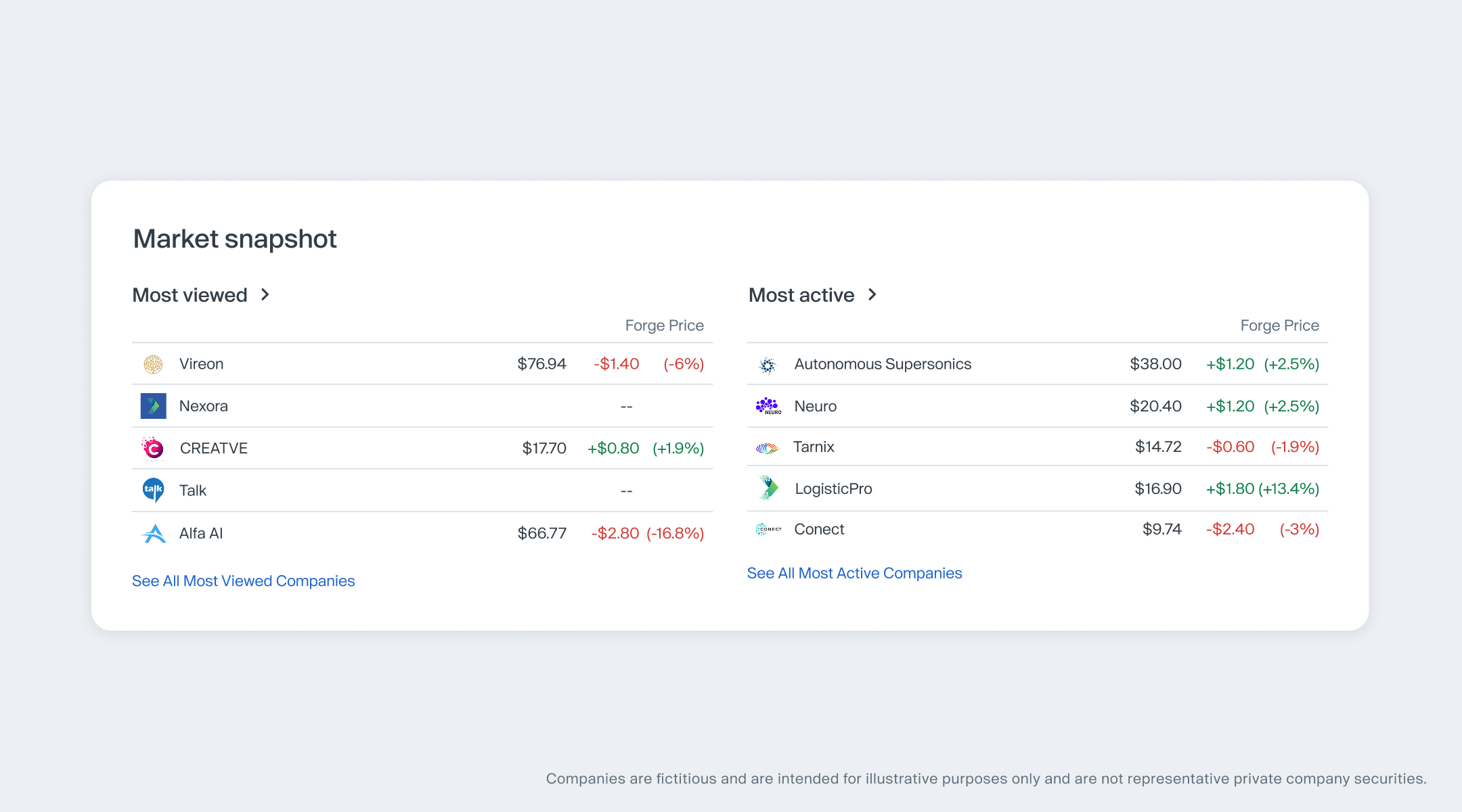

Forge offers in-depth information and data for you to review, including details on latest funding rounds, valuations and industry insights. When conducting research, you have several options to filter companies that interest you. For instance, you can sort popular companies (those that have been viewed the most), those with the most liquidity, and those with potential upcoming IPOs among a range of other filtering tools.

As you conduct your research, you may come across some companies offering Forge funds to purchase equity. If you choose to buy shares through a Forge fund, you may be able to complete your transaction more quickly than with a direct buyer and also will have the potential for greater liquidity to sell your exposure in the future. [Please see “How to Sell Private Shares on Forge: A Complete Guide” for more information on selling shares.]

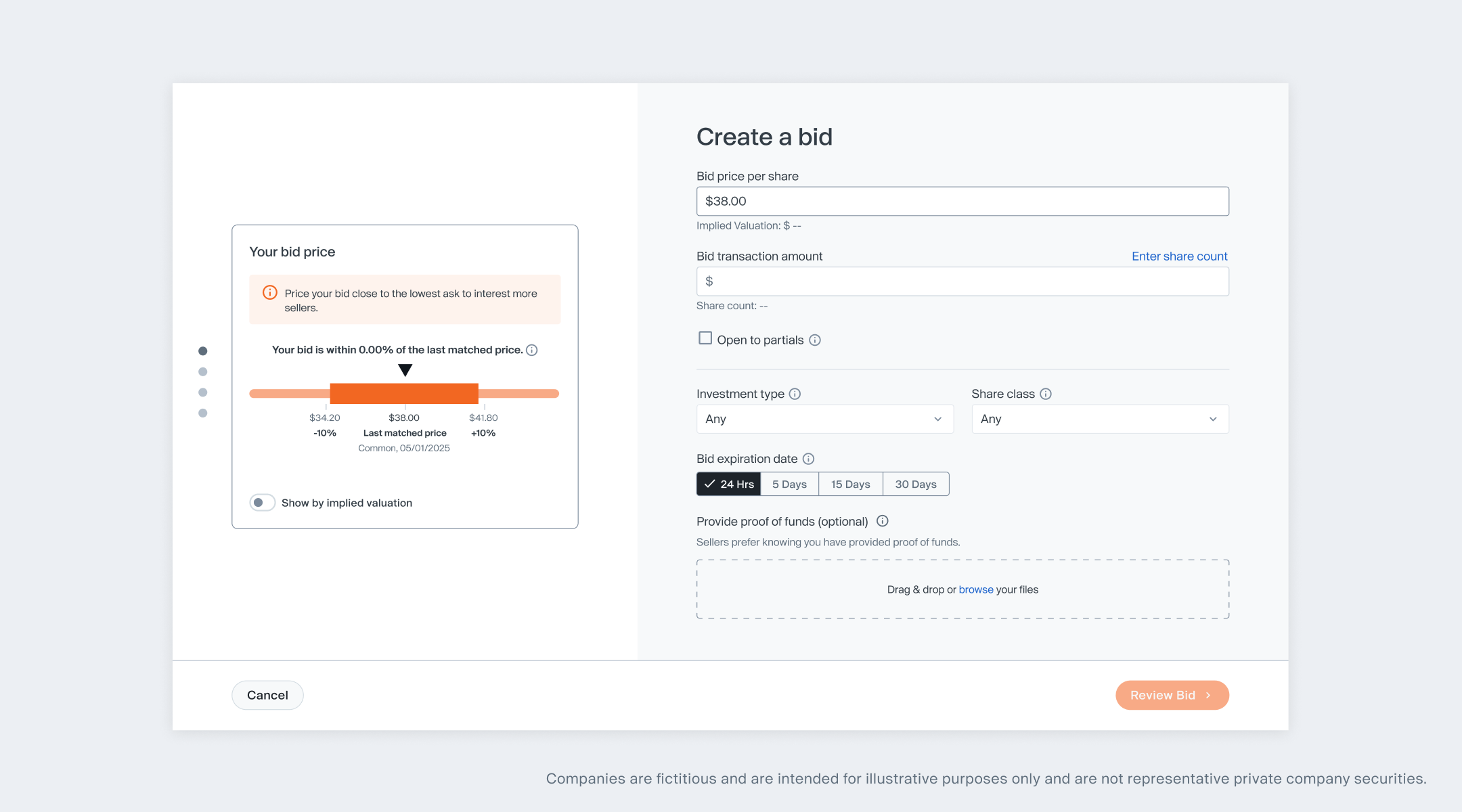

Step 3: Research a potential share price

Once you’ve identified a company that you wish to invest in, you’ll need to determine the price you intend to bid. Like all transactions, buyers and sellers of private shares need to agree on a price to proceed. Again, unlike the public market, which often offers near-instant prices on securities, pricing of pre-IPO company shares is more complex and less transparent than that of publicly traded stocks and exchange-traded funds (ETFs). Forge offers a broad range of data to help you determine the price you’re willing to pay.

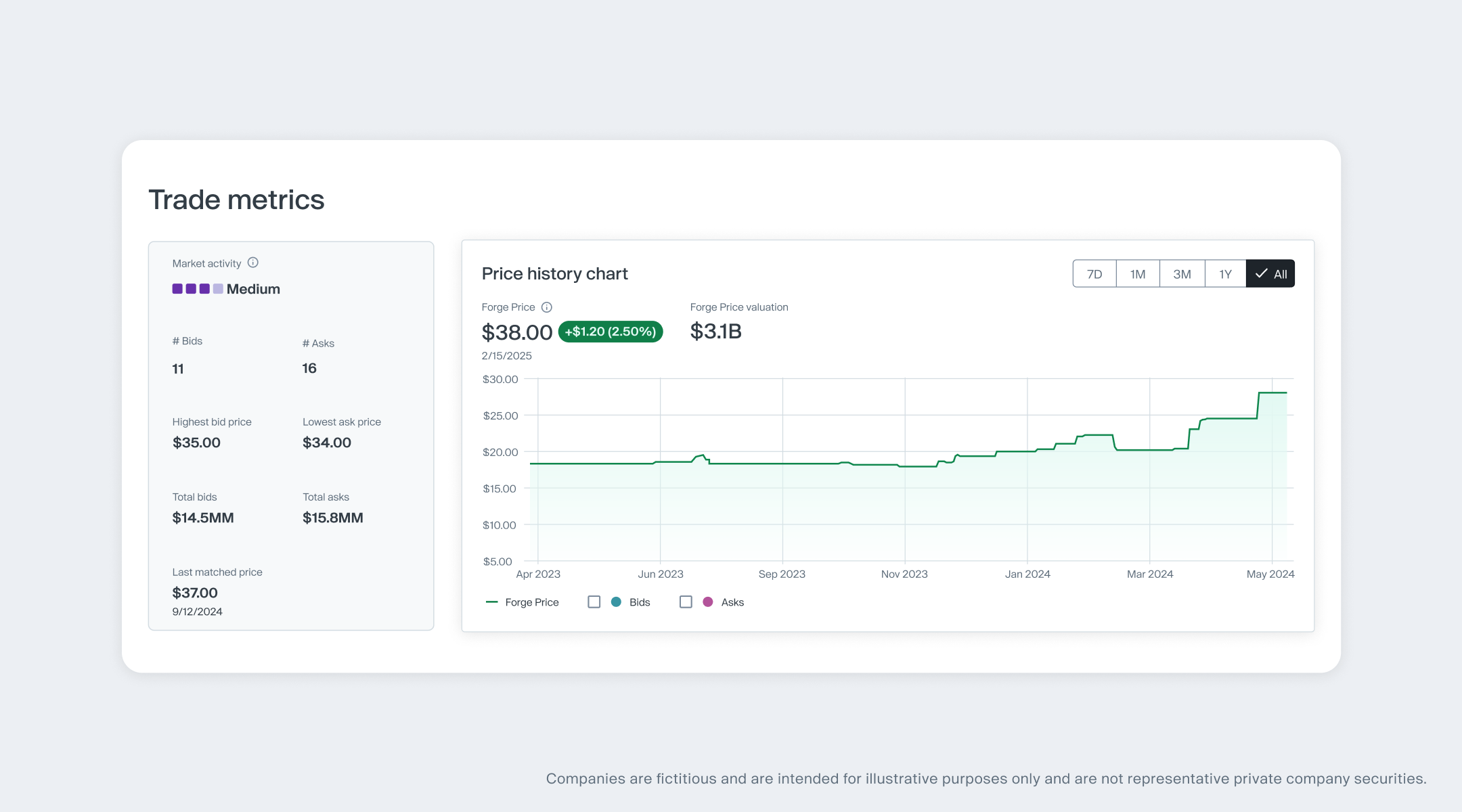

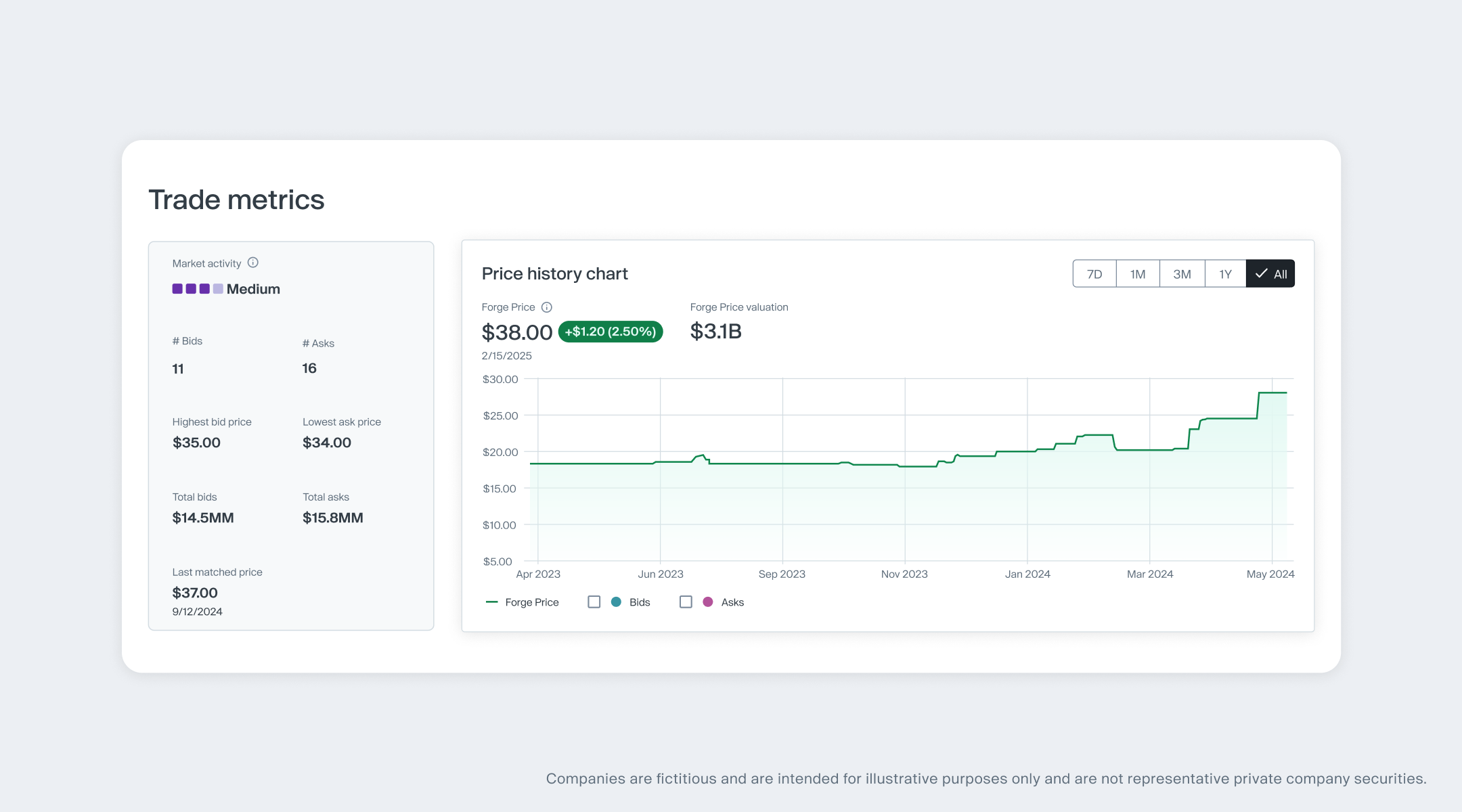

For more than 200 companies, users can access a Forge Price™, which is a derived, indicative price that synthesizes data from various sources, including secondary market transactions, recent funding rounds and active bids and asks on Forge. Forge Price provides a more timely and relevant reflection of company value and price discovery and can serve as a beneficial starting point for buyers seeking a higher likelihood of completing a transaction. However, please note that Forge Price is a derived price based on multiple historical data points and may not always be a future-transactable price.

In addition to referencing Forge Price, here are several other questions to consider:

- What is the lowest current asking price on Forge?

- What is the discount or premium from the company’s last funding round or other liquidity event like a company-sponsored tender offer?

- Based on recent transactions, is the company’s price moving upward, downward or staying relatively flat?

- What is the last-matched price for a closed transaction?

- How often has a company’s shares traded recently and at what range(s)?

For more in-depth education on how to price your shares, consider reading How to set an asking price for your private shares.

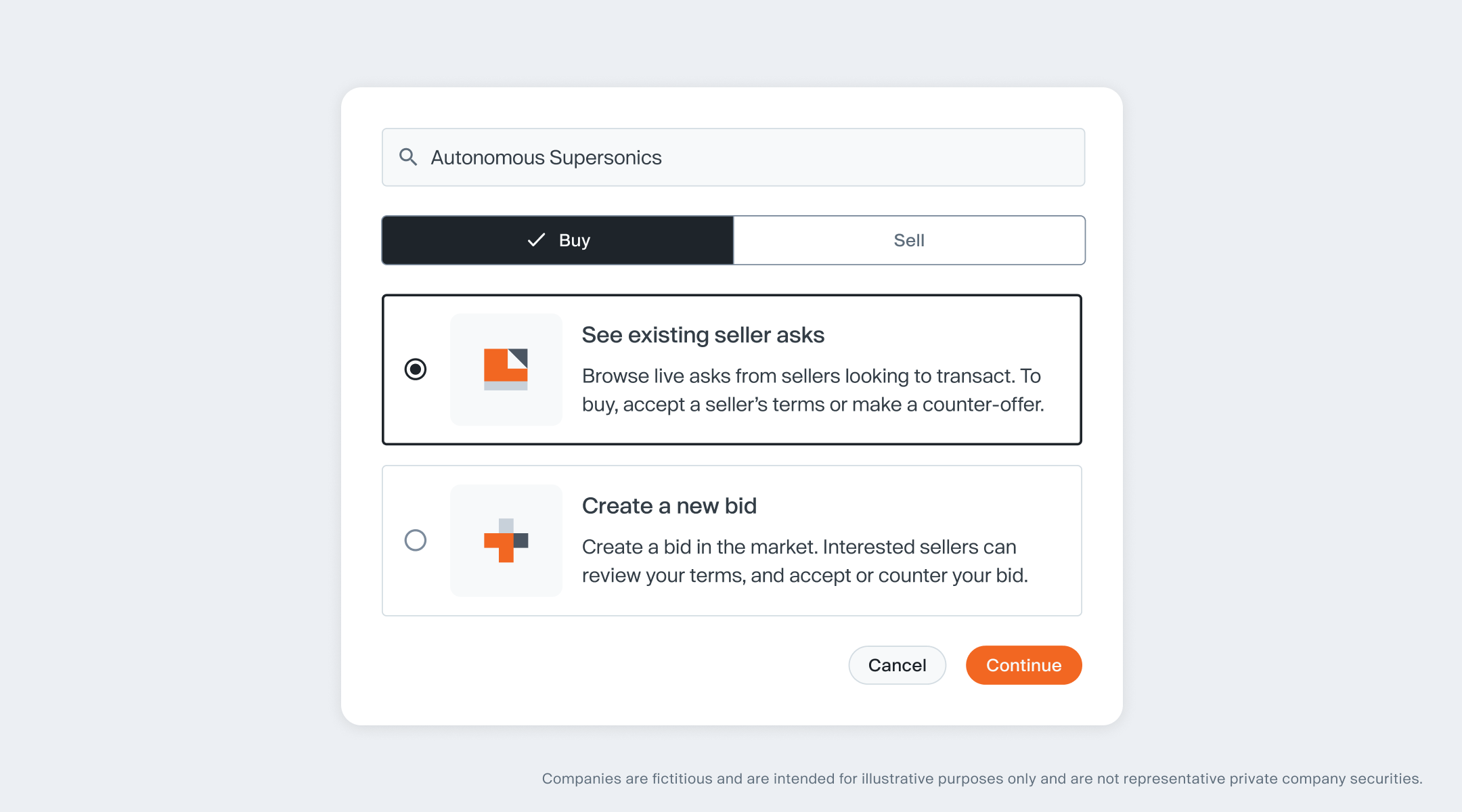

Step 4: Determine if you want to accept or negotiate an existing ask, or create a new bid

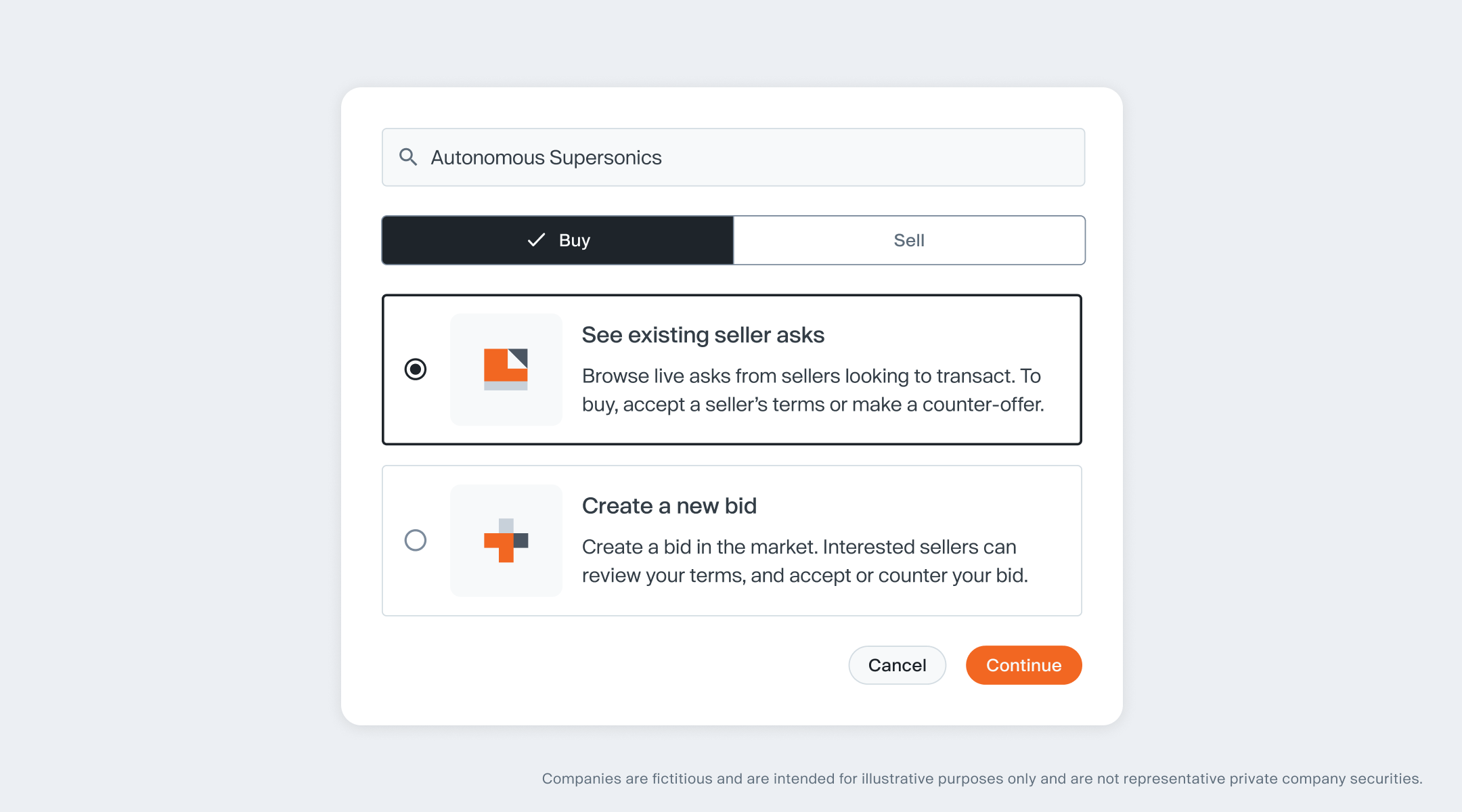

Once you’ve completed your research and identified a company you’d like to invest in, you can choose your preferred price and quantity by submitting a bid, a non-binding offer to purchase shares. At this point, you’ll see a few different options available depending on the company and current market activity.

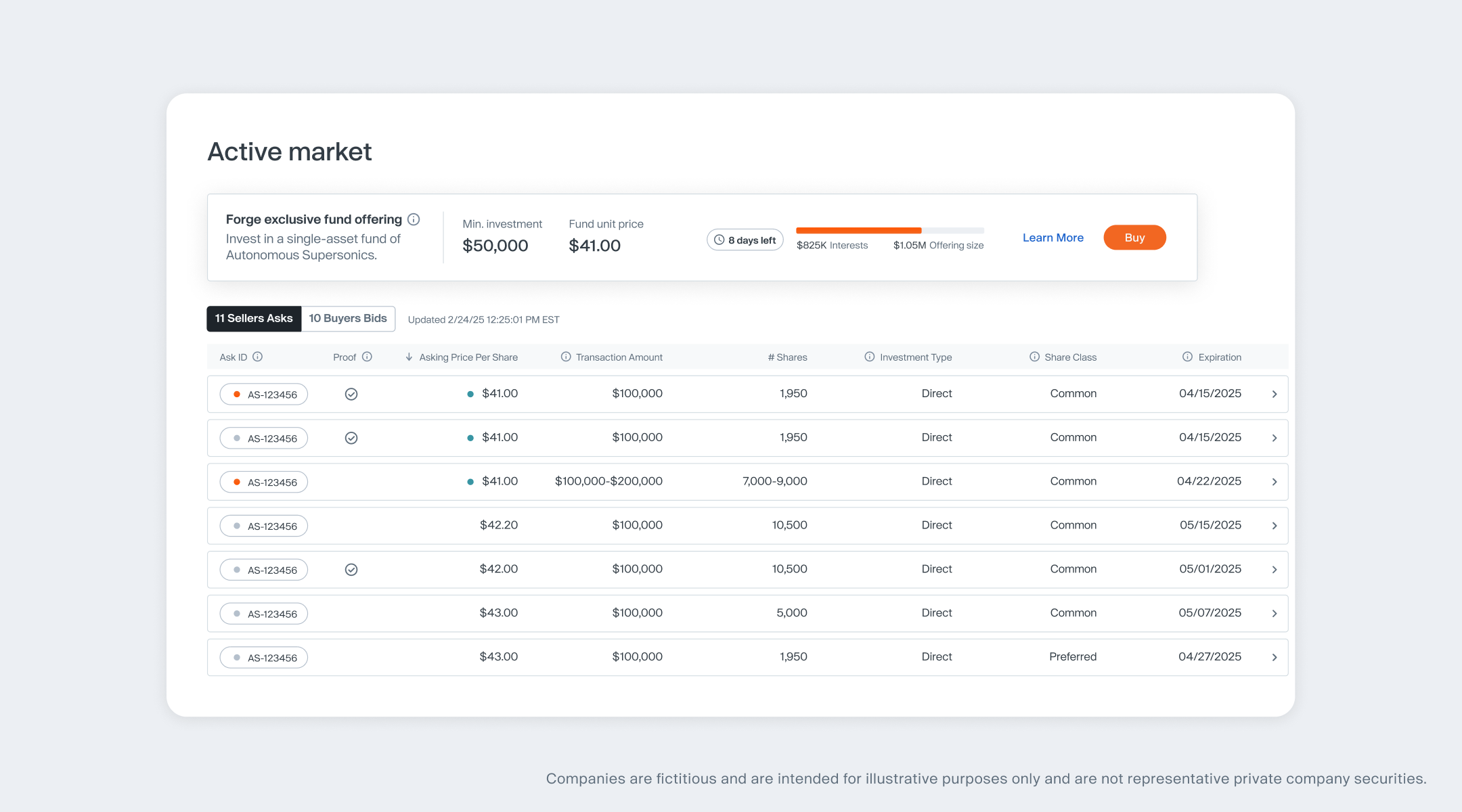

Forge active market: trading via direct or fund trades

Most of the time, you’ll be interacting with Forge’s active market, where live bids and asks are visible. These can include:

- Direct trades between buyers and sellers, or

- Trades via a Forge fund structure, where an intermediary SPV sits between the buyer and seller.

Within the active market, you can take one of two actions:

- Option 1: Respond to a seller’s ask by accepting it or negotiating their terms

You can engage with any active ask listed in the market—whether the trade is direct or facilitated through a Forge fund offering structure (SPV). If the listed terms (price and quantity) work for you, you may accept the ask and move forward with the transaction. If not, you have the option to propose alternate terms (e.g., a lower price or different quantity), initiating a negotiation with the seller.

Tips on negotiating:

When negotiating with a seller, it’s important to understand the concept of bid-ask spread. In some circumstances, particularly when markets are volatile, the bid-ask spread might widen, indicating that there’s disagreement about what price a company’s shares should sell at. But if the bid-ask spreads are tight, that is an indication that buyers and sellers are in greater alignment, which might result in more liquidity.

In the public market, bid-ask spreads can be as low as several cents, or even less, due to the broad amount of information available for most public securities, as well as the level of demand and broad accessibility by investors. However, given the lack of widespread price disclosure of private market trades, private market bid-ask spreads can be several percentage points, if not double digits, apart. The size of a potential transaction can also affect the bid-ask spread, as a seller may be willing to accept a lower price for a larger quantity of shares.

- Option 2: Submit a new bid

Enter your desired price and quantity. This bid will be visible to sellers, who may choose to accept or counter your terms.

Forge’s active market view shows real-time pricing, available quantities and other transaction details, helping you evaluate the market and act confidently.

Step 5: Finalize trading terms and sign transaction documents

At this point, let’s presume that you (whether purchasing directly or through a Forge fund) and the seller have agreed on a final price and quantity. Once both sides agree to all terms, the trade is “accepted,” and legal paperwork is delivered to both you and the seller for signatures. Securing signatures may take between two to five business days.

Step 6: Notify the company and understand the right of first refusal (ROFR) process

After you finalize an agreement with a seller, the purchase is not yet across the finish line. The next step in the process generally depends on the type of transaction and often takes between 30 and 45 calendar days, though that timeline may often vary depending on individual circumstances.

Direct purchase: In most cases when attempting to buy shares directly from a shareholder, the company will have the ability to exercise a right of first refusal (ROFR). This means that the company has the right to purchase shares directly from the seller at the price you set. In most situations, the company has between 30 and 45 business days to exercise their ROFR, though terms may vary significantly between individual companies and some companies respond more quickly to ROFR requests than others.

Why could a company choose to exercise its ROFR? A company may deem the potential transaction price as too low, they may not want to add external investors their cap table or they may have other reasons. In some cases, an existing stockholder may also have a ROFR in addition to the company. Either way, the ROFR process must be completed before a trade can be finalized. If a company or stockholder exercises their ROFR, then your transaction may not proceed.

If this occurs, you can start again by pursuing another company’s shares. Or, if you still want to purchase equity in the original company, in some circumstances, Forge may be able to pursue a transaction via a Forge fund for a company’s shares, though there is no guarantee that one of these options will be available.

The ROFR is typically not applicable for Forge fund offering purchases: If you are buying shares via a SPV, such as a Forge fund offering, the ROFR process in most cases has already been resolved as part of a broader agreement between the company and Forge. For funds and other pooled vehicles, there will likely be other considerations, so it’s important to understand the terms and conditions outlined in the fund agreement.

Step 7: Finalize the trade and settle funds

Once all the steps — including the ROFR process, if applicable — have been completed, the transaction can be finalized.

For a direct sale, this means that you pay the specified dollar amount (including applicable transaction fees) to the seller. In this case, you’ll wire funds to Forge to satisfy the payment.

Likewise, for a purchase via a Forge fund offering, you pay the specified dollar amount (including applicable fund and transaction fees to Forge). The settlement process often takes approximately five to seven business days, though again, the timeline can vary.

Step 8: Complete final documents and close the transaction

Once you complete the transaction and pay the required dollar amount for the shares, you will assume ownership of equity, either directly or via fund units, depending on the transaction type. However, the means of ownership varies depending on whether you purchased your shares directly or through a Forge fund offering.

Direct purchase: In this circumstance, you are the owner of the shares. Depending on the company, proof of ownership may be held in a third-party-equity management partner, such as Carta or Shareworks, which are online platforms that help companies, employees, and investors manage equity ownership stakes, including a company’s cap table. In some cases, your proof of ownership will be available through these platforms. Forge will provide your ownership documents to you after your transaction closes

Single-company Forge fund purchase: If you purchased equity through a Forge fund offering, instead of direct ownership, you own fund units, which offer a one-to-one exchange rate with company shares. In this case, your proof of ownership will be the fund documents provided at the closing of the transaction since the fund will appear as the owner of the shares underlying your units on the company cap table.

Step 9: Understand liquidity for your equity stake

Congratulations! As the owner of private company shares, you have equity in a pre-IPO company with the potential to grow its value over time. However, just as buying shares of private companies is far more complex than transacting in public securities, selling your equity is also more complicated. For more details on selling your shares, please see “How to Sell Private Shares on Forge: A Complete Guide” to learn about liquidity options.

Key points to remember

Transacting in pre-IPO company shares has the potential for strong returns over time, though the process is not nearly as simple as trading publicly listed stocks or ETFs. Forge was created to make the market for private companies more liquid and accessible, as well as to empower both sellers and buyers of private company shares.

Please contact us at [email protected] with any questions along your buying journey.