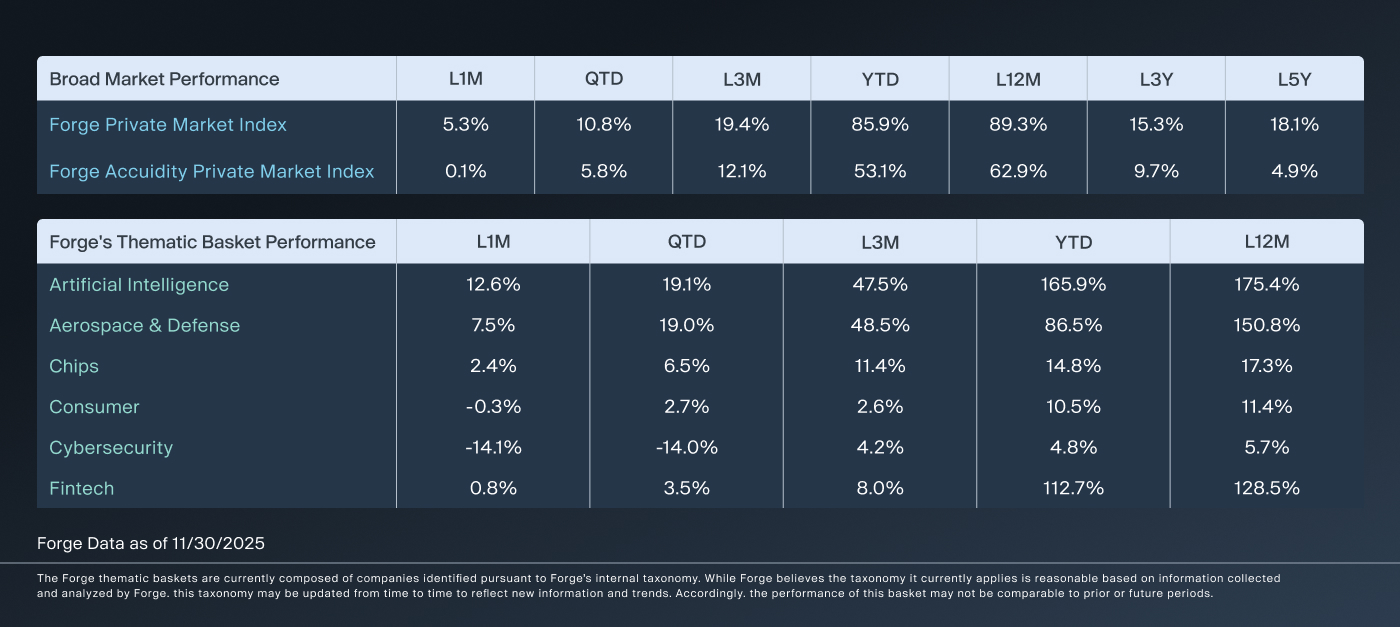

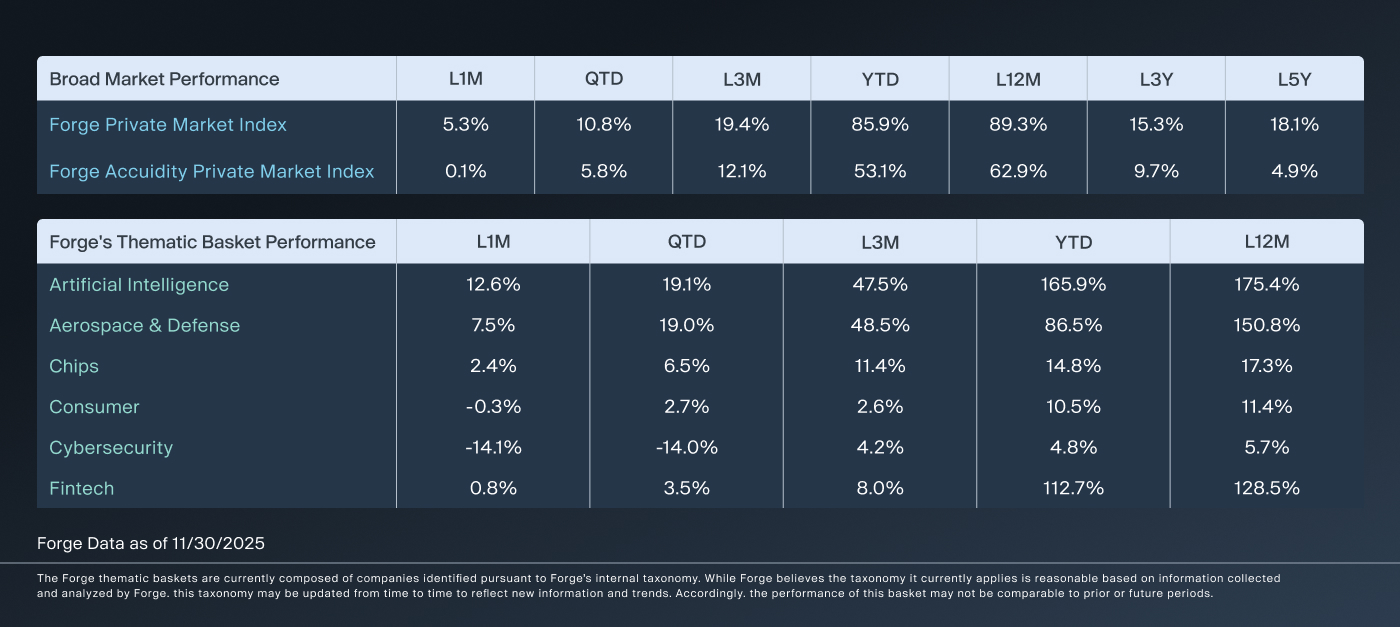

Both Forge private market indices produced gains during the month of November.

- The Forge Private Market Index (FPMI), ended November at +5.3%

- The Forge Accuidity Private Market Index (FAPMI) ended the same month at +0.1%

FPMI and FAPMI are broad-based indices for benchmarking and tracking, respectively, that reflect the health and performance of the private market as a whole. FPMI reflects the up-to-date performance and pricing activity of venture-backed, late-stage companies that are actively traded on the Forge marketplace. FAPMI was developed for the Accuidity Megacorn Fund to track, and is comprised of 60 privately held, late-stage venture-backed US companies.

AI and Aerospace & Defense swapped places and led the private market higher

The Forge AI thematic basket was back on top for November with a 12.6% gain. Although in second place for the month, the Forge Aerospace & Defense thematic basket (+7.5%) still had solid performance. Elon Musk companies drove positive performance in each:

- xAI’s reportedly raised a $15B funding round at a $230B valuation,1 which moved shares +86.8% higher

- SpaceX (+16.3%) saw solid appreciation in its Forge PriceTM, but was not fueled by a particular piece of news

The Cybersecurity basket once again had trailing performance with -14.1% for November. Publicly traded Netskope weighed down the basket with a -22.3% return. Also with negative performance was the Consumer basket at -0.3%. Zipline fell -18.1% during November, contributing to the basket’s negative performance.

Positive returns for both private indices that were mixed against the public market

FPMI (+5.3%) continued its marquee year and bested both QQQ (-1.6%) and SPY (+0.2%). FAPMI (+0.1%) also had positive performance but was unable to top SPY in November.

FPMI received positive contributions from TAE Technologies (+125.0%), xAI, as well as Ramp (+42.3%). While FAPMI saw gains from Ramp and SpaceX but was held back by publicly traded Circle (-37.1%) and Figma (-27.8%). These performances were driven by:

- TAE Technologies saw strong Forge Price appreciation as investors look for beneficiaries of the future energy needs for AI2

- Ramp raised $300M at a $32B valuation led by Lightspeed.3 Only three months ago the company raised $500M at a $22.5B valuation

The private market had another strong performance in November as the longest ever government shutdown came to an end.4 With a solid market environment and a reopened SEC, the IPO market could show signs of life by the end of the year.5

Explore opportunities in the private market

Forge provides data, pricing signals and access solutions designed to help investors navigate today’s evolving private market landscape. Want deeper visibility into private company performance—or to start trading shares? Create a Forge account to access private market data, request liquidity and explore investment opportunities.