With high-profile rocket launches and perhaps an even higher-profile founder in Elon Musk, SpaceX has captured the attention of aerospace fans and investors alike. Not only has the company evolved significantly from a technological perspective, but its valuation has increased substantially to become the world's most valuable private company. That title started with a tender offer in December 2024 that valued the company at around $350 billion.3 Most recently, in February 2026, SpaceX announced it acquired xAI,4 another Musk-founded startup known for its Grok chatbot and which also owns the social media platform X. The deal is the largest merger of all time and values the combined company at $1.25 trillion, with SpaceX accounting for $1 trillion and xAI for $250 billion.5

With this deal, SpaceX will focus more on space-based AI, particularly by building out and launching data centers in space.6

SpaceX could also soon conduct a much-anticipated IPO to bring the valuation even higher. The Financial Times reported in late January, shortly before the xAI acquisition was publicly announced, that SpaceX was considering an IPO in June 2026, with plans to raise up to $50 billion at approximately a $1.5 trillion valuation.7

Meanwhile, accredited investors can potentially invest in SpaceX stock pre-IPO, and retail investors can potentially gain exposure through other publicly traded avenues.

Here, we'll take a closer look at how to invest in SpaceX stock pre-IPO.

SpaceX: Company background

SpaceX, formally named Space Exploration Technologies Corp., was founded in 2002.8 The company started in the Los Angeles area,9 and while it maintains a large presence there,10 it officially relocated its headquarters to the Brownsville area of Texas.11

In addition to Musk serving as founder and CEO, other instrumental leaders have included Tom Mueller, SpaceX's first employee, who led the development of rocket engines that now power SpaceX's Falcon 9 rocket12 (Mueller left SpaceX to form Impulse Space in 202013); another early employee, Gwynne Shotwell, today serves as president and COO, having led key business development initiatives like securing contracts with NASA.14

Partnering with government agencies like NASA, such as for deliveries to the International Space Station, has helped SpaceX rake in nearly $20 billion from government contracts since 2008 through part of 2024, according to USA Today.15

While SpaceX has made a name for itself with innovations like reusable rockets that improve affordability (rather than ones that burn upon re-entering the Earth's atmosphere),16 its satellite internet service, Starlink, has been a a significant contributor to revenue. One analysis by Trefis projected Starlink's subscription revenue at over $10 billion in 2025, accounting for around two-thirds of SpaceX's revenue.17

Going forward, SpaceX is developing its next-generation reusable rocket, Starship. However, SpaceX has reportedly hit delays in advancing Starship.18

Now, following the merger with xAI, SpaceX also plans to launch up to 1 million satellites to create orbital data centers for AI usage.19

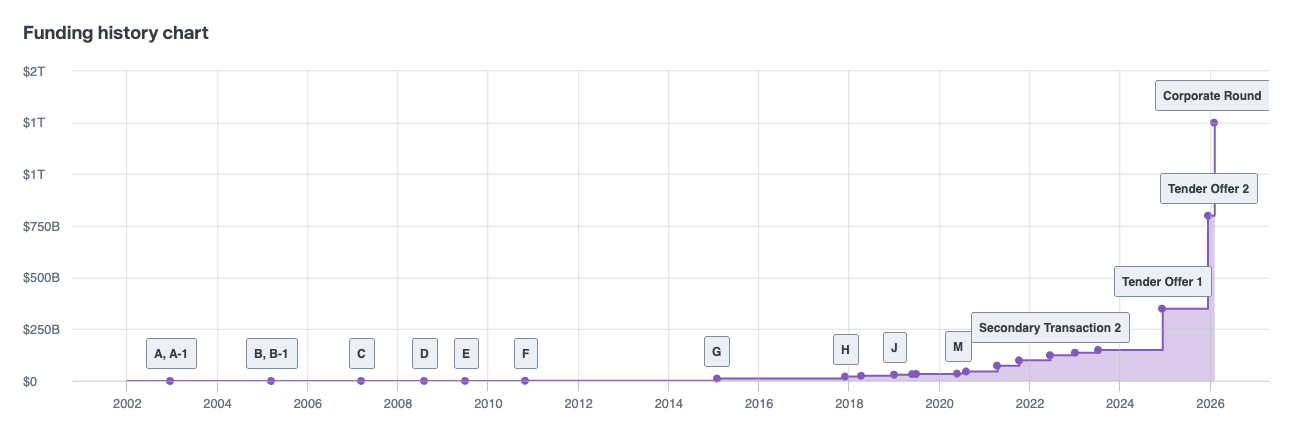

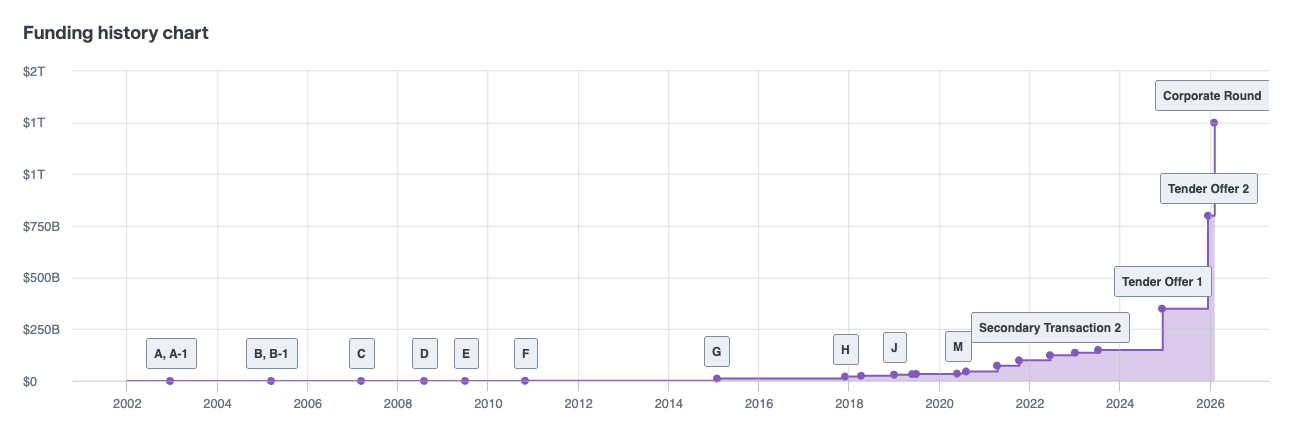

SpaceX stock and funding history

SpaceX has an extensive funding history, with its Series A dating back to 2002. At that time, the company raised $30.5 million at a $122 million valuation and a $1.00 per share stock price.20

Forge Data as of 2/6/2026

By 2007, SpaceX's stock price tripled to $3.00 with its Series C, and in 2010, SpaceX reached unicorn status through its Series F, in a round that raised over $50 million and brought the SpaceX stock price to $7.50.21

In 2015, SpaceX's Series G brought in over $1 billion at a $12 billion valuation, bringing the SpaceX stock price all the way to $77.46. In 2017, the SpaceX Series H raised nearly half a billion more, nearly doubling the SpaceX stock price to $135.00.22

In 2020, SpaceX had its largest primary equity funding round, raising $1.9 billion for its Series N, which brought the company's stock price to $270.00 at a valuation of $46.08 billion.23

Since then, SpaceX's stock price has continued to rise, based in part on moves like tender offers that have increased the company's valuation.

Forge Data as of 2/6/2026

Following the tender offer in December 2024 that brought the valuation to $350 billion, SpaceX's Forge Price rose to $213.39 as of early January 2025, up from an $87.08 Forge Price the year prior.24

The following year, in December 2025, another tender offer took SpaceX's valuation to $800 billion, and its Forge Price jumped all the way to $421. Now, SpaceX's Forge Price is $550 as of early February 2026, up about 138% over the past year. That equates to a $1.05 trillion valuation, but it's possible the Forge Price will rise more in line with the new valuation from the combined company.25

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information and secondary market transactions on Forge.

How to buy SpaceX stock

As SpaceX remains a private company for now, opportunities to acquire its shares are limited. Typically, participation in primary funding rounds or tender offers is restricted to individuals selected by the company. However, accredited investors may be able to gain exposure to SpaceX’s equity through Forge's next-generation marketplace for private market trading, depending on availability and subject to applicable securities regulations.

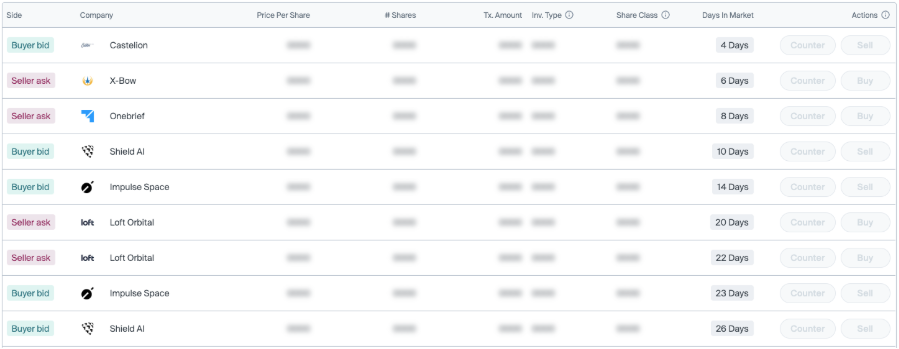

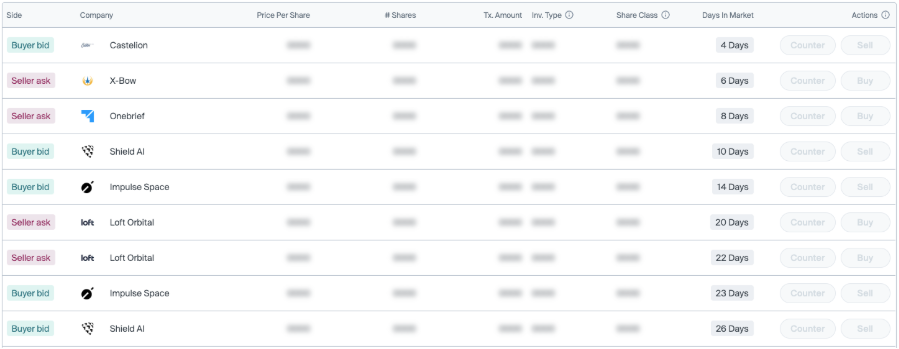

If SpaceX were to go through with an IPO, its stock could become more widely accessible. In the interim, accredited investors may seek indirect exposure to the space industry through companies that have commercial relationships with SpaceX. For example, Loft Orbital has utilized SpaceX’s launch services for deploying its satellite infrastructure, which Loft then rents space on to other customers in a space-infrastructure-as-a-service model.26 While this does not guarantee a correlation in business performance, such relationships may be of interest to investors evaluating the broader space ecosystem.

Who can invest in SpaceX pre-IPO?

Like with any other private company, investing in SpaceX pre-IPO has some general limitations. For the most part, investment is limited to institutional investors or high-net-worth individuals that SpaceX accepts as primary funding round investors. Those who qualify as accredited investors, such as based on having a net worth over $1 million (excluding primary residence), may also be able to invest in SpaceX through a secondary marketplace such as Forge. However, that secondary market investment is contingent on existing investors choosing to and being allowed to list their shares for sale.

Where to buy pre-IPO SpaceX stock

Accredited investors may be able to buy pre-IPO SpaceX stock through a secondary marketplace such as Forge, depending on availability. To trade on a platform such as Forge, existing shareholders such as employees must decide to list their shares for sale, and private companies like SpaceX generally have a right of first refusal (ROFR) to buy shares before they are listed on secondary marketplaces, so availability could be hard to come by.

Through Forge, you can access SpaceX's Forge Price, which provides real-time transparency by synthesizing data from various sources, including secondary market transactions and recent funding rounds

For registered investors with a verified profile may also explore Forge’s active opportunities, a comprehensive dashboard showing active buyer bids and seller asks for SpaceX and similar private companies in the Aerospace and Defense sector.

Sample of active opportunities available on Forge marketplace as of 2/10/2026

Image displayed is for illustrative purposes only.

Potential indirect exposure to SpaceX for non-accredited investors

Although retail investors generally cannot invest in startups like SpaceX directly the way that accredited investors can, that doesn't mean retail investors are completely shut out. Some other options include:

1. Publicly traded funds

One way to still get some exposure to SpaceX stock is to invest in publicly traded funds that hold SpaceX shares. For example, Destiny Tech 100 is a closed-end mutual fund that currently holds nearly one-quarter of its portfolio in SpaceX stock via special purpose vehicles (SPVs).27 The ARK Venture Fund is another closed-end fund, in which SpaceX accounts for over 11% of its portfolio.28

These funds' performance depends in part on SpaceX stock performance, although other holdings also influence fund returns. Keep in mind that fees for some vehicles that hold private assets can be significantly higher compared to other types of funds.

2. Tesla stock

Another way to gain some exposure to SpaceX stock is to invest in Tesla, a publicly traded company. While this is a more indirect route, the fact that both companies are led by Musk could provide some correlation. Tesla also recently invested $2 billion in xAI,29 which links the companies further, following SpaceX's acquisition of xAI. More synergies and collaboration could also occur between the companies in the future, as there have previously been some relatively small business agreements among the companies leading to some revenue flowing between them.30

3. Publicly traded aerospace companies

Investing in other publicly traded aerospace companies like Boeing, Lockheed Martin, and Northrup Grumman could also potentially provide some indirect exposure to SpaceX, in the sense that if the aerospace industry as a whole grows, then all of these stocks could potentially gain value.

Rocket Lab is another publicly traded company that's involved in similar areas such as launch services, so growth in that category could benefit both SpaceX and Rocket Lab, though competition between the companies could also cause one to rise while the other falls.

Similarly, with xAI now in the fold, investors may potentially obtain indirect exposure by investing in other companies involved in AI development, such as Nvidia or more diversified tech companies like Alphabet, Meta, and Microsoft.

How to analyze SpaceX stock

Since private companies do not provide the same financial transparency that public companies generally do, analyzing SpaceX stock can be challenging for the average investor. However, using the available public data such as on SpaceX's funding history and certain revenue figures could help investors compare SpaceX's stock price to other startups trading on private marketplaces like Forge. For example, Reuters recently reported that SpaceX earned about $8 billion in profit last year from around $15-$16 billion in revenue.31

Keep in mind, however, that it's hard to make direct, objective comparisons with limited public data, and this is complicated by the fact that SpaceX is in an elite tier of highly valued private companies, so there aren't necessarily many options for comparison.

There also aren't many publicly traded companies in comparable areas, but looking at the valuations of companies involved in aerospace like Boeing, Lockheed Martin, Rocket Lab, and Northrop Grumman could at least provide some reference points. Still, these companies are involved in areas that SpaceX is not, so these aren't perfect comparisons. Moreover, private companies typically carry more risk than publicly traded companies, due to factors such as limited liquidity, which arguably affects how one would value SpaceX.

Get started investing in SpaceX on Forge

If you want to invest in SpaceX pre-IPO if/when shares become available, create an account with Forge marketplace to access our deep marketplace of private market securities.

After you create a free account, you can potentially buy and sell private market shares in SpaceX and other startups based on availability.

Forge aims to bring greater transparency to an otherwise opaque private market, and as a publicly traded company, it operates within a regulated environment that allows investors to explore private market access.