Investors keen on keeping the AI trade going may have been disappointed to see Cerebras Systems withdraw its IPO plans with the SEC in early October,4 about a year after initially filing its S-1 with the regulator.5 However, the good news is that Cerebras' co-founder and CEO, Andrew Feldman, explained in a LinkedIn post shortly after that the withdrawal was due to the S-1 filing getting stale, and that Cerebras plans to re-file with updated financials and strategic information.6

Granted, Feldman did not provide a timeline for refiling or an eventual Cerebras IPO date, but it does seem like that's still on the horizon.

For now, accredited investors may be able to access private market shares of Cerebras through a next-generation marketplace like Forge, where investors can trade private market shares, leveraging real-time price transparency. Or, retail investors may be able to get indirect or similar exposure via other publicly traded assets.

Here, we'll take a closer look at how to invest in Cerebras stock pre-IPO.

Cerebras: Company background

Cerebras, founded in 2015,7 is often considered a challenger to Nvidia's dominance in the AI chip industry, with Cerebras differentiating itself through designing much larger chips, which the company claims makes its chips faster and more efficient than competitors' offerings.8

In fact, Cerebras' Wafer Scale Engine 3 (WSE-3) chip is the largest AI chip ever built so far,9 measuring around the size of a dinner plate vs. competitors' chips that are typically the size of a postage stamp, as Feldman explained in a CNBC interview.10

That size purportedly improves AI compute performance, which Cerebras sells directly to customers, along with putting the chips in hardware like the CS-3 System, which organizations can use to develop their own AI and high-performance computing (HPC) supercomputers.11 Cerebras also sells cloud services for AI inference and training.12

One of Cerebras' top customers is G42, a tech conglomerate in the UAE that Cerebras has partnered with to develop supercomputers.13 G42, which is also an investor in Cerebras, accounted for 87% of Cerebras' $136.4 million total revenue in the first half of 2024.14

While new revenue totals have not been announced, CEO Feldman noted on LinkedIn that 2024 and the first half of 2025 had record-setting revenue for the company.15

Cerebras stock and funding history

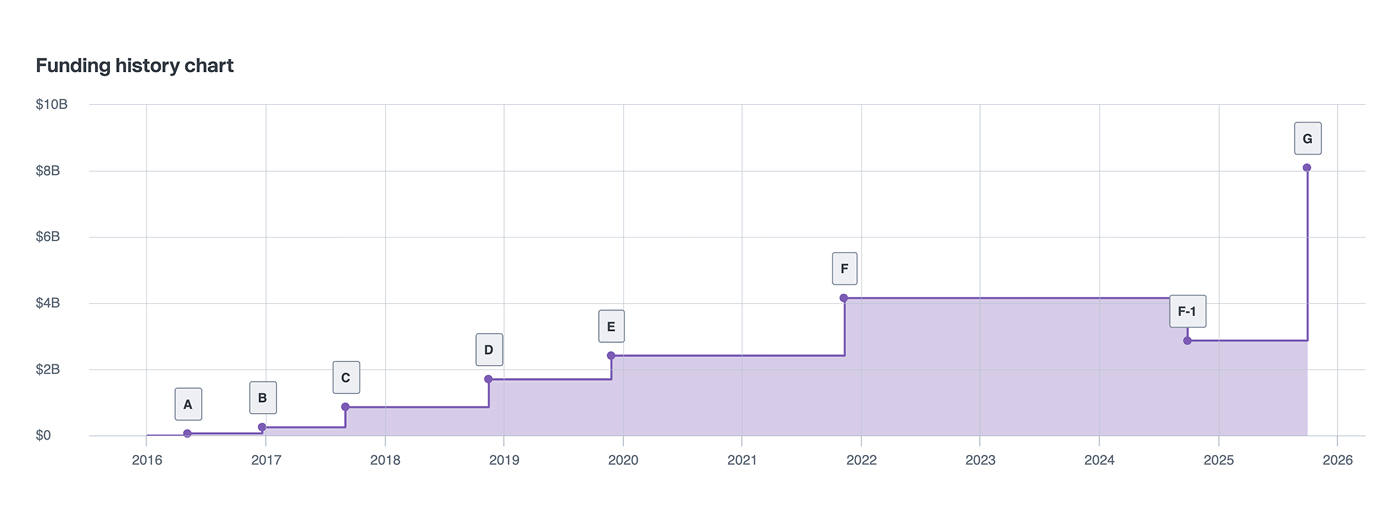

Cerebras' funding history started with its Series A in May 2016, when it raised around $27 million at an implied stock price of $0.85 and a valuation a little over $67 million. A little over two years later, the Cerebras Series D raised around $80 million, bringing the company into unicorn status at a $1.7 billion valuation and $16.15 stock price.16

The following year, Cerebras had a much larger funding round, bringing in over $270 million for its Series E, at a stock price of $18.32 and valuation of over $2.4 billion. Two years later, that valuation jumped to nearly $4.2 billion when the Cerebras Series F raised over $250 million, bringing its stock price to $27.74.17

After a break in primary funding rounds, a smaller down round for its F-1 in September 2024 raised $85 million, bringing the stock price down to $14.66 and valuation to around $2.9 billion. But that downturn didn't last long, as Cerebras recently had its largest round ever, raising $1.1 billion in September 2025, skyrocketing its valuation to $8.1 billion, with a stock price of $36.23.18

That's around where the Cerebras Forge Price sits at the end of October, though it's slightly up at $36.73, implying an $8.21 billion valuation.19

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions, and volume of bids/asks on Forge marketplace.

How to buy Cerebras stock

For now, as a private company, Cerebras' stock is not for sale to the general public. Until it potentially refiles with the SEC and completes the IPO process, investment is generally limited to accredited investors due to private market regulations. For those who do qualify as accredited investors and want to buy Cerebras stock outside of primary funding rounds, you can do so—subject to availability—through Forge's next-generation marketplace for private market trades. Forge's technology and relationships help facilitate trading in private company shares.

Who can invest in Cerebras pre-IPO?

U.S. regulations generally limit private companies when offering securities for sale, so buying Cerebras stock is primarily limited to accredited investors, such as high-net-worth individuals or institutional investors like venture capital funds.

Some of these investors participate in primary funding rounds, but there could also be opportunities to invest in Cerebras pre-IPO if shareholders like employees or early investors sell their shares on a private stock marketplace, such as Forge. Still, investment in this case would be limited to accredited investors.

Where to buy pre-IPO Cerebras stock

As mentioned, pre-IPO Cerebras stock is not available to the general public. Yet those who qualify as accredited investors, such as based on income or net-worth requirements, may be able to buy Cerebras stock pre-IPO through Forge's marketplace for private market trading, subject to availability.

Through Forge, you can access Cerebras' Forge Price, which provides real-time transparency by synthesizing data from various sources, including secondary market transactions, recent funding rounds, and active bids and asks on Forge. These contextual pricing insights may help private market investors evaluate whether to accept or negotiate an existing ask, or see if they want to create a new bid for Cerebras shares.

If you're interested in investing in Cerebras stock pre-IPO, create an account with Forge and place a new bid to show your interest or add this company to your watchlist to track its performance over time.

Alternatives for retail investors who want to buy Cerebras stock

Although retail investors can't directly invest in Cerebras while it remains a private company, there could be ways to gain exposure—even if on an indirect or correlated basis.

For example, Fidelity led the Cerebras Series G recently,20 so investors could keep an eye on whether the asset manager includes these shares in any publicly traded mutual funds or ETFs. For instance, Fidelity's Select Semiconductors Portfolio (FSELX) mutual fund holds over $15 million worth of Cerebras as of the end of October 2025, although this only accounts for 0.059% of the fund.21

Yet this mutual fund also holds names such as Nvidia and Broadcom, which could potentially rise alongside Cerebras if the AI industry as a whole grows. This fund also holds companies such as Taiwan Semiconductor Manufacturing (TSMC),22 which is the foundry that makes Cerebras' chips.23

Likewise, investors could buy individual shares of publicly traded companies like Nvidia, Broadcom, and TSMC, as well as other AI-related semiconductor companies like AMD or Intel, to potentially gain correlated exposure to Cerebras.

Another option is to focus on other areas of AI, like cloud computing that enables AI workloads. That could involve investing in companies like CoreWeave, which IPOed earlier in 2025,24 and thus could potentially provide more of that new stock exposure that investors may have been hoping to get through a Cerebras IPO. Or you could invest in more established publicly traded companies with large cloud computing divisions, like Amazon, Google, or Microsoft.

For diversification, investors could also invest in a mutual fund or ETF outside of Fidelity's offerings that may or may not have any Cerebras exposure. But even a broad-based ETF like Invesco QQQ, which tracks the Nasdaq-100 index,25 could provide some indirect or correlated exposure, such as if the tech industry overall grows—thanks in part to companies like Cerebras powering computing advances.

How to analyze Cerebras stock

While private companies typically provide limited financial details, Cerebras did disclose financial information for 2022, 2023, and the first half of 2024 in its S-1. If and when it refiles its S-1, that would include more up-to-date information. So, that could provide clearer insights if valuing Cerebras stock based on metrics like price-to-sales.26

Investors can similarly look at how other AI-related companies like Nvidia are trading. While this does require significant subjectivity—given the gaps in available data for a publicly traded company like Nvidia vs. a private company like Cerebras—it could still provide directional insight.

Closer comparisons may be possible by exploring private market companies through Forge's private stock marketplace. In addition to looking at real-world market signals informing Cerebras' current Forge Price, investors can discover other available investments and review market interest signals in real time. By seeing how other AI-related companies are trading on Forge, that could help you determine your pricing strategy if you want to trade Cerebras shares.

Keep in mind, however, that private market shares typically lack the liquidity of public market shares. So, even with real-time pricing insights on Forge, there can be more subjectivity involved in determining what you think is a fair valuation. Bid/ask spreads can also be several percentage points apart—if not more—within the private market, given the subjectivity and data limitations.

So, while there are many signals you can use to conduct an investment analysis on Cerebras, much of the analysis ultimately revolves around your personal views and goals.

Get ready to invest in Cerebras on Forge

If you want to invest in Cerebras pre-IPO if/when shares become available, create an account with Forge to access our next-generation marketplace of private market shares.

When you create a free account, you'll get access to more company and transaction details, and from there you can potentially buy and sell private market shares in Cerebras and other startups.

Forge stands out for its transparency into what can otherwise be an opaque private market, and as a publicly traded company itself, Forge provides a regulated, proven way to invest in the private market.