Private Market Glossary

What does unicorn mean?

A unicorn generally means a private company that has reached at least a $1 billion valuation. These companies get their names based on their relative rarity, as it can be difficult for a startup to grow to that size, especially while remaining private.

A better understanding of a unicorn company

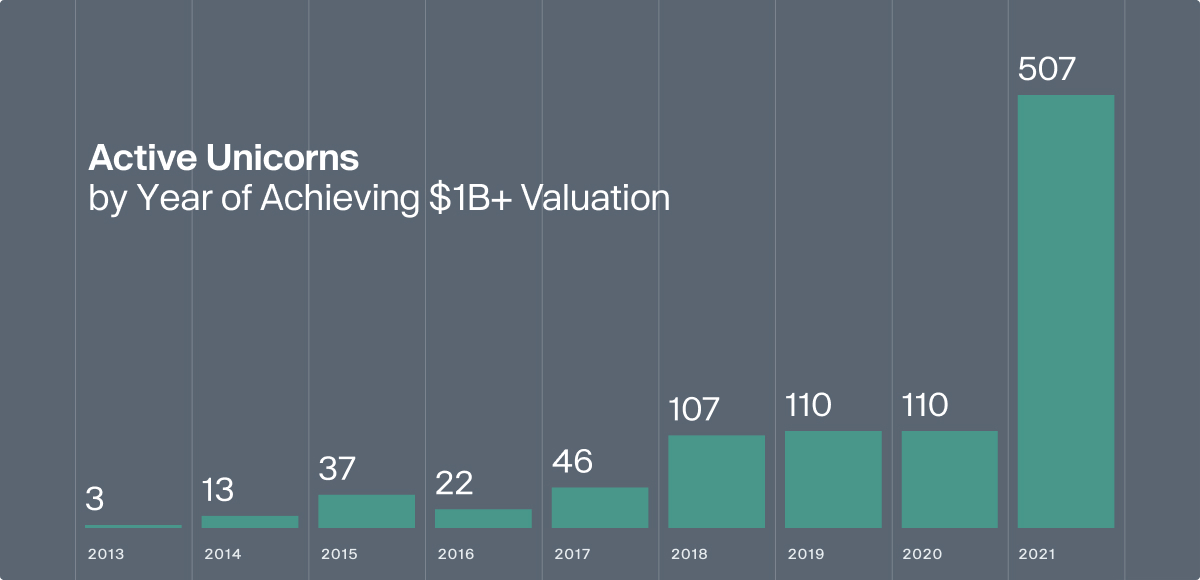

Unicorn companies can be any type of private company that has broken the $1 billion valuation mark. In general, most private companies don’t grow to that size. They might go public before reaching the $1 billion threshold, remain a smaller private company, get acquired, etc. Others might fold entirely. Because of this difficulty, companies that reach the $1 billion mark are considered unicorns because they’re so rare that it's almost like spotting the eponymous mythological creature. However, changing market conditions have made unicorns somewhat more common than in years past. A decade or so ago, only a handful of companies would become unicorns each year, but now the number of private companies that reach unicorn status every year has increased substantially. However, market conditions can change. It might be the case that some years more companies become unicorns, such as if venture capital funding is flowing, while in other years more startups remain smaller or go public before reaching unicorn status. Additionally, turbulent market conditions like those experienced during 2022 and 2023 can also sometimes cause companies that were unicorns to see their valuations diminish to less than $1 billion, such that they are no longer considered unicorns.

What role do unicorns play in the private market?

Unicorns generally are the companies in the private market, though subcategories like decacorns—those with at least a $10 billion valuation—are even larger.

Oftentimes, unicorns are household names that can create an impression of or give a (real or perceived) signal of broader private market conditions. They can also inspire other startups and give investors hope for the potential of other investments.

As Aileen Lee, founder of Cowboy Ventures, who is credited with coining the term unicorn (which she applied to software companies at that time), explained in a 2013 TechCrunch article 1 : “For those aspiring to found, work at, or invest in future unicorns, it still means anything is possible,” she wrote. That said, these companies are “technically outliers” she added, as they make up a small fraction of the startup world.

What are some examples of unicorns?

There are many examples of unicorns, many of which are well-known by the general public. Some that met that definition in 2023 include*:

- ByteDance: A technology company known for its subsidiary TikTok. Last known valuation of $220B according to Forge Data.

- Stripe: A fintech/payments company. Last known valuation of $50B according to Forge Data.

- Canva: A design tool company that includes an integrated marketplace. Last known valuation of $40B according to Forge Data.

- Databricks: A unified data analytics solution. Last known valuation of $37.89B according to Forge Data.

- Epic Games: A gaming company known for titles such as Fortnite. Last known valuation is $32B according to Forge Data.

*Based on the 50 most viewed unicorn companies on forgeglobal.com with the highest valuations on Forge Data, as of March 2023.

*The companies indicated are provided for illustrative purposes only and neither they nor their results or experiences are representative of any broader market, nor is inclusion of a company an endorsement of the company. They are purely examples to provide context and clarity.