Nvidia isn't the only AI chipmaker making waves with investors. Competitor Cerebras is reportedly looking to refile to go public soon, with the goal of conducting an IPO in the second quarter of 2026, according to Reuters.3

Initially, Cerebras filed its Form-S1 with the SEC in September 2024,4 and Renaissance Capital reported that the IPO could raise up to around $800 million.5

However, that IPO was delayed, potentially due to a national security review of UAE-based tech group G42, a minority investor in Cerebras6 that was responsible for over 80% of its revenue in 2023 and the first half of 2024.7

Then, in October 2025, shortly after announcing a $1.1 billion funding round at an $8.1 billion valuation, Cerebras withdrew its S-1 filing. A company spokesperson told CNBC that Cerebras' CEO felt the filing was out of date amidst new AI developments.8

Reuters also reported in December 2025 that G42 is no longer listed as an investor,9 although Semafor noted that it still seems to be a key customer.10

Cerebras: company background

While AI fervor has picked up in the last couple of years, Cerebras has deep roots within the tech/computing world.

The company was founded in 2016 by a team of industry veterans, including current Chief Executive Officer Andrew Feldman and Chief Technology Officer Gary Lauterbach.11 Feldman and Lauterbach previously founded a microserver startup called SeaMicro, which was acquired by semiconductor company AMD in 2012.12

Cerebras' three other co-founders — Jean-Philippe Fricker, Michael James, and Sean Lie — also held prominent roles at SeaMicro.13

Feeding demand

The rise of generative AI, particularly OpenAI's ChatGPT, helped fuel tremendous growth in certain tech companies that power AI computing. Nvidia is perhaps the most prominent example of this boon, with the chip maker's stock price rising nearly 1,300% over the past five years.14

Cerebras competes with Nvidia, but rather than producing relatively small Graphic Processing Units (GPUs) to process AI workloads like Nvidia does, Cerebras has created the world's largest computer chip with its flagship product, the third generation wafer-scale engine (WSE-3).15

Cerebras has also made a push to become more of a cloud services provider for queries to AI models that run on Cerebras' chips, according to CNBC.16 Plus, Cerebras has its hands in related AI areas, like with its CS-3 system, powered by its flagship chip, that other companies can use to run AI workloads.

Amidst the demand for AI hardware and platforms, Cerebras' revenue has been rapidly growing, having more than tripled from 2022 to 2023 to reach $78.7 million. For the first half of 2024, it nearly doubled its full-year 2023 revenue, reaching $136.4 million, according to the S-1 filing.17

Cerebras also has partnerships in place with significant organizations to support AI development, such as with the announcement in early 2024 that Cerebras started working with Mayo Clinic for AI in healthcare.18 It also announced in September the signing of a Memorandum of Understanding (MoU) with Saudi Arabia's state-owned energy giant Aramco to work together to bring AI to various industries and universities in Saudi Arabia.19 And in December 2025, Cerebras announced an MoU with the U.S. Department of Energy to collaborate on next-gen AI and high-performance computing technologies.20

However, Cerebras was not profitable as of its 2024 S-1 filing, largely due to high expenses in areas such as research and development. For the first half of 2024, its net loss was $66.6 million, down from $77.8 million in the first half of 2023.21

Cerebras stock price history

Cerebras' Forge Price is $45.00 at an implied $10.06 billion valuation, as of early January 2026, which represents a 20% premium to its last primary funding round in September 2025.22 Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions on Forge.

Forge Data as of 1/14/2026

In the last two years, Cerebras' Forge Price has jumped about 256% vs. around an 111% gain for the Forge Private Market Index, a broad measurement that reflects the up-to-date performance and pricing activity of venture-backed, late-stage companies that are actively traded in the private market.23 However, Cerebras has had some volatility over the past year, and it's up a more modest 12% vs. a 91.4% percent annual gain for the Forge Private Market Index.24

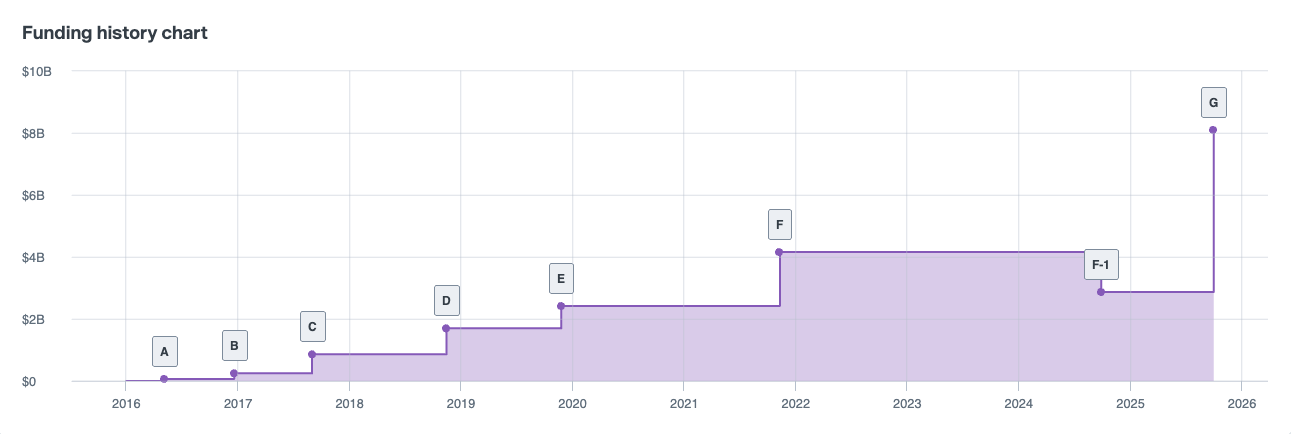

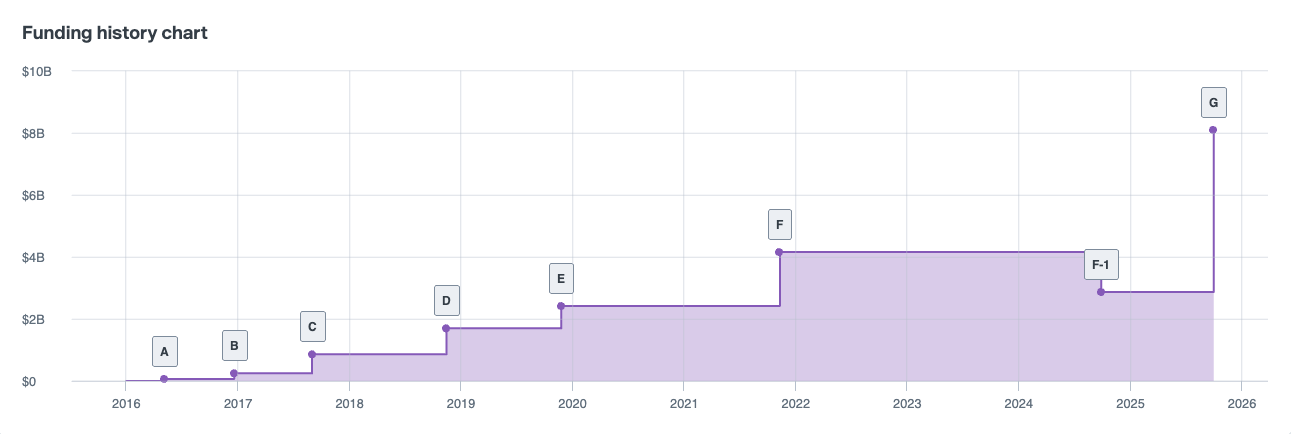

Cerebras funding history and private market valuation

Cerebras' funding totals nearly $2 billion. That financing haul dates back to a Series A in May 2016, when the company raised nearly $27 million at a valuation of a little over $67 million. Cerebras then reached unicorn status with its Series D in November 2018, when it hit a post-money valuation of $1.8 billion. By 2021, it broke $4 billion with its Series F.25

Cerebras then had a down round in September 2024, when it raised $85 million at a $2.87 billion valuation. However, it bounced back with its largest funding round a year later, raising $1.1 billion in September 2025 at an $8.1 billion valuation.26

Forge Data as of 1/14/2026

Some of Cerebras' recent top investors include Fidelity, Atreides Management, Tiger Global, and Alpha Wave Ventures, to name a few.27

Looking ahead

Cerebras' plans to refile for an IPO reflect the continued optimism in the AI market. While details regarding Cerebras’ potential IPO remain publicly undisclosed, the company has indicated continued interest in pursuing a public offering.

Check back here or take a look at Forge’s upcoming IPO calendar to stay in the loop about a possible Cerebras IPO and other pending public offerings.

For now, as it remains private, interested investors can learn more about how to invest in Cerebras pre-IPO as well as eligibility requirements related to such investment opportunities. Those looking to buy shares of Cerebras, or other AI startups, if/when these become available, should also review Forge’s buyer’s guide to investing in private market shares.

Finally, if you’re ready to get started investing in the private market via a marketplace like Forge, you can create an account today.