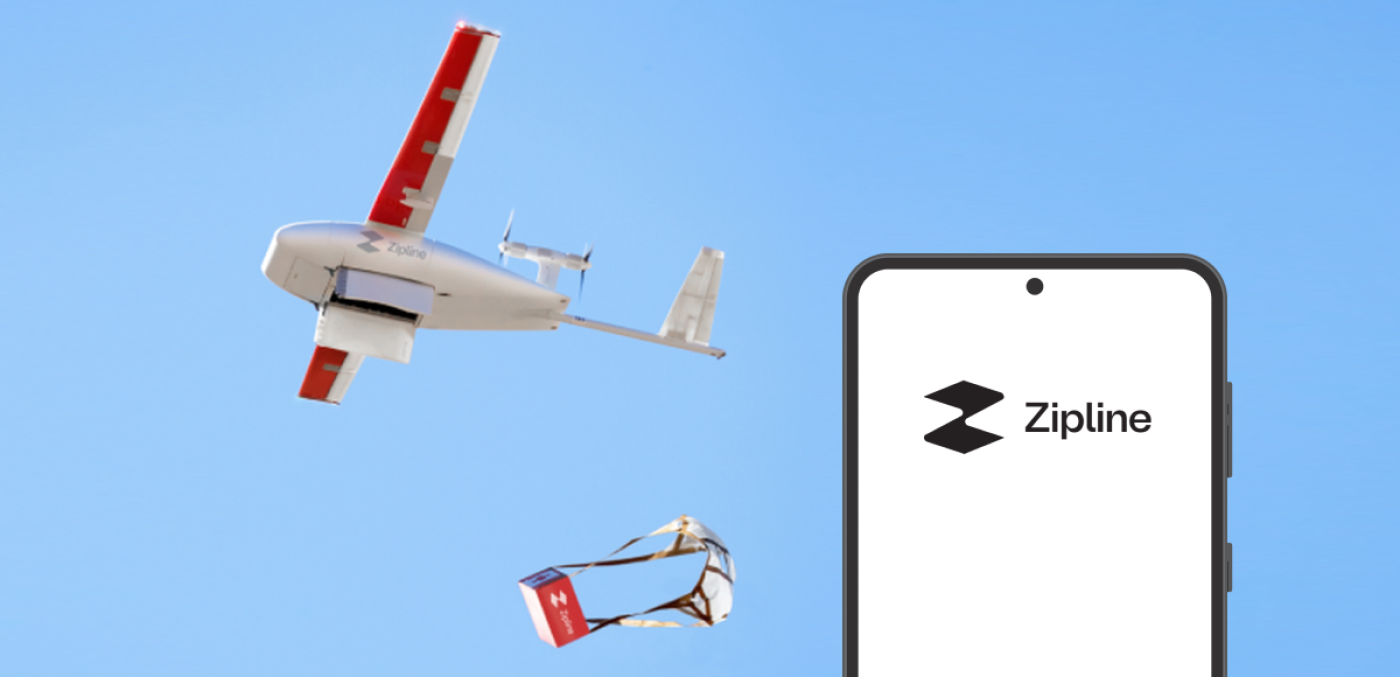

Zipline raises valuation by 55%, secures new funding

In recent months, many companies have had to accept lower valuations to engineer fresh funding rounds. But Zipline, a global drone delivery company, hasn’t needed to make this concession.

According to original reporting by Forbes, the South San Francisco-based company is quietly raising $330 million in a new Series F funding round. The new funding values Zipline at about $4.2 billion, a 55% increase from its $2.7 billion valuation reached two years ago.

Forbes wrote that Zipline’s April 10 securities filing made no mention of a lead investor, nor could one be identified as of Forbes’ publication. And Zipline would only confirm to Forbes that it raised new funding “at an increased valuation, which involved several new and existing investors.” Past investors have included Sequoia, Andreessen Horowitz, Katalyst Ventures, and Emerging Capital Partners.

Founded in 2011, Zipline has emerged as a leading player in the small but growing global drone delivery market. According to tech-news site CNET, the company’s drones have completed more than 500,000 deliveries since 2016. Most of those deliveries have been in the African nations of Rwanda and Ghana, but the company also has operations in Utah, Arkansas and North Carolina. The company’s latest drone, Platform 2, is more maneuverable than its predecessors and thus capable of serving urban and suburban areas in the U.S.

Acelyrin seeking to go public at $1.5 billion value

Zipline isn’t the only company that is defying some of the headwinds facing many startups over the past year. While many private companies have shied away from going public since the tech-stock market started swooning last year, Acelyrin, a late-stage biopharma company, is planning to take the plunge.

Last week, the Los Angeles-based company announced that it’s launching a roadshow for an IPO of 20.6 million shares of common stock. The IPO price is currently expected to be between $16 and $18 per share, which could raise as much as $370.8 million for the company. Acelyrin has applied to list its common stock on the Nasdaq Global Select Market under the symbol, “SLRN.”

The company, which was founded in 2020, is focused on accelerating the development and delivery of transformative medicines in immunology. Before the news of its IPO, the company’s last-known valuation, as of September 2022, was $809.5 million.

Simpplr pulls in $70 million in fresh funds

Imagine a social network along the lines of Meta Platform’s Facebook but geared to the work-related needs of employees of individual companies. That’s what Simpplr offers its corporate customers.

The Redwood City, Calif.-based company announced last week that it has raised $70 million in a Series D funding round led by Sapphire Ventures with participation from Norwest Ventures, Tola Capital and Salesforce Ventures.

The company, which now has a valuation of $547 million tied to this latest funding fund, added that the fresh funds will support ‘the growth of our AI-powered employee experience platform."

Launched in 2014, Simpplr sells its corporate clients what is basically an internal social network tailored for individual companies: employees can create personal profiles, share content, follow users and engage in polls or surveys via an intranet.