The underlying trend of mega-cap tech companies propelling the stock market forward has continued over the past several years first as FANG, followed by FAANG, and then culminating in the moniker the “Magnificent 7.”

Even with some recent stumbles1, in the last 12 months, this group (the “Public Magnificent 7”) – Alphabet (Google), Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla – has delivered returns nearly double those of the S&P 500 overall, which includes those Public Magnificent 7 gains.2

But the public market isn't the only place where a small group of companies accounts for an outsized impact. Forge has identified The Private Magnificent 7, a group of seven companies which has grown larger and delivered outsized performance compared to other private, venture-backed tech unicorns3. These outperformers rank among the private market’s most capitalized, resilient, and well-known private companies powering the innovation economy today.

While there are 568 unicorns in the United States, the seven companies in the Magnificent 7 account for 25% of total valuations. The performance of this group – which includes SpaceX, OpenAI, Stripe, Databricks, Fanatics, Scale AI, and Rippling – far outpaces the majority of private market companies.4

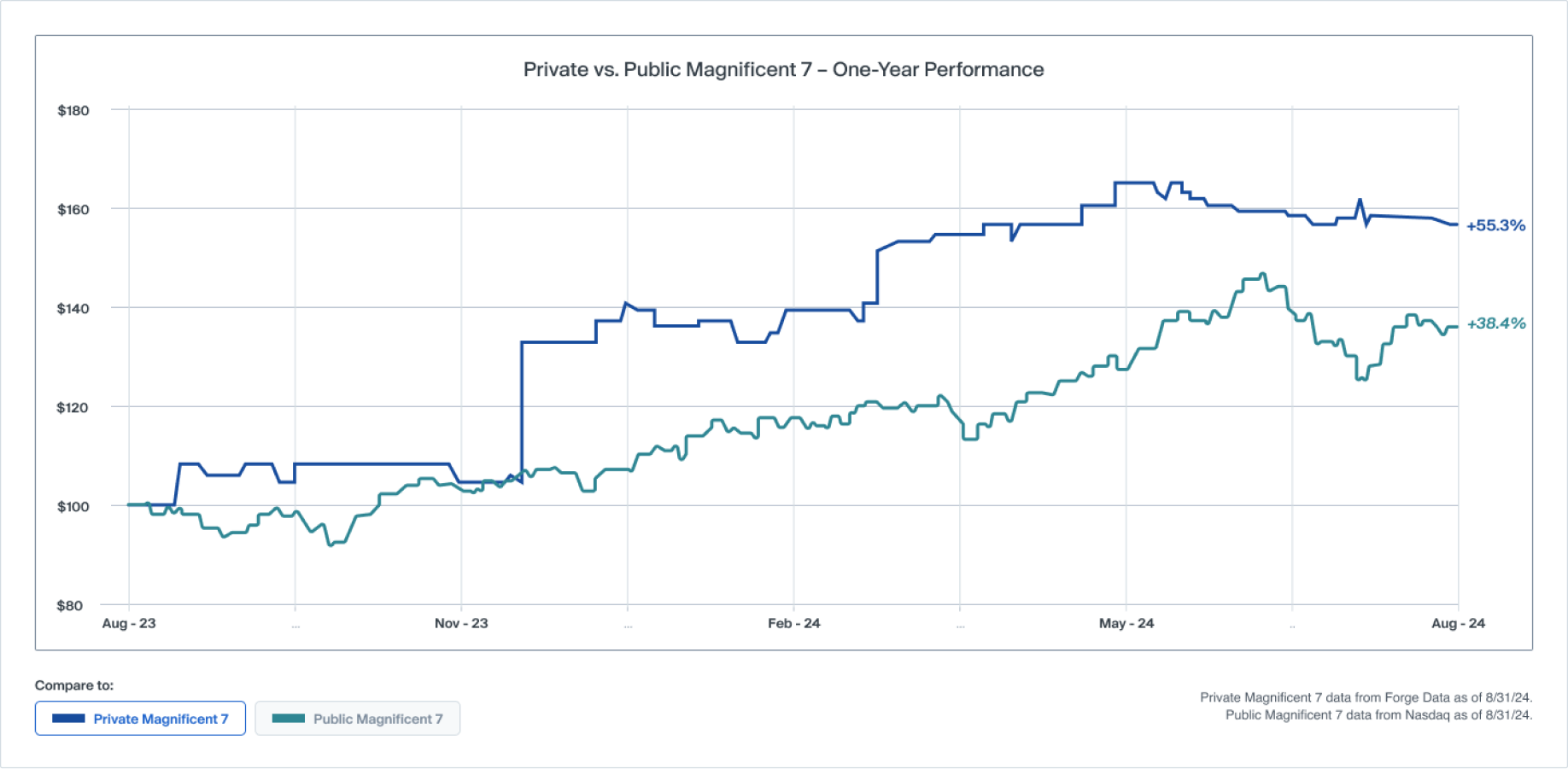

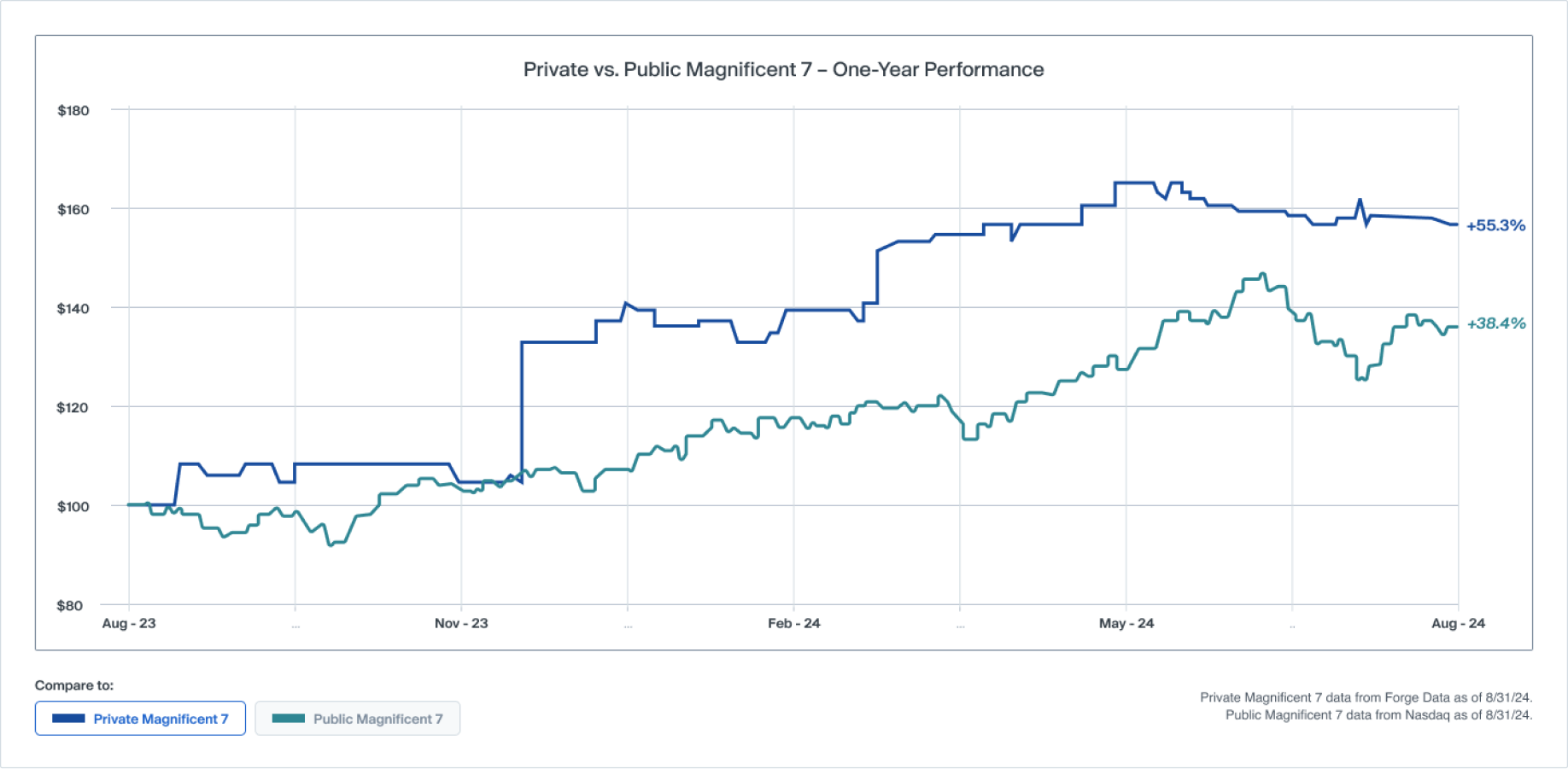

The Private Magnificent 7 returned 55.3% during the 12-month period through August 2024, while the Public Magnificent 7 rose 38.4% during this period.5

This group of private companies remained resilient throughout the most recent market cycle even as valuations for most private companies plummeted from 2021 peaks. Forge data shows the median discount to last funding round for private companies bottomed out at -63% in September of 2023.

The Private Magnificent 7 has an aggregate valuation of about $473 billion based on Forge Price through the end of August, according to Forge data.6

While, overall private market performance has been subdued throughout the most recent market cycle, there could be room to run for the Private Magnificent 7 relative to their public peers, which are 30 times larger in a size as a group. If valuations have now settled down to more attractive levels, especially with interest rates potentially falling soon, then inflows to the private market could mean that these large, high-performing unicorns benefit the most, similar to how the public market Magnificent 7 benefited in part from large overall inflows into the stock market.7

Recent news about the underlying companies within the Private Magnificent 7 doesn’t necessarily point to imminent plans to go public. The Information reported that Stripe is planning a new tender offer to buy back employee shares, financed entirely from its own money, suggesting strong cash flow at Stripe.8

Meanwhile, OpenAI continues its meteoric growth, with The Wall Street Journal reporting in late August that the company is in talks with investors such as Thrive Capital and Microsoft to raise several billion dollars, at a valuation exceeding $100 billion.9

That's not to say that the Private Magnificent 7 is immune from downturns and risk. Fanatics, for example, has experienced recent performance declines10. However, its resilience through the Great Reset, raising up-rounds in both 2021 and late 2022, demonstrated the company continued to swim upstream even as many others in the consumer sector, as well as in the rest of the market, sank deeper during the downturn. And even with recent declines, its Forge Price11 implied valuation is still hovering near 2021 levels.

There are industry veterans who believe companies in the Private Magnificent 7 have room to run. Venture capitalist Tim Draper, speaking to an audience of institutional investors at the Carmo Private Markets California Meeting this month, predicted that we could see the emergence of the first private company valued at $1 Trillion in the next decade. “It could be SpaceX,” he said, noting that he’s an investor in the company.

Four companies were added to the IPO pipeline in August, all in the Healthcare sector. BioAge, Bicara Therapeutics, Ceribell, and MBX Biosciences all filed their S-1s with the SEC and represent over $1.2 billion in market value based on their last funding round valuations12. For those companies that have signaled an IPO is on their radar, OpenAI is said to be in talks to raise a new round that would value the company above $100 billion, according to The Wall Street Journal 13 and Ripple made news for again saying it would seek an IPO outside of the United States.14

The Forge Private Market Index (“FPMI”) posted a 3% decline over the past three months. Exabeam’s acquisition15 and rotation off the FPMI, weighed negatively on the index in the period. The FPMI is up 2.4% year-to-date.

While the summer has remained demure from an activity perspective, median discounts to the last primary funding round of companies that trade on Forge rose sharply to -8% in August. This is the highest median discount recorded since early 2022. Companies in the top 90th percentile averaged 81% premium to their last round while companies in the 75th percentile posted a 2-year high 19% premium to their last funding round. These premiums were largely influenced by demand in AI company shares as well as in shares of companies in the industrial and energy sectors on the Forge platform.

The bid/ask spread returned to below the median after a spike in July, coming in at 8.3%, and more in line with the general trend over the past 1.5 years.

Sell indications of interest (IOIs) slightly outweighed buy IOIs in August.

Unique issuers with sell IOIs dropped in August as the summer slowdown extended into its second month.