Q2 2024 Forge Investment

Outlook

For Professional Investors Only

Road to Recovery: Private Market Accelerates in Q1

The private market gained momentum in Q1 2024, propelled by high-profile exits, increasing buyer demand, and optimism for a reawakening IPO market.

Market Performance — See how the Forge Private Market Index performed relative to public market indices, along with private market returns by sector and company

Secondary Market Activity — Gain an in-depth look at quarterly changes in private market premium/discount levels, bid-ask spreads, and right of first refusal (ROFR) data

Primary Market Activity — Get insights into fundraising trends, including amount raised, valuations, time between rounds, and how investors are seeking greater protections

Mutual Fund Marks — See notable changes in how large asset managers are valuing their private market holdings

Exit Activity — Get a snapshot of IPOs and other exits during the quarter, including analysis of pricing levels

The Forge Private Market Index was up 4.5% in Q1

During Q1 2024, the Forge Private Market Index was up 4.5%, driven by prominent IPOs and 10 names that were marked up by more than 20%.

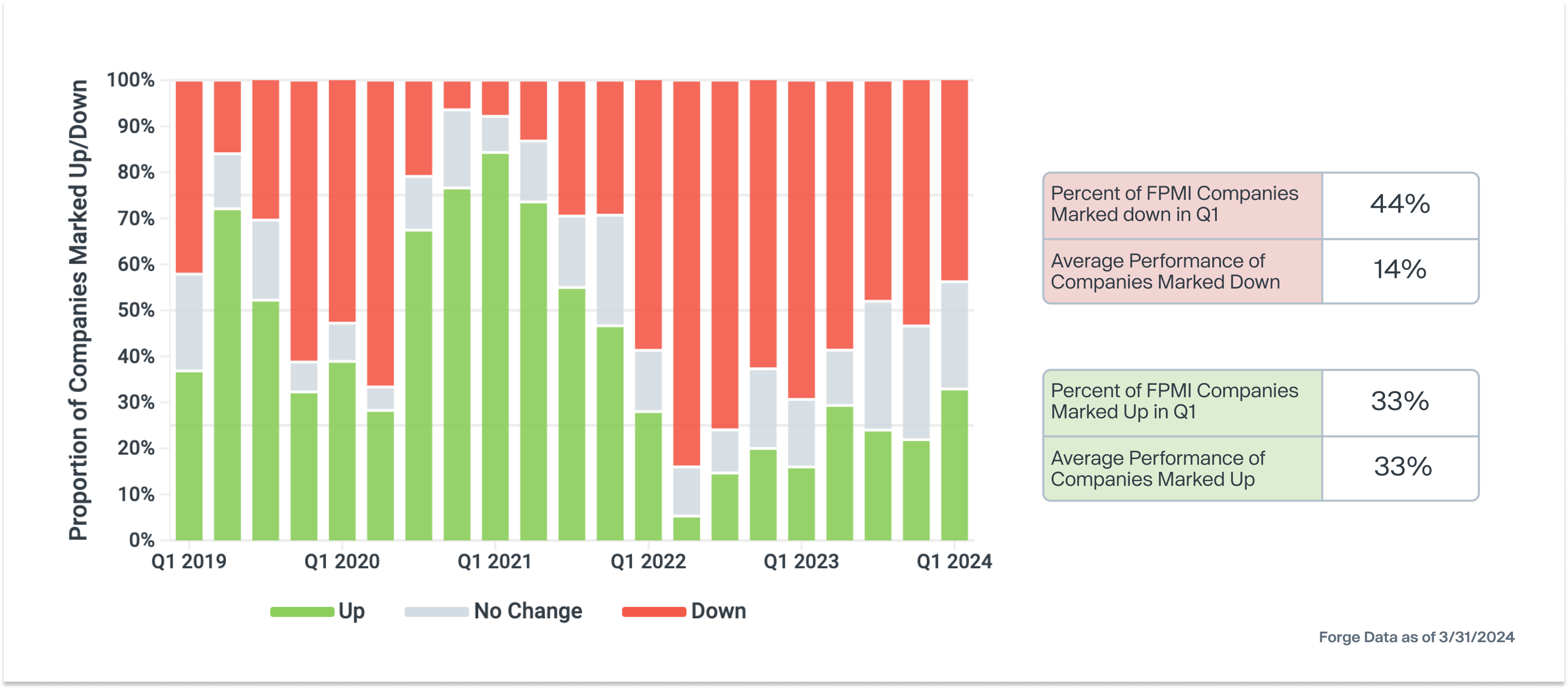

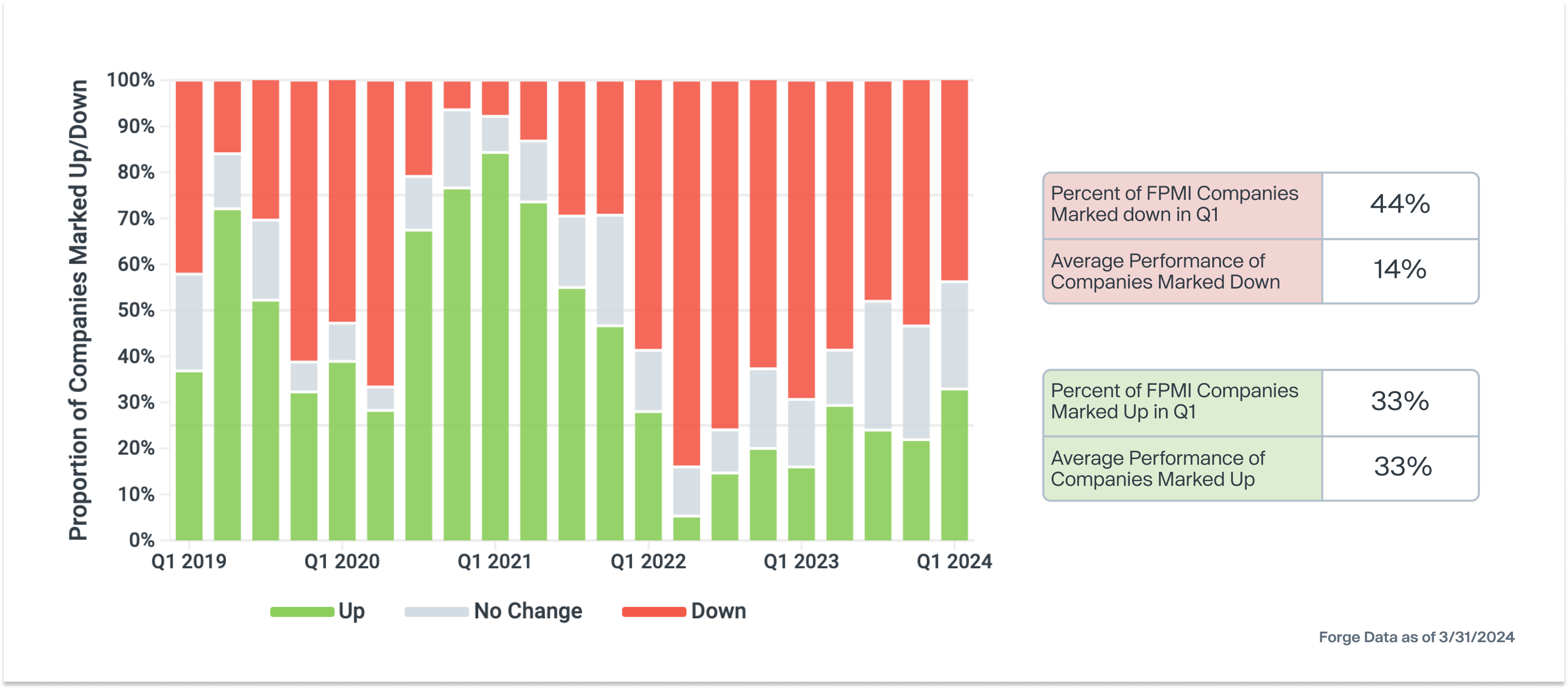

Forge Private Market Index posts most individual company markups since Q4 2021

The first quarter saw the highest percentage of marked-up companies in the Forge Private Market Index in over two years, while the magnitude of the positive performance of marked-up companies outpaced the negative performance of marked-down companies.

In notable shift, the proportion of Buy IOIs reached a 28-month high

In March, the percentage of buy-side IOIs on Forge Markets hit 61%, the highest level since August 2021. Forge also saw a 45% increase in the overall number of IOIs submitted to the platform in Q1 2024 compared to Q4 2023.

By downloading, you agree to Forge’s Terms of Use.

Prior to joining Forge, Andrew launched Semantiqa, an investment management firm focused on the public-market growth equities space. Andrew has also held researcher positions at WeatherStorm Capital and Lattice Strategies (now Hartford Funds).

Before joining Forge, Dan was VP, Global Product Marketing, for BlackRock's iShares ETF business. He previously held positions at Apple and Uber and is a former startup founder.

Prior to his role at Forge, Craig was a marketing consultant serving global and boutique investment management and fintech clients. He has also held marketing roles at UBS Asset Management, Brookfield Asset Management, and Envestnet Asset Management.

Before joining Forge, Riley was a Consultant for Strategy and Analytics at Deloitte assisting large tech clients with in-depth analysis of global data.

Please Read These Important Legal Notices & Disclosures

If you are a resident or a company registered within Germany this content is for marketing purposes only and on behalf of Forge Europe GmbH of Unter den Linden 38, 10117 Berlin, Germany (registered in the District Court Berlin (Charlottenburg) HRB 240763). Forge Europe GmbH is a tied agent in accordance with §3 (2) WpIG and provides investment brokerage, pursuant to §2 (2) Nr. 3 WpIG, exclusively in the name, on the account and under the liability of Effecta GmbH, Florstadt.

If you are resident or a company registered within the United Kingdom or Gibraltar this content is for general marketing purposes only and not a financial promotion on behalf of Forge Europe UK Limited of 10 York Road, London, SE1 7ND, England (registered in England and Wales with company number 14877431). Forge Europe UK Limited is an appointed representative of Kroll Securities Limited which is authorised and regulated by the Financial Conduct Authority (FCA) under Firm Reference Number 466588.

Forge Europe GmbH and, its wholly owned subsidiary, Forge Europe UK Limited (together “Forge Europe”) accept liability to a client as set out in the individual agreement entered into with the client. All other liability to any client is expressly excluded to the fullest extent permitted by applicable laws and regulations. Each Forge Europe company expressly excludes all liability to the fullest extent permitted by applicable laws and regulations to any person who is not a client. You will only be a client if you have entered into a written client agreement with the relevant Forge Europe company.

Nothing contained herein is an invitation or inducement to engage in investment activity. This is not a recommendation, offer, solicitation of an offer, or advice to buy or sell securities by Forge Europe or any of its affiliates, nor an offer of brokerage services in any jurisdiction where Forge Europe is not permitted to offer brokerage services. Forge Europe does not (1) advise any party on the merits of a particular transaction; (2) assist in the determination of fair value of any security; or (3) provide legal, tax, or transactional advisory services. Please be aware that fluctuations in currency exchange rates may affect the value of sums denominated in USD.

The performance shown represents past performance, and past performance is not indicative of future results. Investing in private company securities is not suitable for all investors, is highly speculative, involves a high degree of risk, and you should be prepared to withstand a total loss of your investment. Private company securities are highly illiquid and there is no guarantee that a market will develop for such securities. Each investment also carries its own specific risks and investors should conduct their own, independent due diligence regarding the investment, including obtaining additional information about the company, opinions, financial projections and legal or investment advice. Accordingly, investing in private company securities is appropriate only for those investors who can tolerate a high degree of risk and do not require a liquid investment.

The Forge Private Market Index is calculated and disseminated by Forge Data LLC ("Forge Data") and is a mark of Forge Data. All rights reserved. The Forge Private Market Index is solely for informational purposes and is based upon information from sources believed to be reliable. It is not possible to invest in the Forge Private Market Index, and Forge Data makes no assurance that any investment products based on or underlying the Forge Private Market Index will accurately track index performance or provide positive investment performance. Forge Data is not an investment adviser and makes no representation regarding the advisability of investing in any asset classes or investment vehicles. Private company securities are highly illiquid, and the Forge Private Market Index may rely on a very limited number of trade and/or IOI inputs in its calculation. The performance of the Forge Private Market Index with respect to the growth of $10,000 shown herein does not represent the performance of any actual investment, but rather reflects the hypothetical growth of a $10,000 investment in a basket of securities based on the index. Additionally, the chart assumes reinvestment of dividends and capital gains in the constituent securities but does not reflect any fees or commissions that may be incurred in purchasing or selling such securities, which would lower the figures shown if included. Further, $10,000 may not be a sufficient amount to invest simultaneously in all securities contributing to the performance shown, which would further prevent an investor from matching the performance shown. By downloading this content, you acknowledge that you have reviewed and are subject to the Forge Private Market Index disclaimers and disclosures which contains other important disclaimers, disclosures and restrictions related to the Forge Private Market Index. Additionally, if you are accessing this content away from forgeglobal.com, you acknowledge that you have reviewed and are subject to Forge’s Terms of Use with respect to use and distribution of information as if you were accessing this content on forgeglobal.com.

This material may be distributed to, or directed at, only the following persons: (i) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FP Order”), (ii) high-net-worth entities falling within Article 49(2) of the FP Order, and (iii) any other persons to whom it may otherwise lawfully be communicated (all such persons together being referred to as “FPO Relevant Persons”). Persons who are not FPO Relevant Persons must not act on or rely on this material or any of its contents. Any investment or investment activity to which this material relates is available only to FPO Relevant Persons. The information contained herein is based on currently available information, and Forge Europe undertakes no obligation to update any of such information or to reflect new information or the occurrence of unanticipated events, except as required by law. While Forge Europe believes such information forms a reasonable basis for the contents of this Investment Outlook, such information may be limited or incomplete, and this content should not be read to indicate that Forge Europe has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. This Investment Outlook contains trademarks, service marks, trade names and copyrights of Forge Europe or its affiliates and may contain those of other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products is not intended to, and does not imply, a relationship with Forge Europe or its affiliates or any of its respective affiliates, or an endorsement or sponsorship by or of Forge Europe or its affiliates.

This content is for the sole use of the intended recipient(s). Any unauthorized review, use, disclosure or distribution is prohibited.