In 1950, British mathematician and computer scientist Alan Turing wrote that "at the end of the century the use of words and general educated opinion will have altered so much that one will be able to speak of machines thinking without expecting to be contradicted."1

While he may have been a little ahead of his time, Turing's conviction in artificial intelligence is now being vindicated, as AI moves from a theoretical concept to a transformational force in society. There’s maybe no greater example of that transformation present among us than the release of OpenAI's ChatGPT.

Since this generative AI tool emerged publicly near the end of 2022, AI-related mentions in public company earnings calls have jumped from less than 0.5 sentences per call to over 2 sentences per earnings call.2 Some of that reflects an increase in AI-related risk mentions, but in general, investor interest and issuer exploration of AI have exploded.

This trend is showing up in private markets, with AI-related companies vastly outperforming non-AI companies. Over the past 12 months through October 2024, AI-related private companies tracked by Forge have gained an average of 76%, surpassing the returns of non-AI private companies tracked by Forge through the same period, which have returned an average of 1%.3

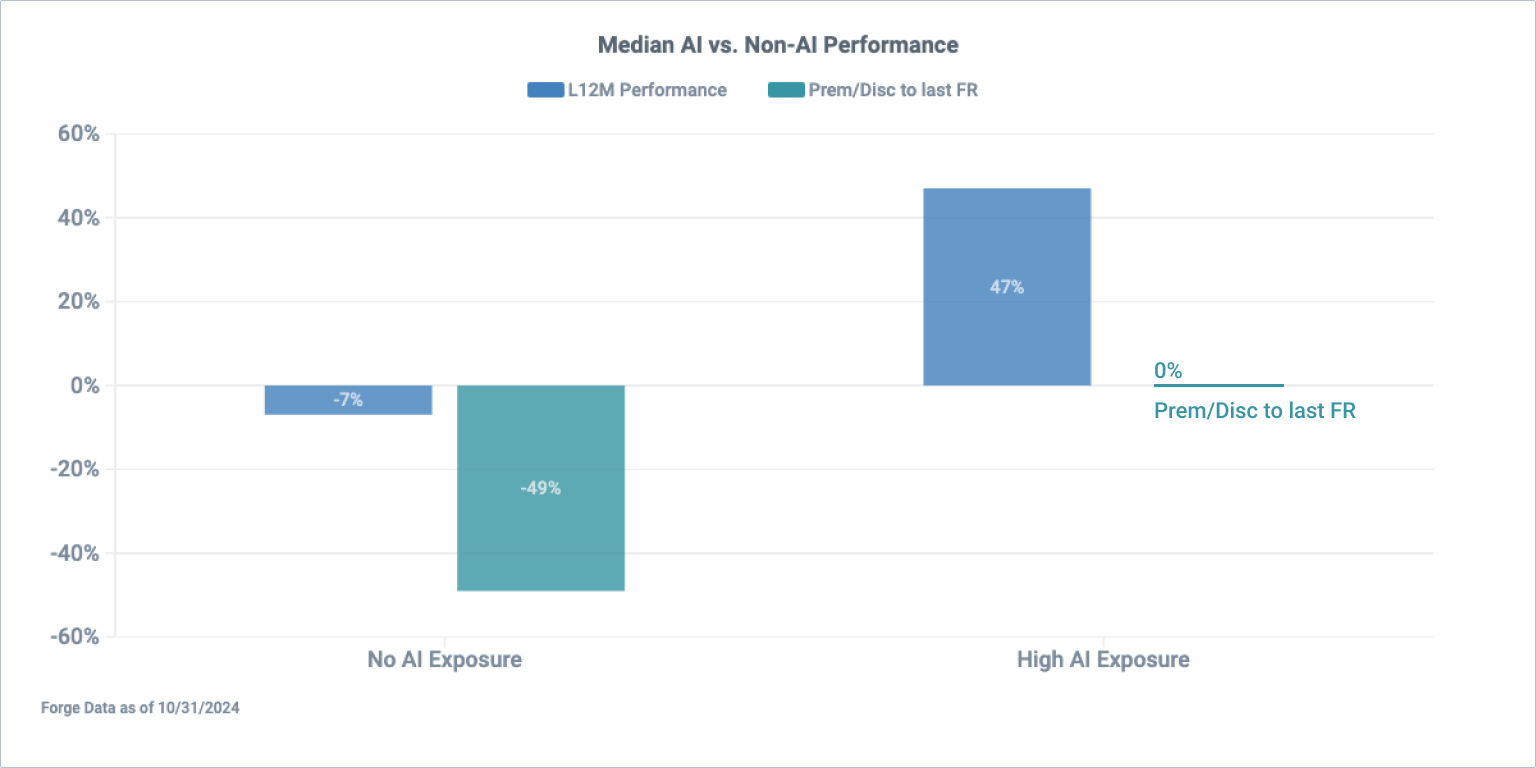

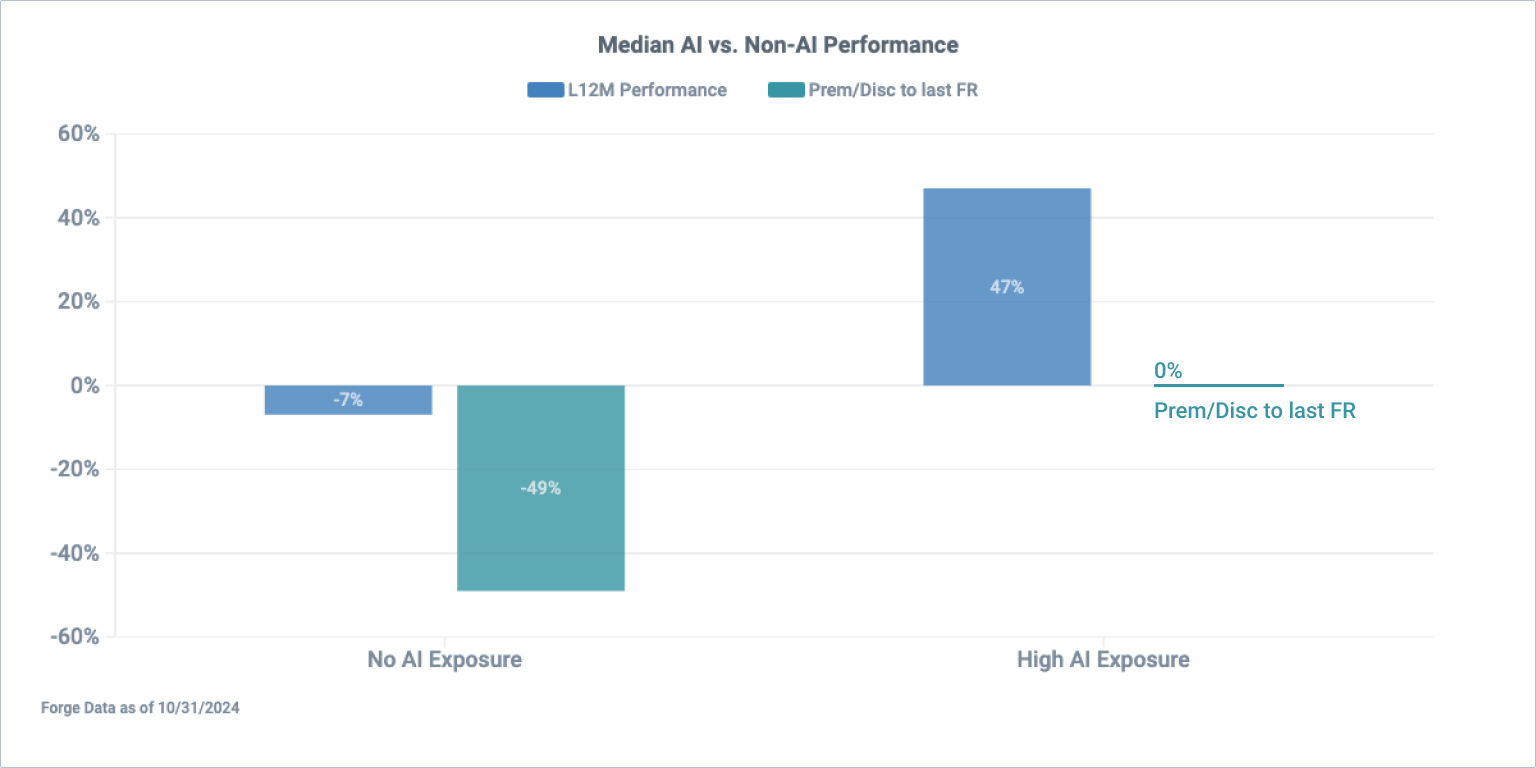

Yet the difference between AI vs. non-AI companies crystallizes among issuers who have high exposure to AI — e.g., companies like Cerebras, OpenAI, and Perplexity whose business models revolve around AI, as opposed to companies that incorporate AI into their offerings but aren't exclusively AI companies. These high-exposure AI companies have returned an average of 213% over the past 12 months through October 2024, with median returns of 47%. These aren't flash-in-the-pan results either; two-year performance (October 2022 to October 2024) is even better, with average returns of 330% and median returns of 57%, according to Forge data.4

Plus, while most private companies tracked by Forge are trading at a discount to their last primary funding round, high-exposure AI companies are only trading at an average discount of -2% and a median of 0% vs. a -28% average and -49% median for companies without AI exposure, over the past 12 months through October 2024. Part of this trend can be attributed to many AI companies raising recent primary funding rounds, and subsequent secondary prices have not deviated substantially from the primary round prices.5

Meanwhile, the AI trend could be starting to influence the outlook for IPOs. In October, for example, China-based autonomous driving technology company WeRide went public in the U.S. at a valuation of over $4 billion.6 Another Chinese autonomous driving company, Pony AI, also filed for an IPO in the U.S. last month.7

That's not to say that dealmaking and investor interest is strictly limited to AI. For example, healthcare company Omada Health reportedly filed for an IPO confidentially in October.8 Also, CareBridge Health is being acquired by Elevance Health for $2.7 billion,9 a big jump from its $1.15 billion valuation from its last primary funding round in 2022.10

These types of developments could potentially pick up steam in the coming months, as the Fed's latest rate cut could lead investors to shift interest toward equities.11 That could lead to more strength across sectors — not just AI names — but for now, the evidence shows that AI-oriented companies are largely responsible for keeping the private market moving up.

IPO activity heated up in October with Klarna12, CoreWeave13 and ServiceTitan14 all reportedly eyeing public listings in the coming weeks and months.

As a whole, October was a strong month for venture-backed startups and companies that have recently gone public. The Forge Private Market Index gained 1.67% in October — buoyed by AI-related company performance — while the Renaissance IPO ETF, which tracks companies that have gone public within the past three years, jumped 4.34%. In contrast, public market indexes like SPY and QQQ were down -0.89% and -0.86% respectively.15

Still, since certain issuers are driving these overarching private market gains, not all underlying metrics are quite as positive.

For example, the median discount to the last primary funding round increased to -23% in October, up from -12% in September. Premiums/discounts on issuers traded in both September and October remained fairly steady, yet issuers traded only in October had higher average discounts than those only traded in September.16

Despite the month-over-month dip, the median discount in October was lower than most of the last two years. During October, the gap between top-tier and bottom-tier performers narrowed moderately, as those in the top percentiles weakened somewhat and those toward the bottom improved slightly.17

Spreads near historic median

A similar story played out in terms of median spreads on new or updated buy/sell indications of interest (IOIs) on Forge marketplace, which rose from 5.5% in September to 9.2% in October. Yet this median spread still remains below the 10.4% average over the last 12 months.18

Also, the uptick in spread was driven almost exclusively by issuers who only traded in October, not September. Issuers that traded in both months had much tighter spreads, with the median falling to 3.8%,19 which indicates more liquidity and market efficiency among the more popular names.

Market remains balanced for buy and sell interests

The distribution of buy and sell IOIs fell slightly from 54% in September to 53% in October,20 though the fact that demand still slightly tilts toward the buy side indicates a healthy appetite for private market investments, whereas periods tilted toward sellers typically coincide with a declining market.

Lastly, the number of unique companies with sell-side interest fell to 162 in October, compared to 211 in September.21 Historically, a sustained period with a lower number of unique sell-side IOIs generally coincides with a bull market.