No matter how you take your unicorn to market, identifying an accurate listing price – aka reference price range – is not for the faint of heart. But there’s a new strategy more and more companies are leveraging to set a reference price through a direct listing that is potentially beneficial to unicorn companies and their existing shareholders.

What are direct listings?

Some companies view direct listings as the least expensive, and most efficient way to get to the public market. Direct listings minimize costs by cutting underwriters out of the process. And by doing so, they give a broader swath of investors the opportunity not just to participate but to potentially benefit from any initial public offering (IPO) pop. Direct listings also eliminate many of the restrictions and fees associated with traditional IPO, as well as some of the risks associated with special purpose acquisition companies (SPACs). However, direct listings also are not without their potential pitfalls. Notably, while cutting out underwriters can reduce costs, the underwriter due diligence process provides an independent check on the quality and accuracy of companies’ disclosures about their past and future performance because underwriters face strict liability under securities laws if these disclosures are false or misleading.

Reference price discovery

Those companies can learn from the direct listing pioneers who came before them, including early entrants like Spotify, Slack, and Palantir.

The more robust trading on the private markets becomes, the better data – and therefore better insight – unicorn companies get to help accurately price their companies.

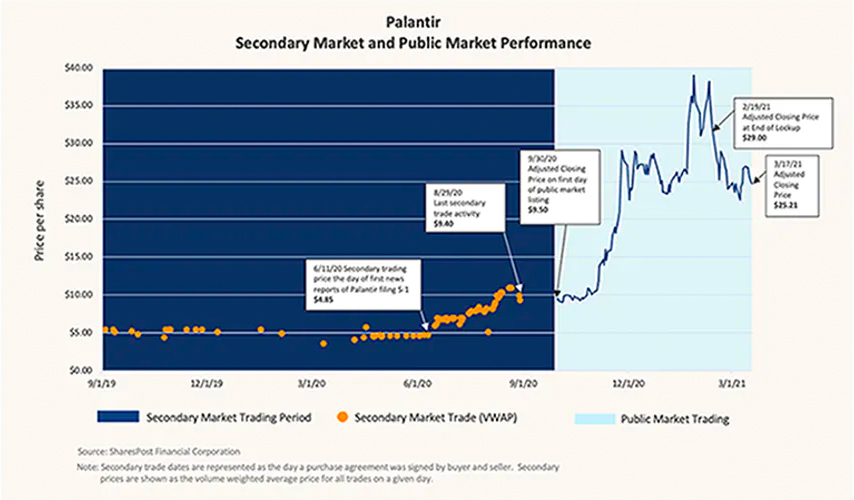

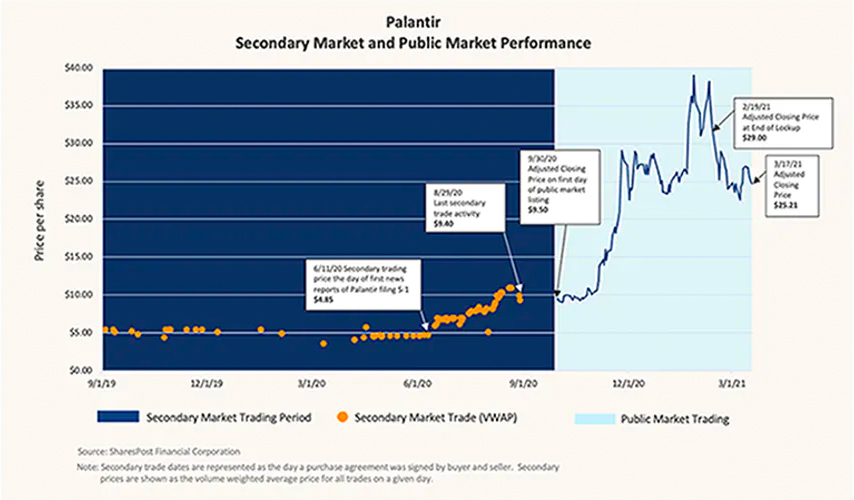

To that end, Palantir pulled off a major win with its direct listing, leveraging the insight from more than $500 million in private market trades of its stock to set its reference price. Palantir’s direct listing reference price landed within the price range of what investors on the private placement market were paying – the last secondary activity on Aug. 29, 2020, was at $9.40, and the close on the first day of public trading, Sept. 30, 2020 was $9.50.

In a traditional IPO, a big pop on day one benefits the institutional investors who got the early go at the stock the day before the debut. When it jumps, employees and executives don’t see those benefits. See Airbnb and DoorDash for good examples.

Roblox, which went public via direct listing in 2021, had a reference price of $45/share set by the NYSE – but no shares actually sold at that price. Instead, Roblox opened at $64.50 on March 10, 2021 – with that increased value filling Roblox equity holders’ pockets.

Benefits of a marketplace

Insights from the Forge marketplace allow private companies to control their own destinies in timing and pricing their public listings. The platform serves as a window for strategic decision making that caters to every unicorn’s specific needs, designed to help companies and existing investors better understand pricing and get ahead of rising market trends.

Leaning in on the secondary private market for pricing insights gives companies an anchor and a more accurate reference point as they prepare to exit. Using a marketplace provides insights that then allow companies to price closer to the actual market price.

Companies may continue to go public outside of the traditional IPO route. For those considering direct listings, SPACs or even the hybrid auction method, having the right data to inform pre-exit decisions is a must. Connect with Forge today to learn more about getting involved in a secondary marketplace.