A more accessible

private market.

We give investors and shareholders a transparent view of the private market with tools, data and insights to help drive informed investment decisions.

Dive deeper into private market trends

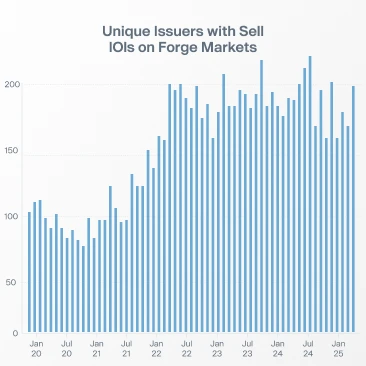

Access proprietary data, trends and insights that aren't available anywhere else.

Stay up-to-date on the private market with Forge's data-driven analysis and insights

Forge has partnered with Deutsche Börse to bring greater liquidity and access to top growth companies to Europe.

Find your edge

Whether you're an investor looking for diversification strategies or a private company seeking liquidity for your valued employees, Forge provides insights on and access to the private market.

Stay informed with in-depth visibility into private market activity.

Scale confidently with customized, flexible employee liquidity programs.

Gain access to trending pre-IPO companies.

Find out what your shares may be worth and control your financial future.

Stay informed with in-depth visibility into private market activity.

Scale confidently with customized, flexible employee liquidity programs.

Gain access to trending pre-IPO companies.

Find out what your shares may be worth and control your financial future.

Find your next potential opportunity