The dotcom bubble of the early aughts felled several startups. For example, Pets.com, a San Francisco-based pet supply company, went public in February 2000 at a valuation of over $300 million. Nine months later, the company’s stock price fell from $11 at its IPO to $0.19 at its bankruptcy announcement, making it one of the most notable examples of the dotcom bubble.

Given the record uptick in IPO activity this past quarter — raising more capital than any quarter in five years — economists and investors alike have begun to draw comparisons between the current economic bubble and the dotcom bubble.

Moreover, with tech companies trading at lofty valuations — Zoom was trading at 69x enterprise value-to-sales in July 2019 compared to an S&P 500 average of 2.21x enterprise value-to-sales — many economists have begun to speculate when the next recession will come and how it will impact unicorns.

Is the Recession Close?

In addition to the uptick in IPO activity in 2019, several other economic indicators suggest a recession is imminent. For example, the yield curve has now been inverted for more than three months.

This suggests that the long-term outlook is poor as short-term investments have higher yields than longer-term investments — which is a precedent for past recessions over the last 50 years. And, the New York Fed’s recession probability model warns that the current odds of a recession in the next year are as high as they were in July 2007, according to a Forbes report.

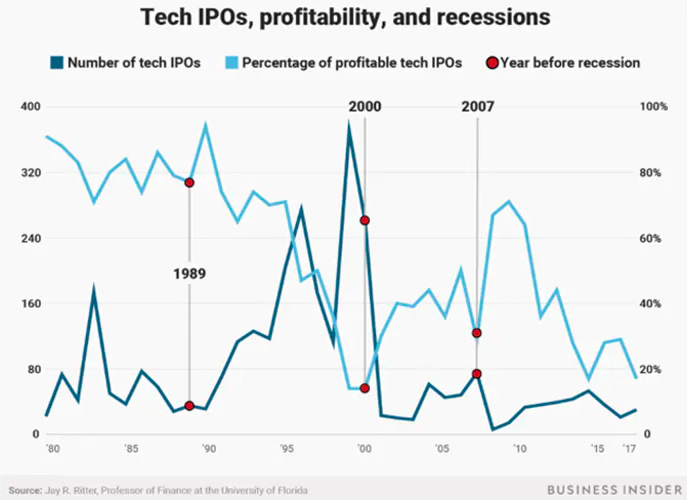

What’s more, a Business Insider report found that in the last three recessions there was an uptick in tech IPO activity in the months leading up to the downturn, and a high percentage of the companies that went public were unprofitable.

There are similar signs happening in today’s IPO market. According to data from Jay Ritter at the University of Florida, and Pitchbook data, the proportion of profitable IPOs has decreased to 16 percent in 2018 and 18 percent 2019 year-to-date (down from 29 percent in 2016).

Additionally, Uber, Lyft, Pinterest, Slack, and Beyond Meat were some of the largest and most anticipated IPOs of the year, but the companies were found to be unprofitable after their public debut, which can be interpreted as a sign of an impending recession.

Companies Will Decide to Stay Private Longer

Even though IPO activity heats up leading up to a recession, the number of companies going public will decrease during an economic downturn. In fact, historical data has also shown a clear relationship between the age of a company before its IPO and the current economic conditions.

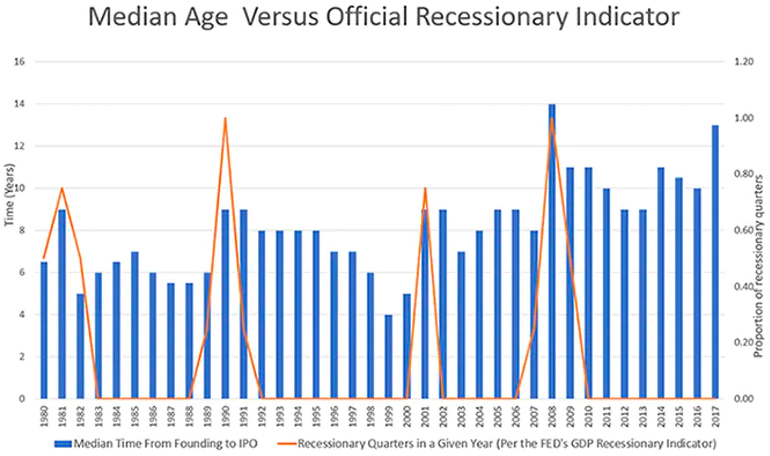

The chart below compares data from a University of Florida study on the median time to IPO for companies in the tech sector. The data is compared to the official recession indicator from the St. Louis Fed.

* Median time from founding to IPO is specific to the tech sector, found in a June 2018 University of Florida study. The orange line is the official recessionary indicator from St. Louis Federal Reserve economic data.

During the 2008 recession, there was a clear uptick in the median time to IPO. The same result happened in the early 2000s after the dotcom bubble burst. This phenomenon seems to be a result of every recession for the past 40 years, and the data shows private tech companies continue to stay private longer even after the recession is over.

Startups Will Take Advantage of Favorable Economic Conditions

Economic conditions during recessions are not always detrimental to start-ups. According to Forbes, factors such as cheaper credit and inexpensive employment costs are reasons why some think the best time to start a business is during a market downturn.

For example, many companies — such as Uber, Lyft, Pinterest, Stripe, WeWork, and Slack — were all started in the shadow of the 2008 financial crisis. Despite unfavorable economic conditions, ultra-low interest rates drove capital into riskier assets, which helped Uber raise $1 million in their first capital round in 2010 according to the Wall Street Journal in May. If this trend continues in the next recession, the private market could bring numerous opportunities for investors to re-allocate their assets away from ultra-low returns to growing start-up companies.

The Private Market Will be Less Volatile

The success of the private market in recent years could pose a risk for the public market in the next recession, according to CNBC. Historically, when a recession hits, investors reallocate their assets away from volatile public stocks. During the next recession, liquidity could cause extreme volatility to the public market. However, the private market will continue to be filled with investors who have a long-term horizon, giving this sector significantly less volatility.

What Does This Mean for Investors?

During the next recession, lower interest rates will mean cheaper capital for companies, as well as lower returns to investors, driving capital into riskier assets that have higher potential returns. What’s more, other factors such as companies staying private longer, start-ups taking advantage of favorable economic conditions, and low volatility could lessen the effect of the recession on private markets.

For retail investors, this could mean a recession is a great time to invest in a relatively stable, long-term assets. Institutional investors could bring ideal investments to put “dry powder,” or excess cash, to work. No matter the results of the next recession, Forge’s platform will remain a great opportunity for investors to take advantage of the favorable effects of an economic downturn.